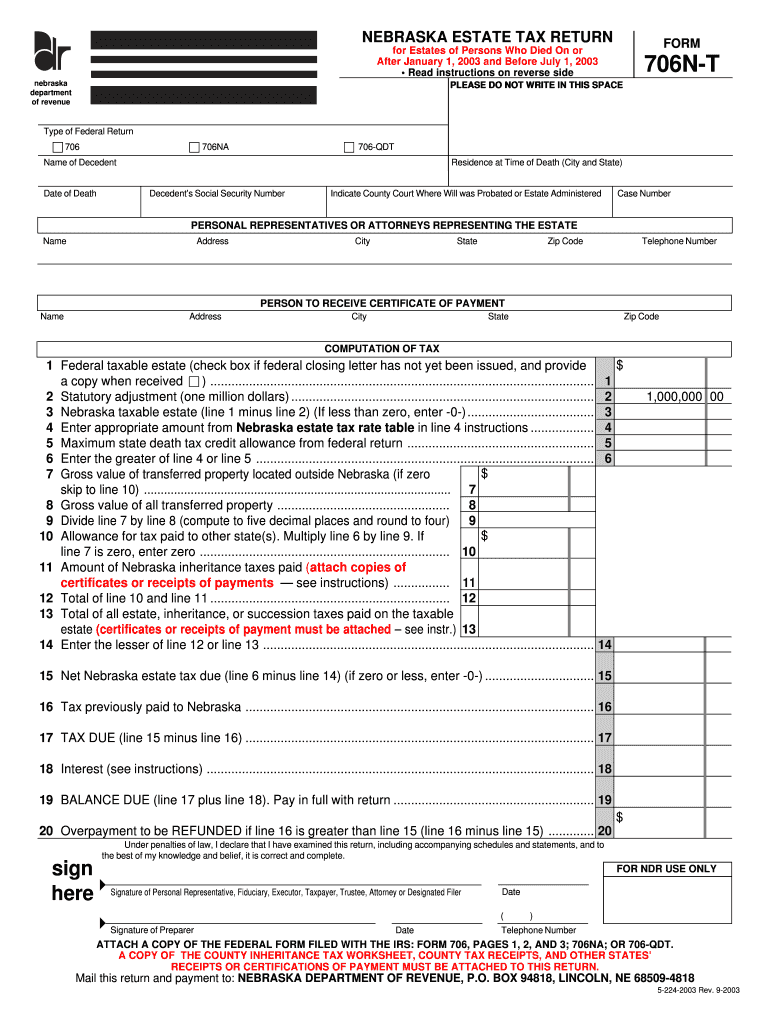

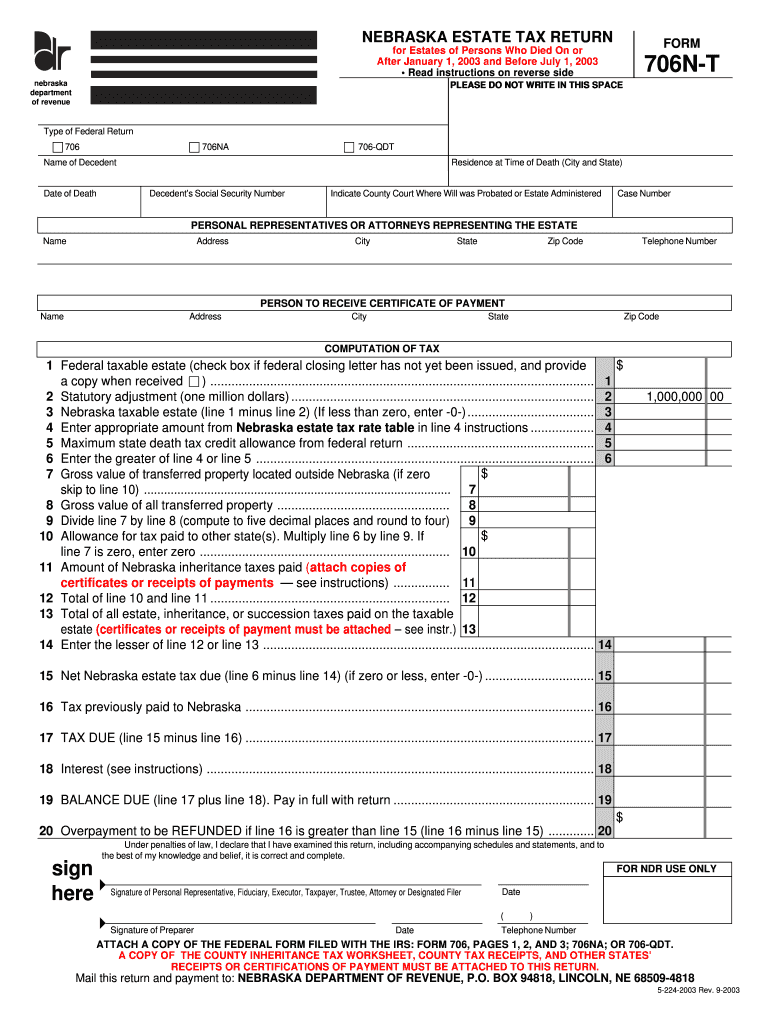

Get the free NEBRASKA ESTATE TAX RETURN

Show details

This document is used for filing the Nebraska estate tax for estates of persons who died on or after January 1, 2003 and before July 1, 2003. It includes instructions for computation of tax and requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska estate tax return

Edit your nebraska estate tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska estate tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska estate tax return online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nebraska estate tax return. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska estate tax return

How to fill out NEBRASKA ESTATE TAX RETURN

01

Gather all necessary documentation, including death certificates, property appraisals, and financial statements.

02

Determine the gross estate value by including all assets owned by the deceased at the time of death.

03

Subtract allowable deductions, such as debts, funeral expenses, and administrative costs, to calculate the taxable estate.

04

Complete the NEBRASKA ESTATE TAX RETURN form using the calculated taxable estate.

05

Provide accurate details on all assets, liabilities, and deductions in the relevant sections of the form.

06

Submit the completed form along with any required documentation to the Nebraska Department of Revenue.

07

Pay any estate tax due by the specified deadline to avoid penalties.

Who needs NEBRASKA ESTATE TAX RETURN?

01

Any individual or estate representative managing the estate of a deceased person who had assets in Nebraska that exceed the exempt threshold for estate taxes.

Fill

form

: Try Risk Free

People Also Ask about

How much money can you inherit without paying taxes on it in Nebraska?

Understanding the Basics of Nebraska Inheritance Tax Laws RELATIONSHIP TO DECEDENTTAX RATE Surviving spouse Always exempt Parents, grandparents, siblings, children 1% in excess of $100,000 Uncles, aunts, nieces, nephews, and other lineal descendants 11% in excess of $40,0002 more rows • Jan 19, 2024

How do I pay inheritance tax in Nebraska?

Tax is Paid to the County The tax is a state of Nebraska inheritance tax, but the county receives the money. The tax is paid to the county of the deceased person's residence or, in the case of real estate, to the county in which the real estate is located.

How do you pay inheritance tax in Nebraska?

Tax is Paid to the County The tax is a state of Nebraska inheritance tax, but the county receives the money. The tax is paid to the county of the deceased person's residence or, in the case of real estate, to the county in which the real estate is located.

How to avoid estate tax in Nebraska?

Property That Is Exempt From Nebraska Inheritance Tax life insurance proceeds that go to a trust or named beneficiary (but not when the beneficiary is the estate), and. money from the estate that immediate family members are entitled to under the homestead allowance or family maintenance allowance.

What is the maximum amount you can inherit without paying taxes?

While state laws differ for inheritance taxes, an inheritance must exceed a certain threshold to be considered taxable. For federal estate taxes as of 2024, if the total estate is under $13.61 million for an individual or $27.22 million for a married couple, there's no need to worry about estate taxes.

How much inheritance is tax free in Nebraska?

What do you need help with? Close relatives pay 1% tax after $100,000. Close relatives of the deceased person are given a $100,000 exemption ($40,000 if the death was before January 1, 2023) from the state inheritance tax. In other words, they don't owe any tax at all unless they inherit more than $100,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEBRASKA ESTATE TAX RETURN?

The Nebraska Estate Tax Return is a legal document that must be filed by the personal representative of a deceased person's estate in Nebraska to report the value of the estate and calculate any estate taxes owed to the state.

Who is required to file NEBRASKA ESTATE TAX RETURN?

Any estate with a gross value exceeding the state exemption threshold is required to file a Nebraska Estate Tax Return. This typically includes estates that have significant assets such as real estate, investments, and other properties.

How to fill out NEBRASKA ESTATE TAX RETURN?

To fill out the Nebraska Estate Tax Return, the personal representative must gather detailed information about the deceased's assets and liabilities, complete the appropriate forms, and ensure that the valuation of all assets is accurate before submitting the return to the Nebraska Department of Revenue.

What is the purpose of NEBRASKA ESTATE TAX RETURN?

The purpose of the Nebraska Estate Tax Return is to determine the tax liability of an estate based on its value at the time of the individual's death, ensuring that the correct amount of estate tax is collected by the state.

What information must be reported on NEBRASKA ESTATE TAX RETURN?

The Nebraska Estate Tax Return must report information including the total value of the estate's assets, liabilities, deductions, and any applicable exemptions, along with details of beneficiaries and property distributions.

Fill out your nebraska estate tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Estate Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.