NY CT-5.4 2009 free printable template

Show details

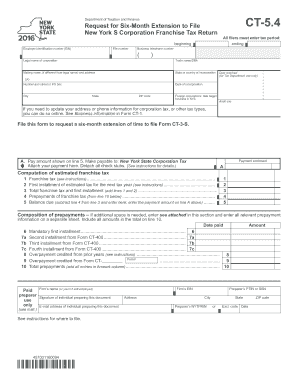

CT-5.4 Staple forms here New York State Department of Taxation and Finance Request for Six-Month Extension to File New York S Corporation Franchise Tax Return beginning Employer identification number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form ct-54

Edit your form ct-54 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ct-54 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ct-54 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form ct-54. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CT-5.4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ct-54

How to fill out NY CT-5.4

01

Obtain the NY CT-5.4 form from the New York State Department of Taxation and Finance website.

02

Fill out your business information including the name, address, and Employer Identification Number (EIN).

03

Indicate the type of disability or exemption you're applying for.

04

Provide details about the disabled individual or individuals covered under the claim.

05

Ensure all necessary documents related to the claim are attached.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form to the appropriate tax office as instructed on the form.

Who needs NY CT-5.4?

01

Individuals or businesses in New York State claiming a credit for employment of persons with disabilities.

02

Employers looking to receive tax benefits under the New York State program for aiding disabled individuals.

Fill

form

: Try Risk Free

People Also Ask about

How do I file an S-Corp extension online?

How do I E-file an S-Corp Tax Extension? Choose Form 7004 and provide your basic business information. Select the form you are requesting an extension for (1120-S). Enter the form details, complete the tax payment (EFW or EFTPS), and transmit the form to the IRS.

Do I need to file a corporate tax return in Connecticut?

Every corporation must file a return on or before the fifteenth day of the month following the due date of the corporation's corresponding federal income tax return for the income year (May 15 for calendar year taxpayers).

Can I file a late S-Corp extension?

S-corp income tax return deadline If the S corporation is unable to file by the deadline, it can obtain an extension of time to file by filing IRS Form 7004.

How do I file an extension for LLC taxes?

To request a filing extension, use the California Department of Tax and Fee Administration's (CDTFA) online services. You must have a CDTFA Online Services Username or User ID and Password. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment.

What is the minimum tax for a corporation in CT?

The minimum tax is $250. Form CT‑1120 ATT, Corporation Business Tax Return Attachment, contains the following computation schedules: Schedule H, Connecticut Apportioned Operating Loss Carryover; • Schedule I, Dividend Deduction; and • Schedule J, Bonus Depreciation Recovery.

What is the CT tax extension form?

To request this extension, you must file Form CT-1127, Application for Extension of Time for Payment of Income Tax, with your timely filed Connecticut income tax return or extension. Purpose: Use Form CT-1040 EXT to request a six-month extension to file your Connecticut income tax return for individuals.

How do I fill out my tax extension form?

Part 1: Identification Line 1: Name and Address. Lines 2 and 3: Social Security Number(s) Line 4: Estimate Your Overall Tax Liability. Line 5: Provide Your Total Payments. Line 6: Your Balance Due. Line 7: Amount You're Paying with Your Tax Extension. Line 8: “Out of the Country” Filers.

How do I file an extension without SSN?

If you're a nonresident or resident alien and you don't have and aren't eligible to get an SSN, you must apply for an ITIN. Although an ITIN isn't required to file Form 4868, you'll need one to file your income tax return. For details on how to apply for an ITIN, see Form W-7 and its instructions.

What must be entered on form 4868 amount you are paying with your extension?

Amount Paid with Extension Enter the total amount that you plan to pay with your extension. Your "Tax Liability" minus your "Tax Payments" would be the total "Balance Due" on your return. You can choose to pay that amount in full, in part, or you can choose not to pay any amount with your extension.

What should I fill in if I don't have the SSN?

If you do not have a Social Security Number (SSN) enter your Individual Tax Identification Number (ITIN). If you do not have an SSN or ITIN leave the entry field blank.

How to file a tax return without a Social Security Number?

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, “Application for IRS Individual Taxpayer Identification Number.” Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form ct-54 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form ct-54 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send form ct-54 to be eSigned by others?

When your form ct-54 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit form ct-54 on an Android device?

You can edit, sign, and distribute form ct-54 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is NY CT-5.4?

NY CT-5.4 is a form used by corporations in New York State to apply for an extension of time to file their corporate tax returns.

Who is required to file NY CT-5.4?

Any corporation that needs more time to file its New York State corporate tax return is required to file NY CT-5.4.

How to fill out NY CT-5.4?

To fill out NY CT-5.4, provide the corporation's name, address, and Employer Identification Number (EIN), along with the desired extension period and signature of an authorized individual.

What is the purpose of NY CT-5.4?

The purpose of NY CT-5.4 is to request an extension of time for filing a corporation's tax return in New York State.

What information must be reported on NY CT-5.4?

The information that must be reported on NY CT-5.4 includes the corporation's name, address, EIN, the tax year for which the extension is requested, and the reason for the extension.

Fill out your form ct-54 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct-54 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.