Get the free N-4

Show details

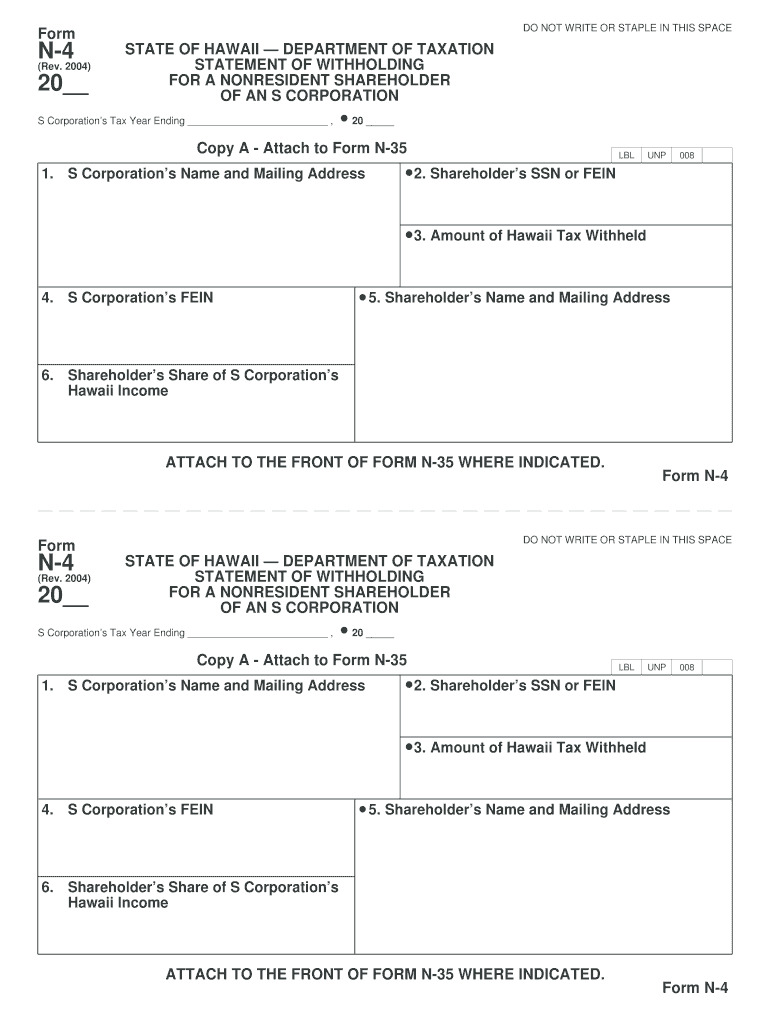

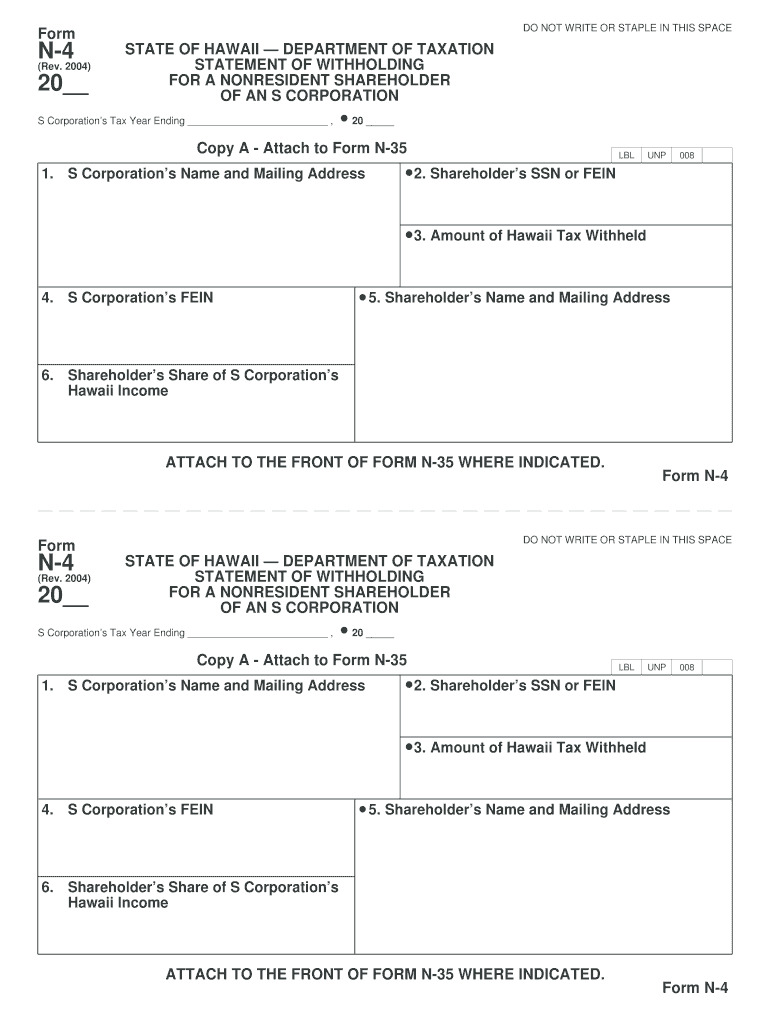

This form is used to report the withholding tax for nonresident shareholders of an S corporation in Hawaii.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign n-4

Edit your n-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit n-4 online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit n-4. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out n-4

How to fill out N-4

01

Obtain the N-4 form from the IRS website or the relevant tax authority.

02

Fill in your personal information in the designated fields, including your name and address.

03

Provide your taxpayer identification number (TIN).

04

Indicate the specific type of income for which you are submitting the N-4.

05

Complete the sections detailing any exemptions or additional information as required.

06

Review the filled-out form for accuracy.

07

Sign and date the form before submission.

08

Submit the form to the appropriate parties or authorities as instructed.

Who needs N-4?

01

Foreign individuals or entities earning income in the U.S. that may be subject to non-resident withholding.

02

Businesses hiring foreign workers or paying foreign contractors.

03

Taxpayers seeking to claim a reduced rate of withholding based on a tax treaty.

Fill

form

: Try Risk Free

People Also Ask about

What is the National 4 English course?

This course helps you understand how language works, and how to use it to communicate ideas and information in English. You will get to use creative and critical thinking to produce ideas and arguments, and to develop critical literacy skills as well as personal, interpersonal and team working skills.

What is ESOL English Level 4?

English for Speakers of Other Languages (ESOL) helps you to improve your reading, writing, listening and speaking skills in English. Studying ESOL will develop your confidence in social and work situations, improve your grammar and vocabulary and allow you to progress to further study or employment.

What is national 4 English equivalent to?

GCSE Vs National 4 Comparison AspectNational 4 Qualification Level Broadly equivalent to GCSE grades 3-1 Typical Age 14-16 years old Assessment Method Internally assessed with continuous assessment throughout the year Grading Pass/Fail (No final exams)1 more row • Jun 17, 2024

What is national 4 English?

This course is suitable for learners who wish to develop their language and communication skills through the exploration and creation of language, literature and media texts. It is designed for learners who are at the stage in their learning when they are ready to develop language and literacy skills at SCQF level 4.

What is a grade 4 in English equivalent to?

Grade 4 is the equivalent of a grade C.

What is a Nat 4 equivalent to?

You may remember these as Standard Grades from your time at school. Broadly speaking, the National 4 qualification replaces Standard Grade at General level, with the National 5 replacing a Credit level Standard Grade. National 4s are at SCQF Level 4, National 5s are at SCQF Level 5 and Highers are at SCQF Level 6.

What does level 4 English mean?

Level 4 = Advanced Able to use the language fluently and accurately on all levels normally pertinent to professional needs to: Page 1.

What is a Level 4 English qualification?

What is a Level 4 qualification? Level 4 qualifications are equivalent to the first year of a bachelor's degree and are considered advanced learning. They are typically taken after college A-levels, an Access to Higher Education programme or similar Level 3 courses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is N-4?

N-4 is a form used in New York State for reporting income tax withholding when an employee is being paid wages.

Who is required to file N-4?

Employers in New York State are required to file N-4 if they are withholding New York state income tax from their employees' wages.

How to fill out N-4?

To fill out N-4, an employer must provide information such as the employee's name, address, and Social Security number, along with details regarding the withholding amounts and any exemptions claimed.

What is the purpose of N-4?

The purpose of N-4 is to report and remit the state income tax withheld from employees' wages to the New York State Department of Taxation and Finance.

What information must be reported on N-4?

The information that must be reported on N-4 includes the employee's identification details, total wages paid, taxes withheld, and any exemptions that apply.

Fill out your n-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

N-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.