Get the free Form 2587

Show details

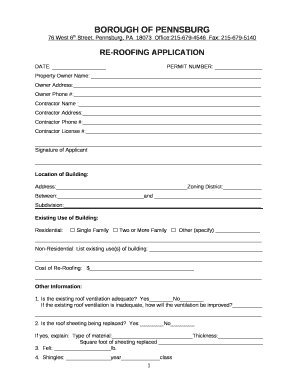

This document serves as an application for the 1999 Special Enrollment Examination conducted by the Internal Revenue Service. It includes instructions for completion, examination dates, fees, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 2587

Edit your form 2587 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2587 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 2587 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 2587. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 2587

How to fill out Form 2587

01

Obtain Form 2587 from the relevant website or office.

02

Begin filling out the personal information section, providing your name, address, and contact details.

03

Indicate the purpose of submitting the form in the designated section.

04

Provide any required identifying information, such as your Social Security Number or Tax ID.

05

Complete any necessary details related to the specific request associated with Form 2587.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form according to the instructions provided, either online or by mailing it to the specified address.

Who needs Form 2587?

01

Individuals or entities who need to request certain information or approvals from the relevant government agency.

02

Taxpayers who are seeking specific records or clarification regarding their tax status.

03

Persons applying for benefits or exemptions that require verification that is managed via this form.

Fill

form

: Try Risk Free

People Also Ask about

How much does the special enrollment exam cost?

How much does it cost to take the special enrollment examination? (updated March 1, 2025) There is a $267 fee per part paid at the time of appointment scheduling. The test fee is non-refundable and non-transferable.

Is EA certification worth it?

Yes, it would be worth it. However, merely becoming an EA is not enough to be a professional. But if you want to work in tax it is necessary.

What is the IRS test drive exam?

TAKE A TEST DRIVE BEFORE EXAM DAY The program, called Test Drive, allows candidates to walk through, on a practice basis, all check-in and testing procedures that occur at the test center on test day.

What is form 2587?

If you are on autopay, the Notice of Automatic Payment (DE 2587) form is the only form you will receive. You only need to return it if you have returned to work. If your claim is eligible for automatic payment, you will receive a DE 2587 at the time your first payment is issued.

Can I take the EA exam online?

When it comes to the content of the EA, there is no difference between completing it at a test center or taking it online. The EA is 90-minutes long and contains 40 sections across three sections (Integrated Reasoning, 12 questions; Verbal Reasoning, 14 questions; Quantitative Reasoning, 14 questions.

How much do enrolled agents charge?

ing to CostHelper, the average hourly rate for enrolled agents (or tax accountants) is between $100-$400. But an even better guide is their total tax filing fees which can range from $250-$2,500 for businesses with few or no employees.

What is the pass rate for the enrolled agent exam?

How hard is the EA exam? The IRS Enrolled Agent exam pass rate fluctuates from 70% to 74%. This is a high pass rate compared to other professional accounting exams, like the CPA, which has an average pass rate of 45-50%. The IRS sets a scaled passing score at 105 out of the available 130 points.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 2587?

Form 2587 is a document used for reporting specific information required by regulatory authorities, most commonly in the context of financial or compliance reporting.

Who is required to file Form 2587?

Typically, businesses or individuals who meet certain criteria set by the regulatory authority are required to file Form 2587. This may include entities involved in regulated activities or services.

How to fill out Form 2587?

To fill out Form 2587, individuals should gather all necessary information, follow the provided instructions on the form, and ensure that all fields are completed accurately before submission.

What is the purpose of Form 2587?

The purpose of Form 2587 is to collect relevant data to ensure compliance with regulations and to maintain transparency in operations and financial reporting.

What information must be reported on Form 2587?

Form 2587 requires reporting of specific financial, operational, and compliance information, such as transaction details, business identification, and any pertinent regulatory disclosures.

Fill out your form 2587 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2587 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.