Get the free UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVE...

Show details

Este documento sirve para informar cambios en los ingresos imponibles realizados por el Servicio de Impuestos Internos o el Departamento de Impuestos y Finanzas del Estado de Nueva York.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unincorporated business tax report

Edit your unincorporated business tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unincorporated business tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unincorporated business tax report online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit unincorporated business tax report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

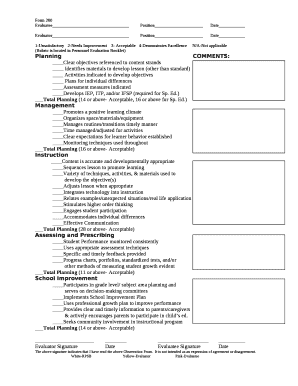

How to fill out unincorporated business tax report

How to fill out UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE

01

Obtain the UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME form from the New York City Department of Finance website or your local tax office.

02

Review any documentation received from the Internal Revenue Service and/or the New York State Department of Taxation and Finance regarding the change in taxable income.

03

Fill in your personal information at the top of the form, including your name, address, and business identification number.

04

Report the original taxable income as well as the revised taxable income as noted in the correspondence from the IRS or NYS.

05

Include any additional explanations or notes that are required or relevant to the changes in your taxable income.

06

Double-check your entries for accuracy and ensure all supporting documents are gathered to accompany your report.

07

Submit the completed form along with any required payments or additional documentation to the appropriate tax authority by the specified deadline.

Who needs UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE?

01

Any individual or business that operates an unincorporated business in New York City and has received a notice from the Internal Revenue Service or the New York State Department of Taxation and Finance regarding a change in their taxable income.

Fill

form

: Try Risk Free

People Also Ask about

Does New York have business property tax?

Twelve states currently do not tax business personal property. These states include Delaware, Hawaii, Illinois, Iowa, Minnesota, New Hampshire, New Jersey, New York, North Dakota, Ohio, Pennsylvania, and South Dakota.

How to pay NYC unincorporated business tax?

You can file the forms and pay online through Business Tax e-Services or send the documents and payment by mail. You can file and pay the tax through Business Tax e-Services. You can pay by: Electronic Funds Transfer (EFT) withdrawn directly from your bank.

What is the unincorporated business tax in New York?

Tax Rates A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account.

Who is required to file NYC 202?

Single-member LLCs must file on Form NYC-202. Partnerships (including any incorporated entity other than a single-member LLC treated as a partnership for federal income tax purposes) or other unincorporated organiza- tions must file Form NYC-204 or Form 204EZ.

What is the tax rate for LLC in NY?

Summary of LLC Taxes in NYC Tax TypeTax Rate New York State Annual Fee $25 to $4,500 depending on income Franchise Tax (Corporations) Based on income, gross receipts, or capital Unincorporated Business Tax 4.425% for income over $95,000 Sales Tax 8.875% total (4.5% NYC + 4% state)2 more rows • Dec 29, 2024

What is the unincorporated business tax in New York State?

Tax Rates A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account.

Who is subject to the NYC city tax?

About. People, trusts, and estates must pay the New York City Personal Income Tax if they earn income in the City. The tax is collected by the New York State Department of Taxation and Finance (DTF). The tax usually shows up as a separate line on pay stubs.

Who pays the NYC UBT tax?

NYC imposes the UBT on the unincorporated business taxable income of an unincorporated business (e.g., a partnership) that is wholly or partly carried on within NYC at a rate of 4%. The UBT is an entity-level tax so unincorporated business taxable income is subject to both the UBT and NYC's personal income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE?

The UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME is a form used to report changes in taxable income that have been made by the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance for unincorporated businesses operating in New York City.

Who is required to file UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE?

Businesses that operate as unincorporated entities and have received a notice from the IRS or the New York State Department of Taxation and Finance regarding a change in their taxable income are required to file this report.

How to fill out UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE?

To fill out the report, follow the instructions provided on the form, which typically include entering the previous taxable income, any adjustments made by the IRS or state, calculating the new taxable income, and providing any required documentation or explanations for the changes.

What is the purpose of UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE?

The purpose of the report is to ensure that the taxable income reported by unincorporated businesses is accurate and reflects any changes made by tax authorities, helping to maintain compliance with tax laws.

What information must be reported on UNINCORPORATED BUSINESS TAX REPORT OF CHANGE IN TAXABLE INCOME MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE?

The report must include information such as the business's name, tax identification number, previous and revised taxable income, details on the nature of changes made, and any supporting documentation requested by the tax authorities.

Fill out your unincorporated business tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unincorporated Business Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.