Get the free ND-1V

Show details

Este formulario es utilizado para enviar el pago de un saldo adeudado al presentar una declaración de impuestos electrónica en Dakota del Norte.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nd-1v

Edit your nd-1v form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nd-1v form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nd-1v online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nd-1v. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

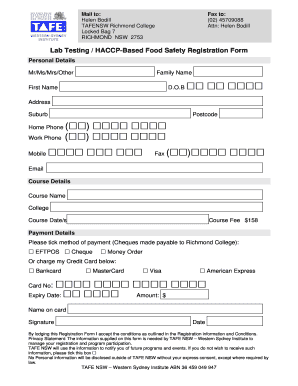

How to fill out nd-1v

How to fill out ND-1V

01

Start by downloading the ND-1V form from the official website or acquiring a physical copy.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

In the first section, provide your personal information, including your full name, contact details, and address.

04

Move to the next section where you will need to state the purpose for filing the ND-1V.

05

Fill out any required financial information accurately, ensuring all figures reflect your current situation.

06

Provide supporting documentation as indicated in the guidelines, making sure they are relevant and up to date.

07

Review the entire form for completeness and accuracy before signing it.

08

Submit the form as instructed, either electronically or by mailing it to the specified address.

Who needs ND-1V?

01

Individuals applying for certain types of assistance or benefits that require the use of the ND-1V form.

02

Residents who are seeking to report specific financial circumstances to relevant authorities.

03

Those who need to update their personal information related to any ongoing benefits or assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

How do you pronounce ND in English?

2:47 23:00 But if you really want to be easily understood.MoreBut if you really want to be easily understood.

How are you pronounce in english?

1:37 2:00 Words. So how are you how are you doing becomes how are you how are you doing.MoreWords. So how are you how are you doing becomes how are you how are you doing.

Does North Dakota have a state tax form?

ing to North Dakota Instructions for Form ND-1, you must file a North Dakota tax return if: If you were a full-year resident of North Dakota for the tax year and you are required to file a federal individual income tax return, you must file a North Dakota individual income tax return.

How do you pronounce suffix in English?

0:21 1:03 And now you know like this video if you found it useful. It helps me a lot appreciate it.MoreAnd now you know like this video if you found it useful. It helps me a lot appreciate it.

How do you pronounce the punctuation mark?

0:00 0:12 <s> punctuation Mark punctuation Mark </S>.More<s> punctuation Mark punctuation Mark </S>.

How do you pronounce nd?

0:46 3:19 So you should feel your tongue moving away from the top of the mouth as you release this sound. SoMoreSo you should feel your tongue moving away from the top of the mouth as you release this sound. So let's have a look at some practice. Words. We'll use the listen and repeat method.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ND-1V?

ND-1V is a form used for reporting non-deductible contributions to a specific account, typically in the context of tax documentation.

Who is required to file ND-1V?

Individuals or entities that have made non-deductible contributions to a retirement account or similar financial instrument are required to file ND-1V.

How to fill out ND-1V?

To fill out ND-1V, gather the necessary information regarding your contributions, complete the form by providing details such as your personal information, the amount contributed, and any other required data, then submit it as per the instructions provided.

What is the purpose of ND-1V?

The purpose of ND-1V is to document and report non-deductible contributions for tax purposes, ensuring that accurate records are maintained for future reference and tax calculations.

What information must be reported on ND-1V?

ND-1V must report information such as the contributor's name, tax identification number, details of the account to which contributions were made, and the total amount of non-deductible contributions.

Fill out your nd-1v online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nd-1v is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.