Get the free Form N-139

Show details

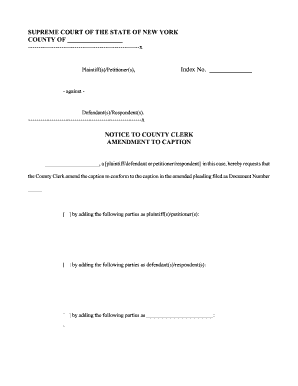

Use Form N-139 to figure your moving expense deduction for a move related to the start of work at a new principal place of work.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form n-139

Edit your form n-139 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-139 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form n-139 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form n-139. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form n-139

How to fill out Form N-139

01

Download Form N-139 from the official USCIS website.

02

Start by entering your personal information in Section 1, including your full name and contact details.

03

In Section 2, provide your Alien Registration Number (if applicable).

04

Fill out Section 3 regarding your immigration status.

05

Complete Section 4 by answering questions about your eligibility for the benefit you are seeking.

06

Review the instructions carefully for any additional information specific to your situation.

07

Sign and date the form at the end to certify that the information provided is true.

08

Submit the form according to the guidelines provided, including the appropriate fees.

Who needs Form N-139?

01

Form N-139 is typically needed by individuals who are applying for certain immigration benefits, particularly those seeking to renew or adjust their immigration status.

02

It may also be required for applicants looking to reinstate their status after a violation.

Fill

form

: Try Risk Free

People Also Ask about

What do non residents of Hawaii need to file?

Hawaiʻi nonresidents or part-year residents should file state Form N-15. A completed copy of the federal return must be attached to the Form N-15. Full-year Hawaiʻi residents filing a federal return should file state Form N-11.

Does Hawaii tax out of state income?

§ 18-235-4-03 - Nonresidents taxable on Hawaii income. (a) A nonresident, as defined in section 235-1, HRS, is taxable on Hawaii source income and is not taxable on out-of-state income. A nonresident is not allowed a credit for taxes paid to another state under section 235-55, HRS.

How to change address on Hawaii tax online?

How do I change the business, mailing, or physical location address for my business? Sign into Hawaii Tax Online to update your address information or complete and submit Form ITPS-COA.

What is the non resident withholding in Hawaii?

In Hawaii, when you purchase property from a non-resident, it's generally required that you withhold 7.25% of the transaction amount to cover the state sales tax, which is typically the seller's responsibility. As the buyer, you'll need to complete Form N-288 to manage this aspect of the transaction.

Does Hawaii tax worldwide income?

a Hawaii resident and as a nonresident? The main difference is that Hawaii residents are taxed on their income from worldwide sources, and nonresidents are taxed on their income from Hawaii sources only. nonresident can deduct on the Form N-15?

Who needs to file a Hawaii tax return?

Who has to file Hawaii state income tax? Filing StatusAgeGross Income Threshold Married Filing Separately Any age $5,544 Head of Household Under 65 $7,568 65 or older $8,712 Qualified Surviving Spouse Under 65 $9,9446 more rows • Feb 24, 2025

What do nonresidents need to file in Hawaii?

If an individual does business in Hawaii, he or she must file a return, even if no taxable income is derived from that business. (Instructions, Form N-15, Individual Income Tax Return — Nonresident and Part-Year Resident) However, a nonresident will be taxed on income from Hawaii sources only.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form N-139?

Form N-139 is a form used by certain non-citizens in the United States to apply for a special immigration benefit.

Who is required to file Form N-139?

Individuals seeking specific immigration benefits related to their eligibility as non-citizens are required to file Form N-139.

How to fill out Form N-139?

Form N-139 can be filled out by providing accurate personal information, detailing your immigration status, and submitting any required supporting documents as instructed on the form.

What is the purpose of Form N-139?

The purpose of Form N-139 is to assess and process applications for special immigration benefits for eligible non-citizens.

What information must be reported on Form N-139?

Form N-139 requires personal identifying information, immigration status, and any relevant background information that supports the application for the immigration benefit.

Fill out your form n-139 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N-139 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.