Get the free LONG TERM DISABILITY - execulinkcom

Show details

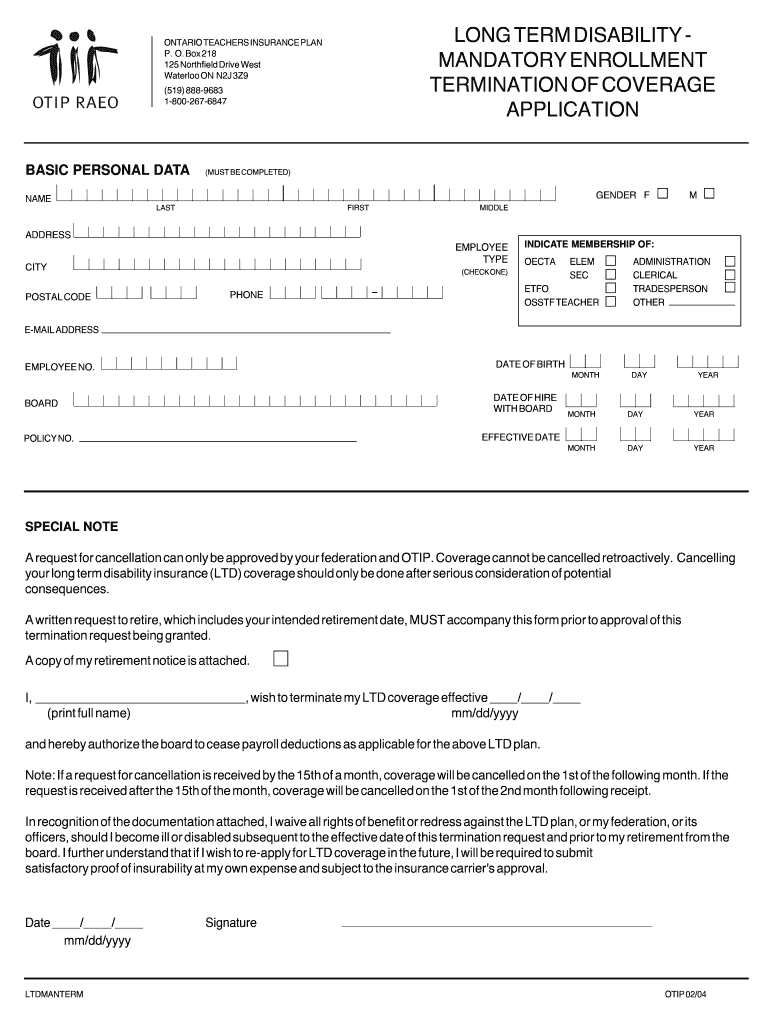

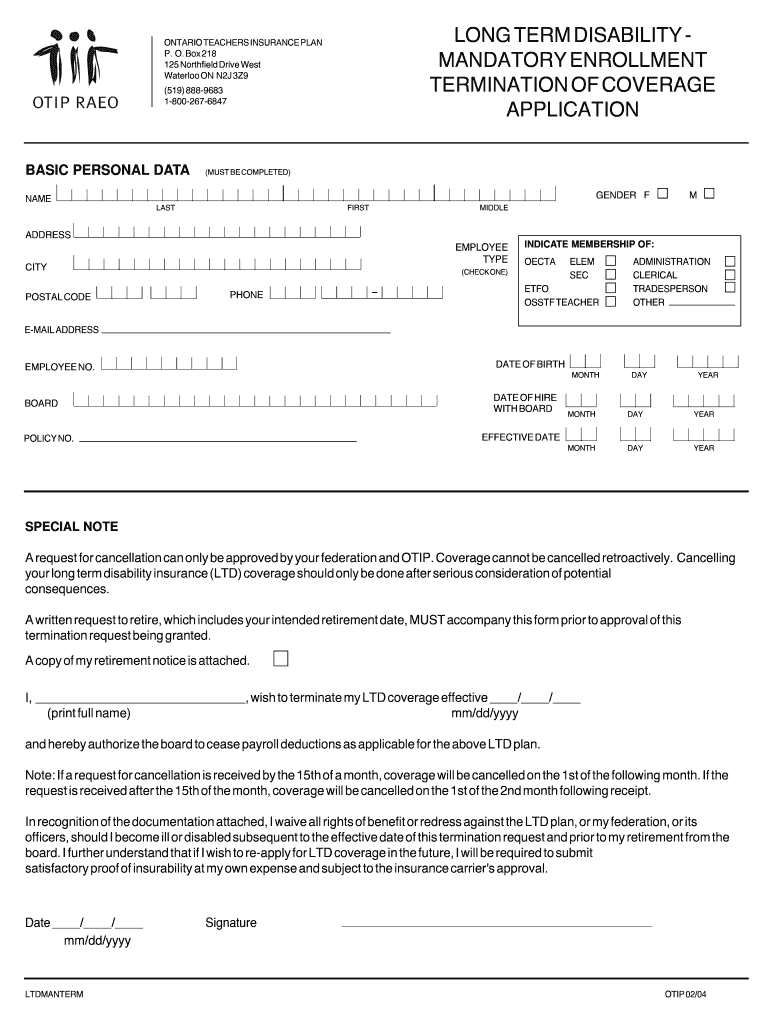

LONG TERM DISABILITY MANDATORY ENROLLMENT TERMINATION OF COVERAGE APPLICATION ONTARIO TEACHERS INSURANCE PLAN P. O. Box 218 125 Northfield Drive West Waterloo ON N2J 3Z9 (519) 8889683 18002676847

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term disability

Edit your long term disability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term disability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long term disability online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit long term disability. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term disability

How to fill out long term disability:

01

Gather necessary documents: Start by collecting important documents such as medical records, employment information, and any supporting documentation related to your disability.

02

Understand the eligibility criteria: Familiarize yourself with the specific criteria and requirements for the long term disability insurance you are applying for. This may include meeting certain medical definitions and having a waiting period before benefits can be received.

03

Complete the application form: Fill out the application form provided by your insurance company accurately and thoroughly. Be sure to include all the required information and double-check for any errors or omissions.

04

Provide supporting documentation: Attach any necessary supporting documentation requested by the insurance company to verify your disability and ensure a complete application. This may include medical reports, treatment history, and statements from healthcare professionals.

05

Submit the application: Once you have completed the application form and gathered all the required documentation, submit your application to the insurance company through the designated method and keep a copy of all the submitted materials for your records.

06

Follow up and communicate: Keep track of your application's progress and communicate with the insurance company as needed. Be prepared to provide any additional information or clarification they may request during the review process.

Who needs long term disability?

01

Individuals with physically demanding jobs: People who work in physically demanding professions are more prone to accidents or injuries that may result in a long term disability. Having long term disability insurance can provide financial protection in case they are unable to work for an extended period.

02

Self-employed individuals: Self-employed individuals often do not have access to the same benefits and protections as those who are employed by a company. Having long term disability insurance can help protect their income and livelihood in the event of a disability.

03

Individuals with pre-existing medical conditions: People with pre-existing medical conditions may face challenges in obtaining traditional disability insurance coverage. Long term disability insurance can be an important option for ensuring financial security in case their condition worsens and prevents them from working.

04

Sole breadwinners or primary income earners: If you are the sole provider for your family or the primary income earner, you may want to consider long term disability insurance to ensure your loved ones are financially supported in case you are unable to work due to a disability.

05

Individuals without significant savings or emergency funds: Long term disability insurance can provide a much-needed financial safety net for individuals who do not have substantial savings or emergency funds to support themselves during a period of extended disability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get long term disability?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific long term disability and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete long term disability online?

Easy online long term disability completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete long term disability on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your long term disability, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is long term disability?

Long term disability provides income replacement for an extended period of time to individuals who are unable to work due to a disability.

Who is required to file long term disability?

Anyone who is unable to work due to a disability and meets the eligibility criteria set by their insurance policy or employer.

How to fill out long term disability?

To fill out long term disability, you will need to provide detailed medical information, complete the necessary forms, and submit them to the insurance company or employer.

What is the purpose of long term disability?

The purpose of long term disability is to provide financial support to individuals who are unable to work due to a disability, helping them to meet their basic needs and maintain their quality of life.

What information must be reported on long term disability?

You must report your medical condition, treatment plan, healthcare providers, work history, and any other relevant information requested by the insurance company or employer.

Fill out your long term disability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Disability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.