Get the free 2003 Construction Materials Credit

Show details

This document provides information regarding the construction materials tax credit for corporate and individual taxpayers, outlining instructions for claiming carryover credits and related tax forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2003 construction materials credit

Edit your 2003 construction materials credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2003 construction materials credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2003 construction materials credit online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2003 construction materials credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

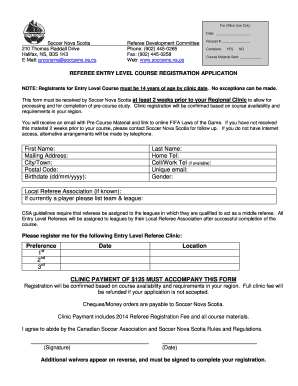

How to fill out 2003 construction materials credit

How to fill out 2003 Construction Materials Credit

01

Begin by obtaining the 2003 Construction Materials Credit form from the IRS website or your tax advisor.

02

Fill out your personal identification information in the designated sections, including your name, address, and Social Security number.

03

Gather documentation for all eligible construction materials purchased during the 2003 tax year.

04

Calculate the total amount spent on qualified construction materials, ensuring they meet the IRS criteria.

05

Enter your total expenditures on the form, following the provided instructions carefully.

06

Review the specific guidelines for any additional requirements, such as tax credits or limitations applicable to your situation.

07

Complete any other required fields as specified in the instructions accompanying the form.

08

Sign and date the form before submission.

09

Submit the completed form along with your tax return to the IRS by the specified deadline.

Who needs 2003 Construction Materials Credit?

01

Individuals or businesses that engaged in construction projects using eligible materials in the year 2003.

02

Contractors who purchased construction materials for projects during the 2003 tax year may also qualify.

03

Anyone looking to obtain tax credits related to construction expenses incurred in that year.

Fill

form

: Try Risk Free

People Also Ask about

What are the basic construction materials?

There are various kinds of building materials used in construction, like steel, cement, concrete, ready mix concrete, binding wires, wood, stone, brick blocks, and aggregate.

What is the issue of construction materials?

A main issue concerning the construction materials and systems is known to be the durability. Materials, such as metals, synthetic materials, cementitious materials and/or material combination and systems are known to deteriorate.

What is the difference between construction and building?

Typically, construction refers more broadly to any project in the field. For example, construction may include constructing a road. Whereas building typically refers to erecting a building such as a home or business.

What is the difference between building materials and construction supplies?

Building materials are all the elements used in the construction of buildings, from housing to commercial and industrial structures. Unlike construction products, building materials specifically focus on the materials used to construct the different parts of a building. This term is widely used in the common language.

What is the difference between building materials and construction materials?

Building materials are all the elements used in the construction of buildings, from housing to commercial and industrial structures. Unlike construction products, building materials specifically focus on the materials used to construct the different parts of a building. This term is widely used in the common language.

Are building materials and construction materials the same?

If you consider a house, building materials are like the bricks, mortar, and timber. But construction materials would include everything from those bricks to the insulation and waterproofing membranes, along with the technical processes that make them part of a safe and durable home.

What is a material of construction?

The materials used in construction can range from natural materials like wood, stone, and clay to synthetic materials like concrete, steel, and plastics.

What is the meaning of construction materials?

A construction building material is any substance used in building a structure. There are various kinds of materials used for building in the construction industry. We use different materials depending on their structural capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2003 Construction Materials Credit?

The 2003 Construction Materials Credit is a tax credit introduced to incentivize businesses and contractors who use certain eligible materials in construction projects. It aims to encourage the use of sustainable and environmentally friendly materials.

Who is required to file 2003 Construction Materials Credit?

Businesses and contractors involved in construction activities who claim the credit for using eligible construction materials in their projects are required to file for the 2003 Construction Materials Credit.

How to fill out 2003 Construction Materials Credit?

To fill out the 2003 Construction Materials Credit, taxpayers should complete the designated tax form by providing information about the materials used, expenses incurred, and any applicable certifications proving the materials' eligibility.

What is the purpose of 2003 Construction Materials Credit?

The purpose of the 2003 Construction Materials Credit is to promote the utilization of specific construction materials that are sustainable, reduce environmental impact, and support green building initiatives.

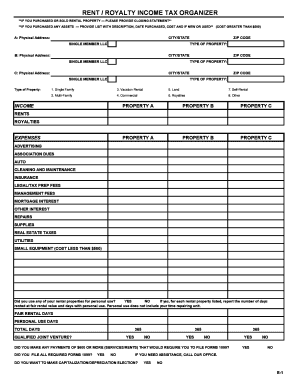

What information must be reported on 2003 Construction Materials Credit?

The information that must be reported includes details about the construction materials used, their costs, the project in which they were utilized, and any other required certifications or documentation to support the claim for the credit.

Fill out your 2003 construction materials credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 Construction Materials Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.