Get the free CT-198.1

Show details

Este documento proporciona información relacionada con el impuesto sobre franquicias que deben pagar las corporaciones comerciales en el estado de Nueva York, incluyendo detalles sobre los períodos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-1981

Edit your ct-1981 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-1981 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct-1981 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct-1981. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-1981

How to fill out CT-198.1

01

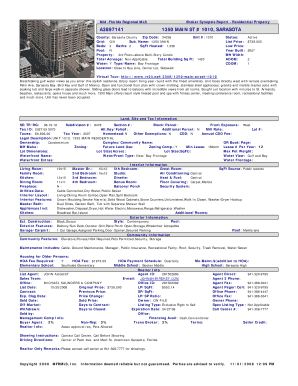

Obtain a blank CT-198.1 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill out your personal information in the designated fields, including your name, Social Security number, and address.

03

Provide details about your business, including the name and Employer Identification Number (EIN) if applicable.

04

Complete the sections related to qualifying expenses and income, ensuring you have the necessary documentation to support your claims.

05

Review the instructions carefully to ensure you're filling out the form correctly, especially any calculations required.

06

Sign and date the form before submission to verify that all information provided is accurate to the best of your knowledge.

07

Submit the completed CT-198.1 form to the appropriate tax authority by the specified deadline.

Who needs CT-198.1?

01

Individuals or businesses who are claiming a credit for New York State taxes based on their investment in qualified properties.

02

Taxpayers looking to reduce their tax liability through the New York State investment tax credit.

Fill

form

: Try Risk Free

People Also Ask about

What is a PET CT scan in English?

A procedure that combines the pictures from a positron emission tomography (PET) scan and a computed tomography (CT) scan. The PET and CT scans are done at the same time with the same machine. The combined scans give more detailed pictures of areas inside the body than either scan gives by itself.

What is a CBCT scan in English?

A dental cone beam CT scan is a type of CT scan used by dentists. It is sometimes called a CBCT scan. This is a quick and painless test. The scan creates 3D images of your jaws and teeth.

Is CT angiography painful?

CT angiography is typically quick and painless. However, it does require an IV catheter to be inserted into your arm. You're awake and don't need anesthesia. You'll lie on an exam table that moves through a large ring that looks a bit like a doughnut.

How long does it take to recover from a CT angiogram?

CT coronary angiogram is noninvasive and doesn't require sedation or recovery time. Before or during the procedure, you may be prescribed: A beta blocker, which is a medication that slows the heart rate.

What is CT angiography in English?

What is computed tomography (CT) angiography? CT angiography is a type of medical test that combines a CT scan with an injection of a special dye to produce pictures of blood vessels and tissues in a part of your body.

Do they put you to sleep for a CT angiogram?

Medicine called a sedative goes through the IV . The medicine helps you feel relaxed and calm during the test or treatment. It may make you feel sleepy. The amount of sedation you need depends on the reason for the coronary angiogram and your overall health.

Why would a doctor order a CT angiogram?

A CT coronary angiogram mainly is done to check for narrowed or blocked arteries in the heart. It may be done if you have symptoms of coronary artery disease. But the test can look for other heart conditions too.

What is CT scan called in English?

A computerized tomography scan, also called a CT scan, is a type of imaging that uses X-ray techniques to create detailed images of the body. It then uses a computer to create cross-sectional images, also called slices, of the bones, blood vessels and soft tissues inside the body.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CT-198.1?

CT-198.1 is a tax form used by certain businesses and organizations to report specific financial information to the tax authorities.

Who is required to file CT-198.1?

Entities such as corporations, partnerships, and limited liability companies that meet specific criteria established by the tax authorities are required to file CT-198.1.

How to fill out CT-198.1?

To fill out CT-198.1, taxpayers should gather their financial documents, complete the form with accurate information regarding their income and deductions, and ensure they follow the instructions provided by the tax authority.

What is the purpose of CT-198.1?

The purpose of CT-198.1 is to provide tax authorities with essential financial data to assess an entity's tax liability and to ensure compliance with tax regulations.

What information must be reported on CT-198.1?

CT-198.1 requires the reporting of information such as gross income, deductions, credits, and any other specific details necessary for accurate tax computation.

Fill out your ct-1981 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-1981 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.