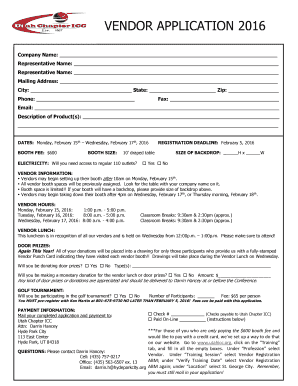

Get the free Kansas Sales and Use Tax Refund Application

Show details

This document serves as an application for refund of sales and use tax in Kansas, detailing sections for retailers and consumers to provide required information for tax refund claims.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas sales and use

Edit your kansas sales and use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas sales and use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas sales and use online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kansas sales and use. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas sales and use

How to fill out Kansas Sales and Use Tax Refund Application

01

Obtain the Kansas Sales and Use Tax Refund Application form from the Kansas Department of Revenue website.

02

Fill in your personal information, including name, address, and contact information.

03

Provide your taxpayer ID number if applicable.

04

Fill out the sales and use tax details for which you are requesting a refund, including the amount and reason for the refund.

05

Include any supporting documentation, such as receipts or invoices, that verify your claim.

06

Sign and date the application form.

07

Submit the completed application by mailing it to the appropriate address provided on the form.

Who needs Kansas Sales and Use Tax Refund Application?

01

Businesses or individuals who have overpaid sales and use tax in Kansas.

02

Purchasers who have paid sales tax on exempt purchases.

03

Taxpayers who have returned or exchanged purchases and need a refund of the sales tax paid.

04

Non-profit organizations seeking to recover sales tax for exempt purchases.

Fill

form

: Try Risk Free

People Also Ask about

How to get a Kansas City tax refund?

The taxpayer must submit Form RD109 and RD109NR, if applicable; and. The taxpayer must submit sufficient documentation to show that the taxpayer is entitled to a refund; and. All of these documents must be submitted by the federal income tax deadline.

How do you claim your refund?

If you don't have internet, call the automated refund hotline at 800-829-1954 for a current-year refund or 866-464-2050 for an amended return.

How long does it take Kansas to process a tax refund?

File with H&R Block to get your max refund taxpayers expecting refunds that filed electronically can expect a deposit within 10 to 14 business days. Taxpayers expecting a refund that filed using a paper form should allow at least 16 to 20 weeks to receive a refund back by mail.

What is the procedure for claiming refund?

Application for refund is required to be filed in FORM GST RFD-01 by the supplier on the common portal and should be submitted with a declaration by the registered person and Certificate by CA or CMA to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any

How to claim US sales tax back?

To claim a sales tax refund, you may need to provide evidence of the sales tax payment and the reason why you believe you are entitled to a refund. This may include receipts, invoices, or other documents showing the amount of sales tax paid.

How do I claim my refund in Kansas?

Complete the application (Form ST-21) and provide the appropriate documentation to the retailer from whom you made the purchase. The consumer may file the refund request directly with the Kansas Department of Revenue if the retailer is no longer in business, insolvent, moved or is unable to act.

How long does a Kansas refund take?

File with H&R Block to get your max refund You may also call 1-785-368-8222, 8 a.m. to 4:45 p.m. Monday through Friday. Generally, if the return was completed correctly. taxpayers expecting refunds that filed electronically can expect a deposit within 10 to 14 business days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Kansas Sales and Use Tax Refund Application?

The Kansas Sales and Use Tax Refund Application is a form used by individuals or businesses to request a refund of sales and use tax that has been erroneously paid or where exemptions apply.

Who is required to file Kansas Sales and Use Tax Refund Application?

Any taxpayer who has paid sales or use tax on purchases that are eligible for a refund, such as exempt purchases made by exempt organizations or businesses, is required to file this application.

How to fill out Kansas Sales and Use Tax Refund Application?

To fill out the application, taxpayers must provide their personal or business information, detail the items or transactions for which they seek a refund, include proof of payment, and submit the completed form to the appropriate Kansas tax authority.

What is the purpose of Kansas Sales and Use Tax Refund Application?

The purpose of the application is to provide a formal process for taxpayers to recover sales and use tax they should not have paid, ensuring compliance with tax laws and fair treatment for eligible taxpayers.

What information must be reported on Kansas Sales and Use Tax Refund Application?

The application must report the taxpayer's identification information, details of the sale or use tax paid, the reason for the refund request, any documentation supporting the claim, and the total amount being claimed for refund.

Fill out your kansas sales and use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Sales And Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.