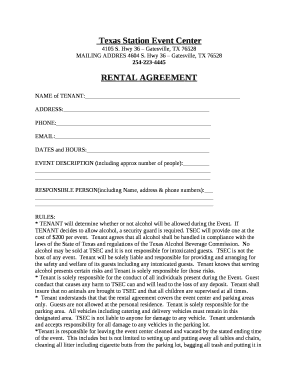

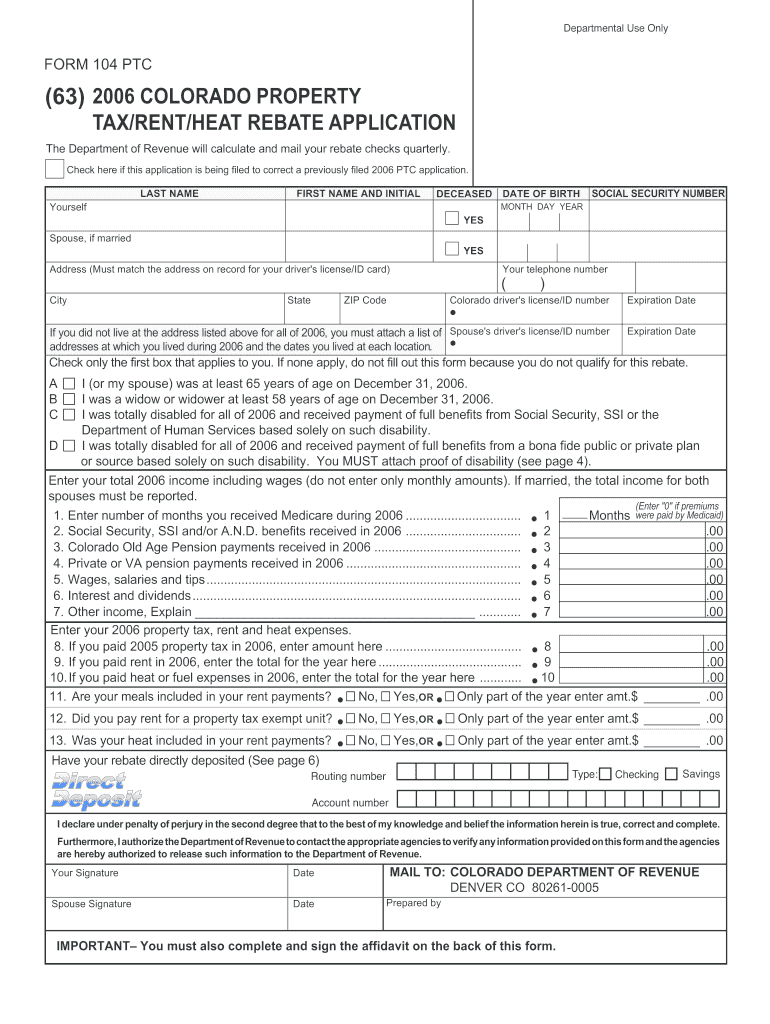

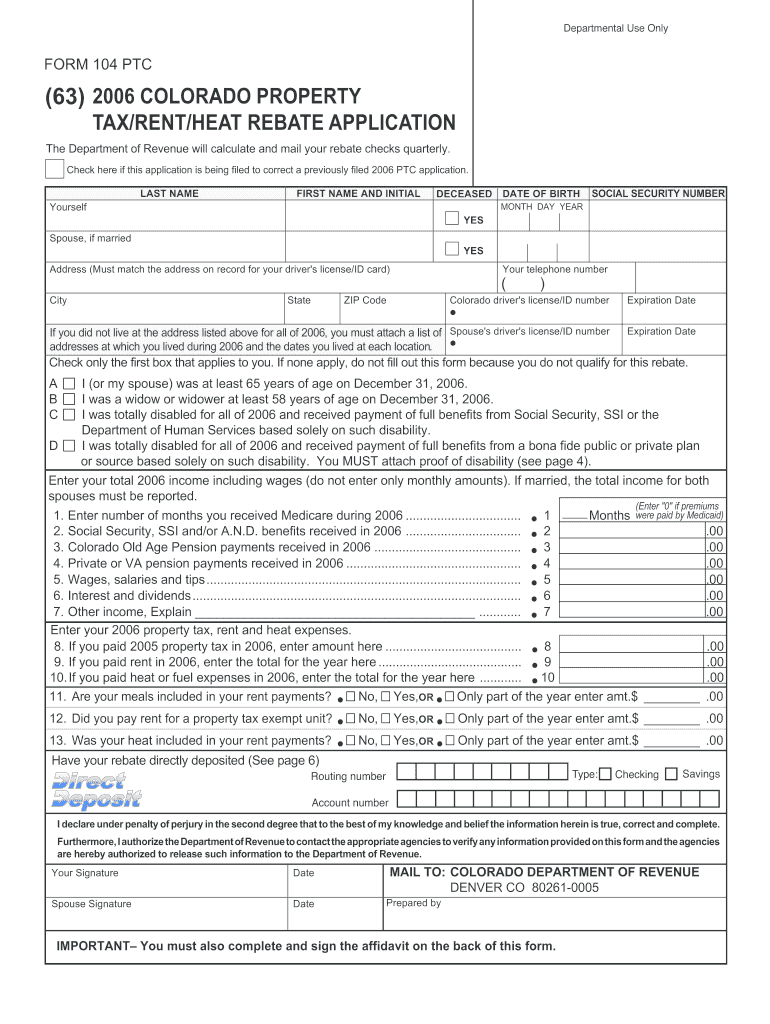

Get the free Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC

Show details

This document is an application form for property tax, rent, and heat rebates in Colorado for the year 2006, including instructions on eligibility and completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign colorado property taxrentheat rebate

Edit your colorado property taxrentheat rebate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado property taxrentheat rebate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado property taxrentheat rebate online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit colorado property taxrentheat rebate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out colorado property taxrentheat rebate

How to fill out Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC

01

Obtain the Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC from the Colorado Department of Revenue website or a local government office.

02

Fill out your personal information at the top of the form, including name, address, and Social Security number.

03

Indicate your filing status and provide details about your property taxes, rental payments, or heating costs.

04

Attach any required documentation, including proof of income and evidence of property tax or rent payments.

05

Review the completed form for accuracy and ensure all required fields are filled out.

06

Sign and date the form at the bottom.

07

Submit the form to the appropriate Colorado Department of Revenue office by the specified deadline.

Who needs Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC?

01

Colorado residents who are at least 65 years old, or disabled individuals, or certain low-income renters or homeowners who qualify.

02

Those who have paid property taxes, rent, or heating costs in the past year and meet the income eligibility criteria.

Fill

form

: Try Risk Free

People Also Ask about

How much is the Colorado PTC rebate for seniors?

The Property Tax, Rent, Heat (PTC) Rebate is available to Colorado residents to help with their property tax, rent, and/or heat expenses. The rebate is based on income and includes people with disabilities and older adults. For tax year 2023, the rebate amount can be up to $1,112 for applicants.

Who qualifies for Colorado tax rebate?

To receive the Colorado TABOR refund, an individual must be at least 18 years of age on or before January 1, 2024, be a Colorado resident for the entire 2024 income tax year, and file a Colorado state income tax return for the 2024 income tax year, or apply for the PTC Rebate.

What is the $800 refund in Colorado?

Taxpayer's Bill of Rights (TABOR) For one year only (2023), TABOR state sales tax refunds claimed on income tax returns, or PTC applications, will provide an equal refund of $800 for all qualifying individuals ($1,600 for two qualifying individuals filing jointly). How do I get the TABOR rebate?

Who is eligible for Colorado rebate?

You may qualify for the PTC Rebate if you are a full-year Colorado resident who is 65 years of age or older, a surviving spouse 58 years of age or older, or disabled, regardless of age. The rebate amount is based on the applicant's income and expenses.

What is the heat rebate for Colorado property taxes?

The rebate amount can be up to $1,154 a year and if you apply by October 15, 2025, you could receive up to a $354 TABOR refund ($177 for single filers). Annually, this program could provide more than $7 million in relief to Coloradans ensuring seniors and Coloradans with disabilities can heat and remain in their homes.

How much is the Colorado property tax rebate?

The rebate helps eligible, low-income Coloradans, who are seniors or are disabled, offset property tax, rent, and heating costs. For 2024 expenses, eligible applicants can receive up to $1,154 in rebate assistance.

How do I claim my Colorado rebate?

Any Coloradan who meets the eligibility requirements should submit a rebate application. Once you complete the application, you can bring it to a Colorado Department of Revenue Taxpayer Service Center or send it in by mail to: Colorado Department of Revenue, Denver, CO 80261-0005.

Who is eligible for the heat pump rebate in Colorado?

The tax credit applies to heat pumps that are installed for both space and water heating purposes. All Colorado residents qualify for this rebate program. Through the Colorado Heat Pump Tax Credit, homeowners can receive discounts up to $1,500 for heat pumps that cover at least 80% of their annual heating needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC?

The Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC is a form used by eligible residents of Colorado to apply for rebates on property taxes, rent, or heating costs incurred during the previous year.

Who is required to file Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC?

Residents of Colorado who are 65 years or older, or who have been disabled for at least 12 months, and meet the income and residency requirements are required to file the Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC.

How to fill out Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC?

To fill out the form, individuals must provide personal information, including their name, address, and Social Security number, report income, list property tax or rent paid, and provide information about heating expenses, along with necessary documentation.

What is the purpose of Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC?

The purpose of the form is to provide financial relief to eligible individuals by reimbursing some of their property taxes, rent, or heating expenses, thereby helping to alleviate financial burdens.

What information must be reported on Colorado Property Tax/Rent/Heat Rebate Application Form 104 PTC?

The form requires reporting of personal identification details, total income for the previous year, amounts paid for property tax or rent, heating expenses, and documentation verifying these payments.

Fill out your colorado property taxrentheat rebate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Property Taxrentheat Rebate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.