Get the free IL-8453

Show details

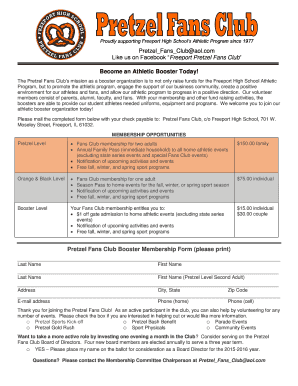

This document provides instructions for the use of Form IL-8453, which is designated for Electronic Return Originators (EROs) in the electronic filing of Illinois Individual Income Tax Returns.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign il-8453

Edit your il-8453 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il-8453 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing il-8453 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit il-8453. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out il-8453

How to fill out IL-8453

01

Retrieve the IL-8453 form from the IRS website or your tax software.

02

Provide your name(s) and address in the designated fields.

03

Input your Social Security Number (SSN) or Employer Identification Number (EIN).

04

Enter the amount of your refund or tax payment on the form.

05

Review your return and confirm that the information matches what is entered on the IL-8453.

06

Sign and date the form where indicated to validate your submission.

07

Keep a copy of the IL-8453 for your records.

Who needs IL-8453?

01

Taxpayers who e-file their federal tax returns and need to submit a paper signature.

02

Individuals or businesses using tax software that requires an electronic signature authorization.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax act 8453 form?

A signed Form 8453 authorizes the transmitter to send the return to the IRS. Form 8453 includes the taxpayer's declaration under penalties of perjury that the return is true and complete, as well as the taxpayer's Consent to Disclosure.

Why is TurboTax asking me to mail form 8453?

If you received a request to submit Form 8453 (US Individual Income Tax Transmittal for an IRS e-file return), you need to mail some forms to the IRS that can't be e-filed. TurboTax creates Form 8453 for you, and it serves as a cover page for your additional documentation.

What is form IL 8453?

General Information. Form IL-8453 is for electronic return originators' (EROs) use only. Taxpayers who file Form IL-1040, Illinois Individual Income Tax. Return or IL-1040-X, Amended Illinois Individual Income Tax Return, using the Tax-Prep Software method must not use Form IL-8453.

Do I really need to mail form 8453?

If you are an electronic return originator (ERO), you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

What is form 8453 ol TurboTax?

A Purpose. Form FTB 8453-OL, California Online e-file Return Authorization for Individuals, is the signature document for self-prepared individual e-file returns. By signing this form, you declare that the return is true, correct, and complete.

Why do I need to mail form 8949?

Purpose of Form. Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

What happens if I don't mail form 8453?

Will It Hold Up My Return? Sign and mail your federal tax signature form and any supporting paperwork at the end of the e-filing process. Form 8453 won't hold up the processing of your return, but you should mail it within 48 hours of when the IRS accepted your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IL-8453?

IL-8453 is a form used by the Illinois Department of Revenue for electronic filing of individual income tax returns, specifically to authenticate the electronic submission.

Who is required to file IL-8453?

Taxpayers who e-file their Illinois individual income tax returns and are required to submit a physical signature must file IL-8453.

How to fill out IL-8453?

To fill out IL-8453, taxpayers must provide their personal information, including name, address, Social Security number, and details from their e-filed return before signing and submitting it.

What is the purpose of IL-8453?

The purpose of IL-8453 is to validate the electronic filing of an Illinois tax return and to provide the Department of Revenue with the taxpayer's signature authorization.

What information must be reported on IL-8453?

IL-8453 requires reporting of the taxpayer's name, Social Security number, address, and the details of the e-filed return including any amounts reported.

Fill out your il-8453 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Il-8453 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.