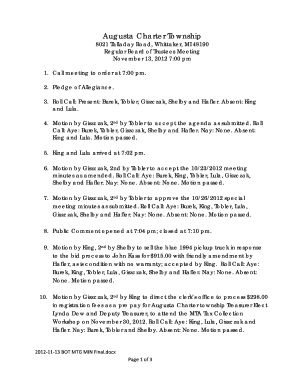

Get the free Specifications for Filing Form 8027

Show details

This document provides specifications and guidance for employers required to file Form 8027, detailing the processes for magnetic and electronic filing of tip income and allocated tips to the IRS.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign specifications for filing form

Edit your specifications for filing form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your specifications for filing form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit specifications for filing form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit specifications for filing form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out specifications for filing form

How to fill out Specifications for Filing Form 8027

01

Gather the required information such as the employer's name, address, and Employer Identification Number (EIN).

02

Identify the types of payments that need to be reported, including cash and non-cash payments.

03

Determine the reporting period for which you are filling out the form.

04

Complete the appropriate sections of the Specifications for Filing Form 8027, ensuring that the figures are accurate and correspond to your accounting records.

05

Review the completed specifications for any errors or omissions before submission.

06

Submit the completed Specifications for Filing Form 8027 to the IRS and keep a copy for your records.

Who needs Specifications for Filing Form 8027?

01

Businesses that are required to report information about their annual tip income, specifically large food and beverage establishments or those with certain thresholds of tipping.

Fill

form

: Try Risk Free

People Also Ask about

How do you report tip allocation?

Employers use Form 8027 to: Annually report to the IRS receipts and tips from their large food or beverage establishments. Determine allocated tips for tipped employees.

Who is required to file form 8027?

For purposes of Form 8027, the customer for whom a work site employee performs services (that is, the employer who operates a large food or beverage establishment) is considered the employer and must file Form 8027. The CPEO must furnish to the customer any information necessary to complete this form.

Why do I have to report cash tips?

You are legally required to report your cash tips. It is income, and therefore taxable. Not declaring it is technically tax evasion.

What is the tip allocation form 8027?

The purpose of Form 8027 is to determine if employees are receiving sufficient tips from the gross receipts reported. Per the IRS, they should receive a minimum of 8% tips unless the business has been granted a lower allocation rate to apply.

What percentage of cash tips must be claimed?

You need to claim 100% of the tips you receive, cash and credit. It is all taxable income.

Who needs to fill out a W8BEN form?

Non-US individuals who receive certain types of income from US sources — such as interest, dividends, rents, royalties, and certain other types of income — need to fill out the W-8 BEN. The form is used to claim any applicable tax treaty benefits and to verify that the individual is not a US resident for tax purposes.

What is the tip credit form 8027?

Employers use Form 8027 to: Annually report to the IRS receipts and tips from their large food or beverage establishments. Determine allocated tips for tipped employees.

Who needs to file form 8027?

For purposes of Form 8027, the customer for whom a work site employee performs services (that is, the employer who operates a large food or beverage establishment) is considered the employer and must file Form 8027. The CPEO must furnish to the customer any information necessary to complete this form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Specifications for Filing Form 8027?

Specifications for Filing Form 8027 is a document that outlines the requirements for employers to report information about tips received by employees, particularly in the food and beverage industry.

Who is required to file Specifications for Filing Form 8027?

Employers who operate a large food or beverage establishment where tipping is customary must file Form 8027 if they meet certain criteria, such as having more than 10 employees on a typical business day.

How to fill out Specifications for Filing Form 8027?

To fill out Form 8027, employers must collect data on employees' tip allocations, total sales, and the number of employees who receive tips. They should then input this information into the appropriate sections of the form as outlined in the instructions provided by the IRS.

What is the purpose of Specifications for Filing Form 8027?

The purpose of Form 8027 is to facilitate the reporting of tip income to the IRS, ensuring compliance with tax regulations and helping to accurately assess tax obligations related to employee tips.

What information must be reported on Specifications for Filing Form 8027?

Form 8027 requires employers to report information such as the total amount of tips received by employees, the total gross receipts of the establishment, and the number of employees who received tips during the reporting period.

Fill out your specifications for filing form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Specifications For Filing Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.