Get the free N-103

Show details

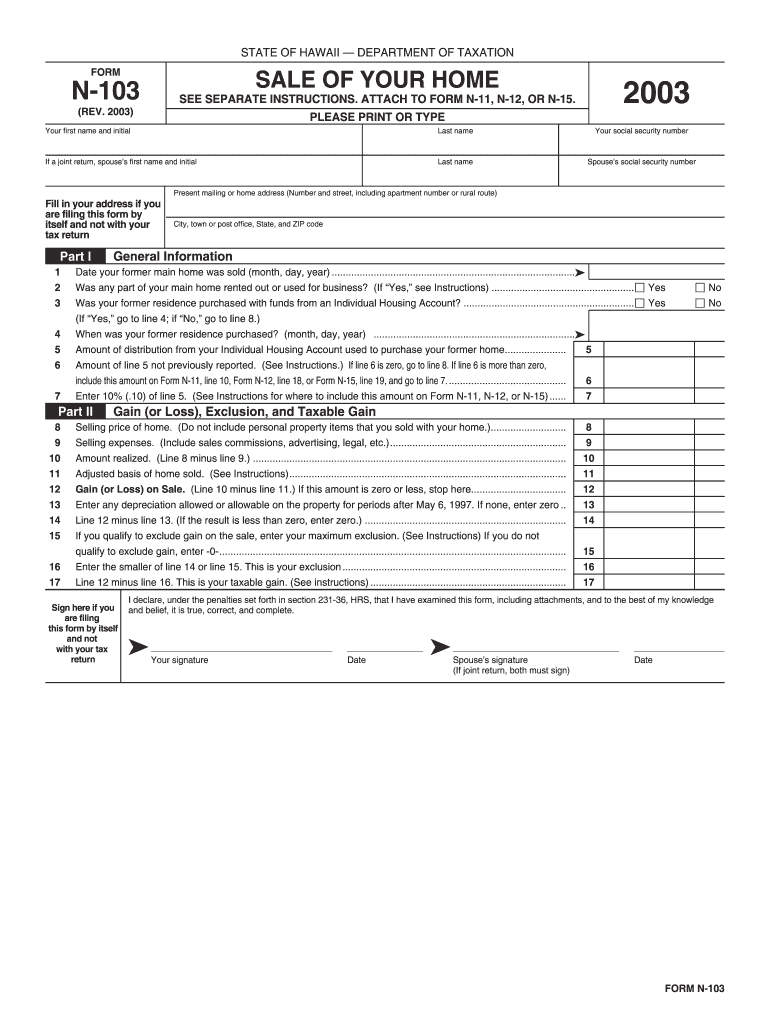

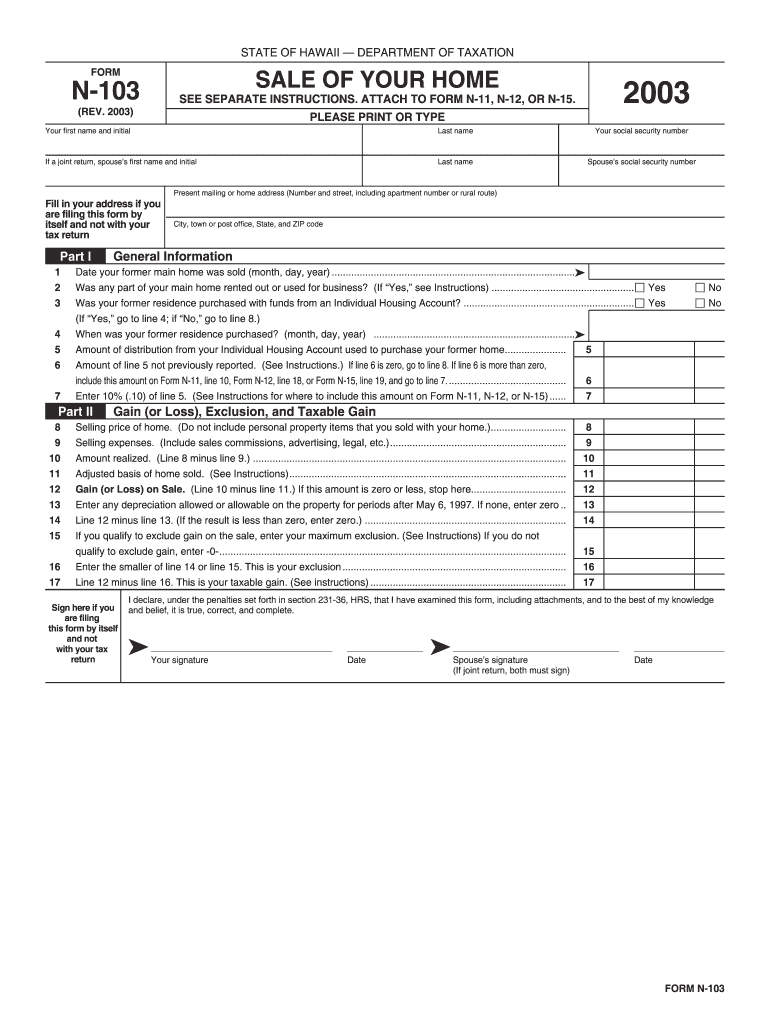

This form is used to report the sale of your home in Hawaii, including any applicable gains or losses, and to determine potential exclusions from taxable gain. It must be attached to the Hawaii income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign n-103

Edit your n-103 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n-103 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit n-103 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit n-103. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out n-103

How to fill out N-103

01

Gather personal information, including your name, address, and alien registration number.

02

Provide details about your immigration status and any previous applications.

03

Fill out the sections regarding your eligibility for the benefits you are applying for.

04

Review the instructions carefully for any specific requirements related to your situation.

05

Sign and date the form at the end, ensuring that all information is accurate and complete.

06

Submit the form according to the instructions provided, ensuring you keep a copy for your records.

Who needs N-103?

01

Individuals who are seeking to apply for immigration benefits or status adjustments through the U.S. Citizenship and Immigration Services (USCIS).

02

Foreign nationals who require documentation related to their immigration status.

Fill

form

: Try Risk Free

People Also Ask about

What is the song 103 in the Bible?

Psalm 103 Of David. Praise the LORD, O my soul; all my inmost being, praise his holy name. who satisfies your desires with good things so that your youth is renewed like the eagle's. The LORD works righteousness and justice for all the oppressed.

How do you say 103 in English?

0:32 4:12 Before we begin please don't forget to hit the notification bell to get our latest. Videos. Now sitMoreBefore we begin please don't forget to hit the notification bell to get our latest. Videos. Now sit back and get ready to practice these numbers together let's give it a. Try.

What are the promises in Psalm 103?

“The Lord is compassionate and gracious, slow to anger, abounding in love. He will not always accuse, nor will he harbor his anger forever; he does not treat us as our sins deserve or repay us ing to our iniquities.” (Psalm 103:8-10 NIV) Psalm 103 provides another reminder of the forgiveness that God offers.

What is the meaning behind Psalm 103?

Psalm 103 is a meditation on the goodness of God and how we ought to worship the Lord because of His goodness. David expressed this in the opening words of the psalm, “Bless the Lord, O my soul, and all that is within me, bless His holy name!”

When and why did David write Psalm 103?

Baptist preacher and biblical commentator Charles Spurgeon suggests that the psalm was written in David's later life, as seen by the psalmist's focus on the frailty of life and his "higher sense of the preciousness of pardon, because a keener sense of sin".

What does 103 mean biblically?

Psalm 103 tells of God who delivers the nation from bondage (7) and the individual from sin (10-13). God is portrayed as loving with motherly affection (4, 13) as well as with fatherly compassion (13). Psalm 104 speaks of God who creates and sustains all life.

What is the main message of Psalm 103?

Psalm 103 Short Summary: It speaks of God's patient nature, how He tolerates us longer than we deserve to be tolerated. He chooses not always to punish us for our sins but to show us compassion. This psalm contains the famous words, which are now a title of a hymn, “Bless the Lord, O my soul… bless His holy name!”

What emotions are expressed in Psalm 103?

Psalm 103 expresses a response to difficulty and pain that is a bit different from the lament of Psalm 40 (shared by Mal previously) - it's a posture and a choice to focus on God, to lift my eyes off myself and off my immediate circumstances, and to give God praise in spite of my circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is N-103?

N-103 is a tax form used for reporting specific income and expenses related to business activities.

Who is required to file N-103?

Individuals or entities engaged in business activities that meet certain income thresholds are required to file N-103.

How to fill out N-103?

To fill out N-103, gather all necessary financial records, complete the form accurately by entering required information and submitting it to the relevant tax authority.

What is the purpose of N-103?

The purpose of N-103 is to provide a comprehensive report of business income and deductions to ensure proper tax calculations.

What information must be reported on N-103?

N-103 requires reporting of total business income, allowable deductions, expenses, and any other pertinent financial information related to the business.

Fill out your n-103 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

N-103 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.