Get the free PROFIT-SHARING PLAN

Show details

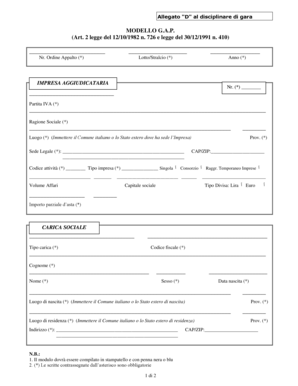

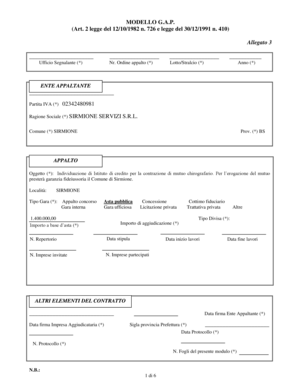

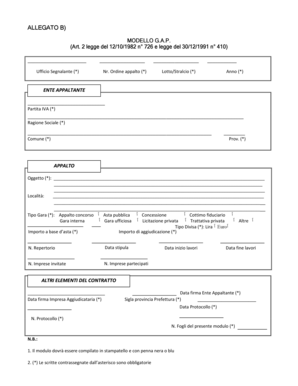

This document serves as a model profit-sharing plan which can be customized to meet specific circumstances. It provides structure regarding contributions, benefits, and other essential elements of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign profit-sharing plan

Edit your profit-sharing plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your profit-sharing plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing profit-sharing plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit profit-sharing plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out profit-sharing plan

How to fill out PROFIT-SHARING PLAN

01

Review the terms of the profit-sharing plan to understand its structure and requirements.

02

Gather financial documents such as profit and loss statements and balance sheets.

03

Determine the eligible employees who will participate in the profit-sharing plan.

04

Calculate the total profit available for sharing based on the specified criteria.

05

Allocate the profit among eligible employees according to the predetermined formula or method.

06

Prepare the necessary documentation outlining the distribution and share amounts for each participant.

07

Communicate the details of the profit-sharing plan to all eligible employees.

08

Set a timeline for payments or contributions to the profit-sharing plan.

Who needs PROFIT-SHARING PLAN?

01

Businesses looking to motivate employees and enhance retention.

02

Companies wanting to align employee interests with organizational performance.

03

Organizations aiming to share profits as a part of their employee compensation strategy.

04

Firms that wish to attract top talent through competitive benefits.

Fill

form

: Try Risk Free

People Also Ask about

How to structure a profit-sharing plan?

In addition, there are four initial steps for setting up a profit sharing plan: Adopt a written plan document, Arrange a trust for the plan's assets, Develop a recordkeeping system, and. Provide plan information to eligible employees.

Which of the following describes a profit sharing plan?

Profit sharing is most commonly a retirement savings plan funded entirely by employers. Participating employees receive a portion of the business's quarterly or annual revenue. The exact amount is subject to the employer's discretion, though the IRS imposes annual contribution limits per employee.

What is an example of a profit-sharing plan?

What is an example of how profit sharing works? As a basic same-dollar example, suppose a business generated a profit of $100,000 in a year and decided to allocate 5% to the profit sharing plan. If there are 10 eligible employees, each would receive $500 (5% of $100,000).

What real life example illustrates sharing profit gains?

The Home Depot profit sharing plan has been in place for over two decades. This home improvement and DIY giant shares a percentage of its annual profits with eligible employees (non-management staff members) and associates each year as a cash bonus - they call it "Success Sharing".

Is a PSP the same as a 401k?

Under a 401(k), individuals contribute money to their retirement account and receive a tax deduction for this contribution. Their employer may also contribute and receive a tax deduction. Under profit-sharing, only the employer contributes to the retirement account.

What is 6% profit sharing?

The 6% rule applies when you have both a 401(k) and a defined benefit plan in place. Normally, your 401(k)profit-sharing contribution can go up to 25% of your W-2 compensation. However, once you add a DB plan, the IRS limits that profit sharing contribution to 6% of your compensation.

What is an example of profit sharing?

The company's profits are $500,000. The profit sharing formula would play out as follows: Employee 1 = ($500,000 X 0.10) X ($100,000/$300,000) = $16,666. Employee 2 = ($500,000 X 0.10) X ($200,000/$300,000) = $33,333.

What is 6% profit-sharing?

The 6% rule applies when you have both a 401(k) and a defined benefit plan in place. Normally, your 401(k)profit-sharing contribution can go up to 25% of your W-2 compensation. However, once you add a DB plan, the IRS limits that profit sharing contribution to 6% of your compensation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROFIT-SHARING PLAN?

A profit-sharing plan is a type of retirement plan that allows companies to share their profits with employees by making contributions to their retirement accounts. This incentivizes employees to contribute to the company's success.

Who is required to file PROFIT-SHARING PLAN?

Employers who sponsor a profit-sharing plan are required to file it with the appropriate government agency, typically the IRS in the United States. This includes businesses of various sizes that offer such plans to their employees.

How to fill out PROFIT-SHARING PLAN?

To fill out a profit-sharing plan, employers should gather necessary information such as business details, employee eligibility criteria, contribution formulas, and distribution rules, then complete the required IRS forms accurately, often using a qualified tax professional for assistance.

What is the purpose of PROFIT-SHARING PLAN?

The purpose of a profit-sharing plan is to incentivize employees by allowing them to receive a share of the company's profits, improving morale and productivity, and aiding in employee retention while also providing tax advantages for both the employer and employees.

What information must be reported on PROFIT-SHARING PLAN?

Information that must be reported on a profit-sharing plan includes plan details such as contribution amounts, allocation formulas, vesting schedules, participant information, and compliance with relevant tax regulations.

Fill out your profit-sharing plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Profit-Sharing Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.