Get the free Nonresident Withholding Tax Statement

Show details

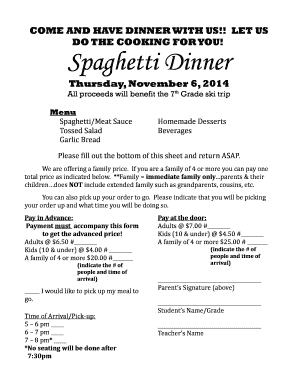

Form 592-B is used to show the amount of income subject to withholding and tax withheld for nonresidents for the year. A separate Form 592-B must be filed for each nonresident.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonresident withholding tax statement

Edit your nonresident withholding tax statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonresident withholding tax statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonresident withholding tax statement online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nonresident withholding tax statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonresident withholding tax statement

How to fill out Nonresident Withholding Tax Statement

01

Obtain the Nonresident Withholding Tax Statement form from the appropriate tax authority website.

02

Fill out your personal information such as name, address, and taxpayer identification number.

03

Indicate the type of income earned that is subject to withholding.

04

Specify the total amount of income received during the tax year.

05

Calculate the amount of tax withheld using the applicable tax rates.

06

Review the form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the relevant tax authority by the deadline.

Who needs Nonresident Withholding Tax Statement?

01

Nonresident individuals or entities that receive income from sources within a jurisdiction that require tax withholding.

02

Foreign investors who earn income from rental properties, dividends, interest or other sources in that jurisdiction.

03

Any nonresident who is subject to tax withholding as part of their income earnings.

Fill

form

: Try Risk Free

People Also Ask about

What is non-resident withholding tax in the US?

Non-resident withholding taxes are income tax obligations that foreign governments, most often the United States (U.S.), collect. This tax usually results from owning U.S. dividend-paying assets in your portfolio.

What is a 1040 NR non resident alien income tax return?

What is Form 1040-NR? Form 1040-NR (some may refer to it as 1040NR), is the nonresident version of Form 1040, formally known as the US Individual Income Tax Return. Essentially, it is the primary tax return form for nonresidents who earned US-sourced income to file during tax season.

What is a non-resident withholding?

Generally, NRA withholding describes the withholding regime that requires 30% withholding on a payment of U.S. source income and the filing of Form 1042 and related Form 1042-S. Payments to all foreign persons, including nonresident alien individuals, foreign entities and governments, may be subject to NRA withholding.

What is a NRA in finance?

A nonresident alien is taxed only on his income from U.S. sources, using special tax withholding, reporting and filing. Resident aliens are taxed on their worldwide income, the same as U.S. citizens.

What is non-resident withhold tax?

We're required by law to deduct non-resident Withholding Tax (NRWT) when an account holder is a non-resident or has an overseas home address. The money we withhold is paid to the Australian Taxation Office (ATO).

What is a withholding statement?

A withholding statement details the underlying beneficial owners of the income and the corresponding information regarding the allocation of the payment. This statement ensures that the correct withholding rates apply to the income distributed.

What is the withholding tax in Brazil for non residents?

According to the Brazilian domestic legislation, non-residents in Brazil are subject to withholding income taxation on capital gains arising from the disposal of Brazilian assets, of any kind, levied at rates varying from 15% to 22.5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nonresident Withholding Tax Statement?

The Nonresident Withholding Tax Statement is a tax document used to report income paid to nonresident individuals or entities, as well as the taxes withheld on that income.

Who is required to file Nonresident Withholding Tax Statement?

Entities or individuals who make payments to nonresidents, such as interest, dividends, rents, or royalties, and are required to withhold tax on those payments must file the Nonresident Withholding Tax Statement.

How to fill out Nonresident Withholding Tax Statement?

To fill out the Nonresident Withholding Tax Statement, you need to provide the payer's and payee's information, details of the income paid, tax withheld, and any relevant identification numbers, ensuring all data is accurate and complete.

What is the purpose of Nonresident Withholding Tax Statement?

The purpose of the Nonresident Withholding Tax Statement is to document and report the amounts withheld from payments made to nonresidents, ensuring compliance with tax regulations and facilitating the collection of taxes owed.

What information must be reported on Nonresident Withholding Tax Statement?

The information that must be reported includes the names and addresses of the payer and payee, the type of payment, the total amount paid, the amount of tax withheld, and any applicable identification numbers.

Fill out your nonresident withholding tax statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonresident Withholding Tax Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.