Get the free Deferred Annuity Withdrawal Form

Show details

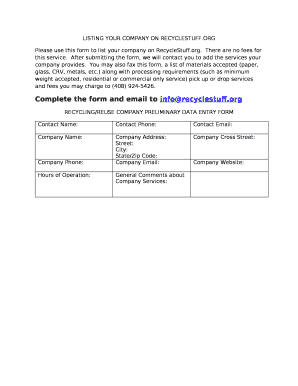

This form is used by owners of deferred annuities to request withdrawals, either partial or full, as well as to elect systematic withdrawal preferences. It includes information on potential penalties,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred annuity withdrawal form

Edit your deferred annuity withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred annuity withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred annuity withdrawal form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deferred annuity withdrawal form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred annuity withdrawal form

How to fill out Deferred Annuity Withdrawal Form

01

Obtain the Deferred Annuity Withdrawal Form from your insurance company or financial services provider.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Provide your annuity contract number to identify your specific account.

04

Indicate the amount you wish to withdraw and specify whether it is a full or partial withdrawal.

05

Review any tax implications that come with the withdrawal and consider consulting a tax advisor.

06

Sign and date the form to confirm that you understand the terms and conditions.

07

Submit the completed form to the financial institution via the specified method (mail, email, or in-person).

Who needs Deferred Annuity Withdrawal Form?

01

Individuals who have a deferred annuity and wish to access their funds or withdraw a portion of their investment.

02

Policyholders needing to adjust their financial strategy or respond to life changes, such as retirement or unexpected expenses.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for annuity withdrawals?

Qualified annuity payments are taxed as ordinary income, not as capital gains, at distribution or withdrawal. If you take your money out of your annuity before you reach age 59 ½, you will owe an additional 10% early withdrawal penalty to the IRS.

Can deferred annuities be surrendered?

Yes, you can cash out an annuity, but if the surrender period hasn't expired yet, you'll pay a surrender fee.

How much does a $100 000 annuity payout per month?

The bottom line. A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

What is the 5 year rule for deferred annuities?

It essentially requires that the entire value of the annuity be distributed, either all at once or in multiple withdrawals, within five years of the original owner's death.

Should I cash out my annuity?

Closing or cashing out an annuity altogether is an option if you need all the funds. However, this may also result in surrender charges, tax implications and the 10% federal tax penalty. So make sure the use of your cash provides more value than the fee you'll likely pay for surrendering your annuity.

How are deferred annuities paid out?

A deferred annuity is funded with a lump sum or payments over time ( called an accumulation period ). Payout begins on a future date. An immediate annuity starts paying when you deposit a lump sum or in the first 12 months following its purchase.

What can I do with a deferred annuity?

A deferred annuity is commonly used to generate a steady stream of income in retirement. Funded by a large, one-time payment or in smaller amounts over months or years, a deferred annuity provides you with flexibility and an opportunity for growth.

How do you cash out a deferred annuity?

Ways to cash out an annuity include withdrawal, loan, return of premium, surrender and with a crisis waiver. Cashing out an annuity has pros — access to immediate cash and potential tax advantages — but also cons including surrender charges, taxes, penalties and loss of future income stream.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deferred Annuity Withdrawal Form?

A Deferred Annuity Withdrawal Form is a document used by policyholders to request the withdrawal of funds from a deferred annuity account.

Who is required to file Deferred Annuity Withdrawal Form?

The policyholder or the annuitant of the deferred annuity is required to file the form to access their funds.

How to fill out Deferred Annuity Withdrawal Form?

To fill out the form, the policyholder must provide personal information, account details, the amount to be withdrawn, and specify the method of payment.

What is the purpose of Deferred Annuity Withdrawal Form?

The purpose of the form is to formally request the withdrawal of funds from a deferred annuity, ensuring compliance with contractual and regulatory requirements.

What information must be reported on Deferred Annuity Withdrawal Form?

The form must include the policyholder's name, account number, withdrawal amount, date of request, and any additional instructions relevant to the transaction.

Fill out your deferred annuity withdrawal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Annuity Withdrawal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.