Get the free Schedule D (565)/FTB 3885P

Show details

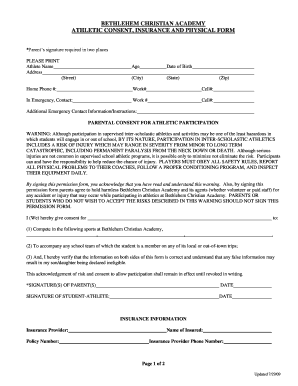

Document for reporting capital gain or loss and for computing depreciation and amortization for California state tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule d 565ftb 3885p

Edit your schedule d 565ftb 3885p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule d 565ftb 3885p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule d 565ftb 3885p online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule d 565ftb 3885p. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule d 565ftb 3885p

How to fill out Schedule D (565)/FTB 3885P

01

Gather information about your capital gains and losses for the tax year.

02

Obtain a blank Schedule D (565)/FTB 3885P form from the California Franchise Tax Board website.

03

Start with Part I and list all sales or exchanges of capital assets, including the sale price and cost basis.

04

Calculate your total gains and losses by subtracting the cost basis from the sale price for each asset.

05

Move to Part II to summarize your net capital gain or loss and determine if it is long-term or short-term.

06

Complete any additional sections as required for your specific tax situation, including special considerations for certain assets.

07

Double-check all calculations for accuracy.

08

Attach Schedule D (565)/FTB 3885P to your California income tax return when filing.

Who needs Schedule D (565)/FTB 3885P?

01

Taxpayers in California who have capital gains or losses from the sale of assets, including stocks, bonds, and real estate.

02

Businesses that must report capital gains and losses to comply with California tax regulations.

03

Individuals who are required to file Form 565 (Partnership Return) or Form 568 (Limited Liability Company Return) and have capital transactions.

Fill

form

: Try Risk Free

People Also Ask about

What are the downsides of bonus depreciation?

Electing to take bonus depreciation is often favorable for businesses seeking to minimize their short-term tax liabilities. Though future-year liabilities may be higher due to having a lower amount of depreciation to claim, this may also create a net business loss that can be rolled over and carried to future years.

Who needs to file CA form 565?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

What is the difference between form 565 and 568 in California?

Partnerships in California typically file Form 565, while LLCs taxed as partnerships file Form 568. Doing business in California can trigger tax obligations even without physical presence. An automatic six-month extension applies to Form 565 and Form 568 — but payment deadlines remain firm.

Why am I getting mail from the State of California Franchise Tax Board?

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due.

What is Form 565 of the franchise tax board?

Form 565 is an information return for calendar year 2024 or fiscal years beginning in 2024. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

Do I have to pay the California Franchise Tax Board?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

What are the rules for 179 bonus depreciation?

Internal Revenue Code Section 179 allows businesses to expense the full purchase price of qualifying equipment and/or software purchased during the tax year. When you buy a piece of qualifying equipment, you may be able to deduct the full purchase price on your business income tax return.

Does California allow depreciation on rental property?

As a California rental property owner, the state tax code allows you to claim deductions for mortgage interest, property taxes, repairs, maintenance, insurance, and even depreciation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule D (565)/FTB 3885P?

Schedule D (565)/FTB 3885P is a form used by partnerships in California to report the capital gains and losses from the sale of capital assets. It is part of the California Franchise Tax Board (FTB) tax filing requirements.

Who is required to file Schedule D (565)/FTB 3885P?

Partnerships that have capital gains or losses to report for the tax year are required to file Schedule D (565)/FTB 3885P.

How to fill out Schedule D (565)/FTB 3885P?

To fill out Schedule D (565)/FTB 3885P, complete the sections detailing the partnership's capital gains and losses, and provide supporting information for each transaction, including dates, descriptions, and amounts.

What is the purpose of Schedule D (565)/FTB 3885P?

The purpose of Schedule D (565)/FTB 3885P is to calculate and report the capital gains and losses of a partnership for tax purposes, ensuring accurate tax liabilities are assessed.

What information must be reported on Schedule D (565)/FTB 3885P?

The information that must be reported on Schedule D (565)/FTB 3885P includes details of all capital assets sold or exchanged, the amount of gain or loss for each transaction, and the overall summary of capital gains and losses for the partnership.

Fill out your schedule d 565ftb 3885p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule D 565ftb 3885p is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.