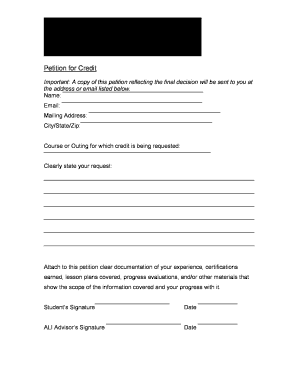

Get the free Michigan Historic Preservation Tax Credit Assignment

Show details

This document is used for assigning tax credits related to Michigan's Historic Preservation Tax Credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan historic preservation tax

Edit your michigan historic preservation tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan historic preservation tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan historic preservation tax online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan historic preservation tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan historic preservation tax

How to fill out Michigan Historic Preservation Tax Credit Assignment

01

Obtain the Michigan Historic Preservation Tax Credit Assignment form from the Michigan State Housing Development Authority website.

02

Review the eligibility criteria for the tax credit to ensure your property qualifies.

03

Complete the property information section by providing the property's address and details.

04

Fill out the taxpayer information section, including your name, social security number or business tax ID, and contact information.

05

Provide details of the rehabilitation work that has been undertaken on the property.

06

Attach required documentation, such as before-and-after photographs, receipts, and a copy of the State Historic Preservation Office approval if applicable.

07

Sign and date the form to certify the information provided is accurate.

08

Submit the completed form to the Michigan State Housing Development Authority.

Who needs Michigan Historic Preservation Tax Credit Assignment?

01

Individuals and businesses that own historic properties in Michigan and have completed qualifying rehabilitation work.

02

Property developers and contractors involved in the restoration of historic sites.

03

Homeowners looking to benefit from tax credits for renovating their historic homes.

Fill

form

: Try Risk Free

People Also Ask about

What is the Michigan historic preservation tax credit?

The Michigan historic preservation tax credit is a state income tax credit of 25 percent that is available for certain historic resources. The credits are available to encourage investment in Michigan's historic resources.

What is the property tax credit for seniors over 65 in Michigan?

Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200.

What organization helps preserve historically important buildings in Michigan?

The State Historic Preservation Office evaluates, protects and promotes Michigan's historic built environment and archaeological sites.

What makes a house historic in Michigan?

Places on the NRHP are designated because they hold historic significance, integrity and meet one of the following criteria: Associated with events that have made a significant contribution to the broad patterns of our history; or are associated with the lives of significant persons in or past; or embody the

Who is eligible for the Michigan tax credit?

To get the EITC for the 2024 tax year (for tax returns filed in early 2025), your income has to be below the following levels: $59,899 ($66,819 if married filing jointly) with three or more qualifying children. $55,768 ($62,688 if married filing jointly) with two qualifying children.

Who qualifies for homestead property tax credit in Michigan?

Who Qualifies? You can claim a property tax credit if all the following apply: You are considered a "natural person" (owner or claimant), and not a living trust, irrevocable trust, or other legal entity, such as a S corporation or LLC, etc. Your homestead is in Michigan (whether you rent or own).

How much is the Michigan property tax credit?

Values and Limits Maximum Taxable Value$154,400 Total Household Resources (THR) Limit $67,300 Phase-out begins when Total Household Resources exceeds $58,300 Credit Limit $1,700

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Michigan Historic Preservation Tax Credit Assignment?

The Michigan Historic Preservation Tax Credit Assignment is a program that allows property owners who have rehabilitated historic properties to assign their tax credits to other individuals or entities. This is designed to incentivize the preservation of historic buildings by providing a financial benefit.

Who is required to file Michigan Historic Preservation Tax Credit Assignment?

Property owners who have received tax credits for the rehabilitation of historic properties are required to file the Michigan Historic Preservation Tax Credit Assignment if they wish to assign their credits to another party.

How to fill out Michigan Historic Preservation Tax Credit Assignment?

To fill out the Michigan Historic Preservation Tax Credit Assignment, you need to complete the designated form, providing required information such as property details, the amount of credits being assigned, and the information of the assignee. It is important to follow the instructions on the form and ensure all sections are accurately filled.

What is the purpose of Michigan Historic Preservation Tax Credit Assignment?

The purpose of the Michigan Historic Preservation Tax Credit Assignment is to encourage the rehabilitation of historic properties by making tax credits more transferable and accessible. It allows property owners to monetize their tax credits, thus making preservation projects more financially feasible.

What information must be reported on Michigan Historic Preservation Tax Credit Assignment?

The information that must be reported on the Michigan Historic Preservation Tax Credit Assignment includes the property address, the amount of tax credits being assigned, details about the property owner, and the recipient of the credits, along with any supporting documentation required by the program.

Fill out your michigan historic preservation tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Historic Preservation Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.