Get the free COMMODITY FUTURES CUSTOMER CLAIM FORM

Show details

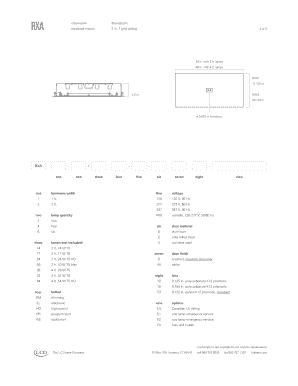

This form is used by customers of Peregrine Financial Group, Inc. to submit claims based on futures accounts in bankruptcy proceedings.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commodity futures customer claim

Edit your commodity futures customer claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commodity futures customer claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commodity futures customer claim online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commodity futures customer claim. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commodity futures customer claim

How to fill out COMMODITY FUTURES CUSTOMER CLAIM FORM

01

Obtain the COMMODITY FUTURES CUSTOMER CLAIM FORM from the appropriate regulatory authority or website.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal details, including name, address, and contact information.

04

Provide details about your trading account, such as account number and type of account.

05

Describe the nature of your claim, including the amount involved and the reasons for the claim.

06

Attach any necessary supporting documentation that substantiates your claim.

07

Review the completed form to ensure accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form as instructed, either electronically or via mail, to the designated address.

Who needs COMMODITY FUTURES CUSTOMER CLAIM FORM?

01

Individuals or entities who have engaged in commodity futures trading and believe they have a valid claim.

02

Customers who experienced financial losses due to situations such as broker insolvency or fraud.

03

Clients seeking to recover funds or assets from a failed futures trading company.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between financial futures and commodity futures?

Futures are a type of financial derivative in which you agree to buy or sell a certain asset at a certain price at a particular time in the future. Commodities are a type of asset representing fungible goods, such as oil, iron ore, or wheat.

What are the four types of futures contracts?

Here are the types of futures contracts to know: Commodity Futures. You already know that a futures contract's value is based on an underlying asset. Currency Futures. Understanding what is currency futures can help unlock more investment opportunities. Stock Futures. Index Futures. Interest Rate Futures.

What is an example of an option on a commodity future?

For example; If you are holding a Gold option on a commodity future, you will have the opportunity to either buy, in the case of a call, or sell, in the case of a put, a Gold futures contract at a specific price on or before the expiration of that contract.

What is an example of a commodity futures contract?

As an example, let's say an initial margin amount of $3,700 allows an investor to enter into a futures contract for 1,000 barrels of oil valued at $45,000 — with oil priced at $45 per barrel. If the price of oil is trading at $60 at the contract's expiry, the investor has a $15 gain or a $15,000 profit.

What is an example of a commodity agreement?

Some examples of international commodity agreements include: 1) OPEC - Organization of Petroleum Exporting Countries, focuses on coordinating and unifying petroleum policies. 2) International Coffee Agreement - established to tackle the problems of oversupply and low prices affecting coffee producers.

What is the formula for commodity futures?

The Futures price is defined as: The Futures Price = Spot Price + Finance + Storage Cost -Convenience Yield. The finance means interest rate on the money borrowed to own the physical commodity.

What is an example of a commodity futures?

Example of Commodity Futures Typically, soybean futures contracts include the quantity of 5,000 bushels. The farmer's break-even point on a bushel of soybeans is $10 per bushel, meaning $10 is the minimum price needed to cover the costs of producing the soybeans.

What is an example of a futures contract?

Futures contracts allow participants to hedge against price fluctuations or speculate on future price movements. For example, a farmer may use a futures contract to lock in a price for their crop to protect against price declines, while an investor might speculate on rising prices to earn a profit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COMMODITY FUTURES CUSTOMER CLAIM FORM?

The Commodity Futures Customer Claim Form is a document used by customers to assert their claims for funds or property held by a commodity futures broker that has become insolvent or gone into bankruptcy.

Who is required to file COMMODITY FUTURES CUSTOMER CLAIM FORM?

Customers of commodity futures brokers who have funds or property owed to them due to the broker's insolvency are required to file the Commodity Futures Customer Claim Form.

How to fill out COMMODITY FUTURES CUSTOMER CLAIM FORM?

To fill out the form, customers must provide their personal information, details of their account, and the amount of money or property they are claiming, along with supporting documentation to substantiate their claims.

What is the purpose of COMMODITY FUTURES CUSTOMER CLAIM FORM?

The purpose of the form is to enable customers to formally present their claims for recovery of funds or property in the event their futures broker is unable to return their assets due to financial failure.

What information must be reported on COMMODITY FUTURES CUSTOMER CLAIM FORM?

The form requires customers to report their name, address, account number, details of transactions, the nature of the claim, and any relevant financial documents that support the claim.

Fill out your commodity futures customer claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commodity Futures Customer Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.