Get the free ROC-BT-SUMMARY

Show details

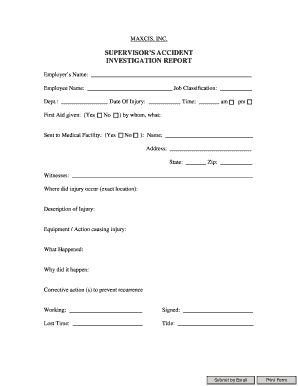

Este formulario se utiliza para reportar cambios relacionados con la declaración de impuestos de negocios en New Hampshire, incluyendo ajustes del IRS para el año calendario indicado.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roc-bt-summary

Edit your roc-bt-summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roc-bt-summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roc-bt-summary online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit roc-bt-summary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roc-bt-summary

How to fill out ROC-BT-SUMMARY

01

Gather all relevant data and documents needed for the ROC-BT-SUMMARY.

02

Start with Section A by entering the basic information required, such as your name and contact details.

03

Move to Section B to provide a summary of your business activities for the reporting period.

04

In Section C, input financial data, including income, expenses, and profit or loss.

05

Ensure all figures are accurate and reflect the supporting documentation.

06

Review each section for completeness and clarity, making any necessary adjustments.

07

Sign and date the form at the end to certify the information provided.

Who needs ROC-BT-SUMMARY?

01

Individuals or businesses that are required to file periodic summaries of their financial activities.

02

Accountants or financial advisors preparing tax returns or financial statements.

03

Regulatory bodies requiring standardized reporting from businesses.

Fill

form

: Try Risk Free

People Also Ask about

What is special about the New Hampshire colony?

Six months before the signing of the Declaration of Independence, New Hampshire became the first colony to declare its independence from England. Josiah Bartlett, William Whipple, and Matthew Thornton signed the Declaration for New Hampshire. The New Hampshire Colony became a state in 1788.

Does New Hampshire have a partnership tax return?

(d) Partnership business organizations required to pay estimated taxes as provided in RSA 77-A:6, II shall complete and file Form NH-1065-ES "Estimated Partnership Business Tax" quarterly payment form with payment on or before the 15th day of the fourth, sixth, ninth and twelfth month of the taxable period to which

What is the New Hampshire Priority Climate Action Plan?

The New Hampshire Priority Climate Action Plan includes: "a summary of New Hampshire's past and present greenhouse gas emissions; a detailed, state-level greenhouse gas inventory; a list of priority measures that could reduce the state's greenhouse gas emissions; and an analysis of how those measures would benefit low-

Who must file NH 1120?

All business organizations, including single member Limited Liability Companies (SMLLC), taxed as a corporation federally must file a Form NH-1120 return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $103,000 (for taxable periods

What is the ideology of New Hampshire?

New Hampshire is often noted for its moderate politics (especially in relation to strongly Democratic neighboring states) and its status as a prominent swing state.

What is the new hampshire BT summary?

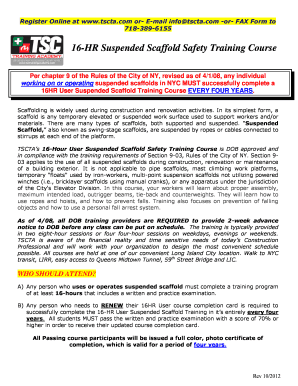

IF YOU ARE REQUIRED TO FILE A RETURN FOR EITHER TAX, THEN YOU MUST FILE A BUSINESS TAX SUMMARY (BT-SUMMARY). THE BT-SUMMARY SUMMARIZES BOTH THE BET AND/OR THE BPT RETURNS.

What is the New Hampshire business enterprise tax?

What is Business Enterprise Tax (BET)? A tax assessed on the enterprise value tax base, which is the sum of all compensation paid or accrued, interest paid or accrued, and dividends paid by the business enterprise, after special adjustments and apportionment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ROC-BT-SUMMARY?

ROC-BT-SUMMARY is a regulatory form required by the government for businesses in India to report their financial and operational data. It summarizes the business transaction details and is part of compliance requirements.

Who is required to file ROC-BT-SUMMARY?

All companies registered under the Companies Act, 2013 in India are required to file ROC-BT-SUMMARY as part of their annual filing obligations.

How to fill out ROC-BT-SUMMARY?

To fill out ROC-BT-SUMMARY, companies need to gather financial data including transaction details, revenue, expenses, and other relevant information as per the prescribed format and guidelines by the Ministry of Corporate Affairs.

What is the purpose of ROC-BT-SUMMARY?

The purpose of ROC-BT-SUMMARY is to ensure transparency and compliance in the financial reporting of companies, allowing the government to monitor economic activities and assess tax liabilities.

What information must be reported on ROC-BT-SUMMARY?

ROC-BT-SUMMARY must report information such as the company's financial performance, details of transactions, shareholding patterns, directorships, and any other relevant data as mandated by regulatory authorities.

Fill out your roc-bt-summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roc-Bt-Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.