KY UI-3 1999 free printable template

Show details

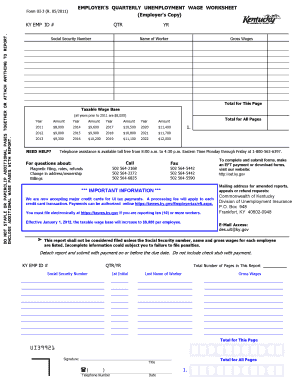

EMPLOYER'S QUARTERLY UNEMPLOYMENT TAX WORKSHEET DO NOT STAPLE OR PAPERCLIP ADDITIONAL PAGES TOGETHER OR ATTACH ANYTHING TO REPORT. ENCLOSE ADDITIONAL WAGE PAGES WITH REPORT. Keep top portion for your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign njmobgghtz form

Edit your njmobgghtz form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your njmobgghtz form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit njmobgghtz form online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit njmobgghtz form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY UI-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out njmobgghtz form

How to fill out KY UI-3

01

Obtain the KY UI-3 form from the Kentucky Labor Cabinet website or your local Kentucky unemployment office.

02

Fill in your personal information including your name, address, and Social Security number.

03

Provide the details of your previous employment, including the names and addresses of employers, dates of employment, and wages earned.

04

Complete the reason for separation from each employer (e.g., layoff, voluntary quit).

05

If applicable, list any other sources of income you are currently receiving.

06

Review the form for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and correct.

08

Submit the completed form to the appropriate unemployment office either by mail or in person.

Who needs KY UI-3?

01

Individuals who have recently lost their job and are seeking unemployment benefits in Kentucky.

02

Workers who need to report their job history and reasons for unemployment to qualify for UI benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is Kentucky unemployment insurance rate for 2022?

Unemployment tax rates for 2022 are determined with Schedule C, the office said on its website. Rates range from 0.5% to 2.9% for positive-rated employers and from 7% to 9.5% for negative-rated employers. The standard tax rate for new employers remains 2.7%.

What is the unemployment tax rate in Kentucky 2023?

The employee unemployment tax withholding rate will increase to 0.07% in 2023 (0.06% in 2022).

How do I get a Kentucky unemployment tax form?

Log in to your unemployment insurance account. Enter the Verification Code from your email address. Click on the 'My 1099' link located at the top of the page. You will have the option to download or view the document.

What is the UI rate in Kentucky 2022?

As a result of HB 144, the 2022 SUI tax rates now range from 0.3% to 9.0%, down from the original range from 0.5% to 9.5%. The new employer rate remains at 2.7%, except for construction employers which pay at 9.0% (down from the previously assigned 9.5%).

What is Kentucky unemployment tax wage base?

The legislation also reduces the 2022 SUI taxable wage base to $10,800, down from the original $11,100 scheduled to be in effect for 2022, the same taxable wage base in effect for 2020 and 2021. As a result of HB 144, the 2022 SUI tax rates now range from 0.3% to 9.0%, down from the original range from 0.5% to 9.5%.

What is Kentucky 2023 unemployment wage base?

2023 Updates and Changes (Updated 12/15/2022) 2023 Taxable Wage Base will increase to $11,100 per worker. SCUF assessment will be reinstated for reporting year 2023 pursuant to KRS 341.243. 2023 Contribution Rates will be set on Rate Schedule A.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit njmobgghtz form in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing njmobgghtz form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the njmobgghtz form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign njmobgghtz form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete njmobgghtz form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your njmobgghtz form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is KY UI-3?

KY UI-3 is a form used by employers in Kentucky to report their unemployment insurance contributions and employee wage information to the state's unemployment insurance program.

Who is required to file KY UI-3?

All employers who are subject to unemployment insurance laws in Kentucky are required to file the KY UI-3 form regularly, typically quarterly.

How to fill out KY UI-3?

To fill out the KY UI-3, employers need to provide their business information, employee wage details, and the amount of unemployment insurance contribution owed. Specific instructions are available on the form or the Kentucky Labor Cabinet website.

What is the purpose of KY UI-3?

The purpose of KY UI-3 is to collect necessary information from employers about their workforce and to ensure proper funding of the unemployment insurance system in Kentucky.

What information must be reported on KY UI-3?

The information that must be reported on KY UI-3 includes the employer's account number, total wages paid, number of employees, and calculations of the unemployment insurance contributions due.

Fill out your njmobgghtz form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Njmobgghtz Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.