Get the free Foreign Corporation Reinstatement

Show details

This document serves as an application for foreign corporations to reinstate their authority to transact business in Minnesota, detailing the necessary filing requirements and instructions for completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign corporation reinstatement

Edit your foreign corporation reinstatement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign corporation reinstatement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign corporation reinstatement online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit foreign corporation reinstatement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

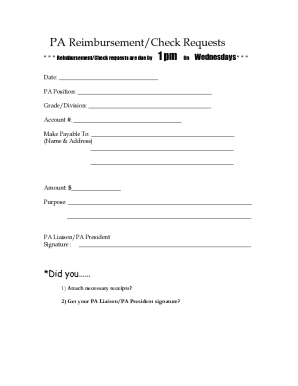

How to fill out foreign corporation reinstatement

How to fill out Foreign Corporation Reinstatement

01

Obtain the Foreign Corporation Reinstatement application form from the appropriate state agency.

02

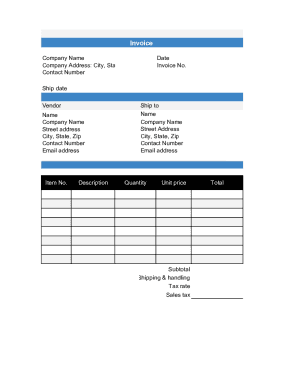

Fill in the required sections of the form, including the corporation's name, identification number, and address.

03

Provide details about the corporation's business activities and the reason for reinstatement.

04

Attach any necessary documents, such as proof of taxes paid or compliance with state regulations.

05

Pay the required reinstatement fee as specified by the state agency.

06

Submit the completed application and payment to the appropriate office, either by mail or online, as permitted.

Who needs Foreign Corporation Reinstatement?

01

A foreign corporation that has had its certificate of authority revoked or suspended.

02

Corporations wishing to legally resume operations in the state after failing to maintain compliance with state business regulations.

03

Companies having outstanding tax obligations or other compliance issues with the state and seeking to rectify them.

Fill

form

: Try Risk Free

People Also Ask about

What is dissolved by proclamation in NY?

Dissolution of a Corporation By Proclamation The New York secretary of state has the authority to dissolve a corporation for failure to file franchise tax returns or pay franchise taxes for two or more years. Once a business has been dissolved by proclamation, it will cease to exist.

What is a foreign-owned corporation?

The term applies both to domestic corporations that are incorporated in another state and to corporations that are incorporated in a nation other than the United States (known as "alien corporations"). All states require that foreign corporations register with the state before conducting business in the state.

How to reinstate a corporation in NY?

In order to be reinstated, a business entity must do the following: Cure the grounds that caused it to be dissolved. Pay all taxes, interest, and penalties that are due. File an application for reinstatement with the state administrator.

How long does it take to reinstate a corporation in Illinois?

Corporation – The processing of corporate reinstatement documents in Illinois takes around 7-10 days. Expedited processing takes 24 hours.

How much is the dissolution fee in NY?

$60 filing fee for Certificate of Dissolution.

How can I reactivate my business?

After fixing the cause of noncompliance, the next step is for the entity to file a reinstatement ( sometimes called a revival) with the Secretary of State and pay any state fees. Reinstating a business requires filing with the Secretary of State, and often with the Department of Revenue or Taxation.

How to reinstate a corporation in New York?

How to Apply: To start the reinstatement process, call the Tax Department's Corporate Dissolution Unit at 518-485-2639. File any outstanding returns and include payment for any taxes due, whether current or delinquent. Obtain a Written Consent from the Tax Department after all delinquencies have been cured.

Can you reinstate a dissolved corporation in California?

Can I reinstate a corporation if it has been dissolved for several years? Yes, but you may need to pay all back taxes, penalties, and filing fees. In some cases, forming a new corporation may be more cost-effective. What is the difference between a Secretary of State suspension and a Franchise Tax Board suspension?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Foreign Corporation Reinstatement?

Foreign Corporation Reinstatement is the process by which a foreign corporation that has had its authority to do business revoked or suspended in a state can restore its status and regain its ability to operate legally within that state.

Who is required to file Foreign Corporation Reinstatement?

Any foreign corporation that has had its authority to conduct business in a state revoked or suspended is required to file for Foreign Corporation Reinstatement.

How to fill out Foreign Corporation Reinstatement?

To fill out the Foreign Corporation Reinstatement, a corporation typically needs to complete a designated form provided by the state, pay any required fees, and submit any necessary documents that demonstrate compliance with state laws.

What is the purpose of Foreign Corporation Reinstatement?

The purpose of Foreign Corporation Reinstatement is to allow foreign corporations to regain their legal ability to conduct business in a state after resolving any issues that led to the revocation or suspension of their business authority.

What information must be reported on Foreign Corporation Reinstatement?

The information that must be reported on Foreign Corporation Reinstatement may include the corporation's name, state of incorporation, date of revocation or suspension, details about any outstanding taxes or penalties, and assurances of compliance with state laws.

Fill out your foreign corporation reinstatement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Corporation Reinstatement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.