Get the free FORM N-288C

Show details

This form is used to apply for a refund of the amount withheld on dispositions by nonresident persons of Hawaii real property interests in excess of the transferor/seller’s tax liability for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form n-288c

Edit your form n-288c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-288c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form n-288c online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form n-288c. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

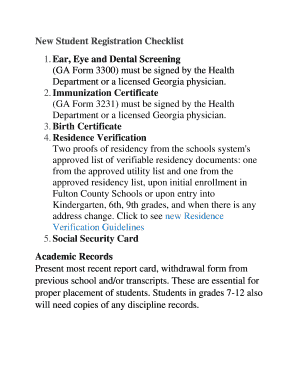

How to fill out form n-288c

How to fill out FORM N-288C

01

Obtain FORM N-288C from the official U.S. Citizenship and Immigration Services (USCIS) website.

02

Read the instructions carefully to understand the purpose of the form.

03

Provide personal information in Section 1, including your name, address, and Alien Registration Number (if applicable).

04

Fill out Section 2 regarding the information concerning the application you are associated with.

05

In Section 3, provide details about the reasons for your relief request.

06

Ensure all necessary signatures are provided in the designated areas.

07

Review the completed form for accuracy and completeness.

08

Submit the form via the indicated method and keep a copy for your records.

Who needs FORM N-288C?

01

Individuals who are seeking to request a waiver of inadmissibility or deportation.

02

Applicants who have received a notice of determination about their immigration case and require a formal response.

Fill

form

: Try Risk Free

People Also Ask about

What is Form N 288A?

Purpose: Form N-288A primary function is to declare the specifics of withholding tax on dispositions by nonresident persons of Hawaii real property interests. It accompanies Form N-288 to provide a detailed breakdown of the withholding tax for each nonresident involved in the property transfer.

How do I get my money back from Harpta?

You can file form N15 to obtain your refund. If you sell your property in April, the N15 tax form for that year will not be available until January of the following year--just like most income tax returns. Fortunately, Hawaii also offers form N288C which can be completed and filed to get your money back much sooner!

Who pays harpta tax in Hawaii?

Who Has to Pay HARPTA? In Hawaii and on Maui, real estate buyers are contractually obligated to collect and remit HARPTA withholdings when dealing with out-of-state sellers. In many cases, HARPTA withholdings are collected and remitted by escrow companies as part of the usual sales transaction process.

Who is responsible for paying the conveyance tax in Hawaii?

(a) The conveyance tax shall be paid by the seller or any other person conveying realty, or any interests therein, by a document subject to the provision of Administrative Rules § 18-247-1; except, however, in the case where the United States or any agency or instrumentality thereof or the State of Hawaii or any agency

What is firpta in Hawaii?

“FIRPTA” stands for the Foreign Investment in Real Property Tax Act, a federal law. • FIRPTA requires a foreign seller of a USRPI to pay a capital gains tax upon. the sale of USRPI.

Who is required to pay general excise tax in Hawaii?

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person engaging in the business activity. Your “gross income” is the total of all your business income before you deduct your business expenses.

Do Hawaii residents pay HARPTA?

HARPTA Exemptions: Hawaii residents, sellers participating in a 1031 tax-deferred exchange, and sellers losing money on a sale may be eligible for an exemption. HARPTA vs. FIRPTA: While HARPTA applies to non-residents selling Hawaii real estate, FIRPTA is a federal law targeting foreign sellers of U.S. property.

What is form n 288A in Hawaii?

Purpose: Form N-288A primary function is to declare the specifics of withholding tax on dispositions by nonresident persons of Hawaii real property interests. It accompanies Form N-288 to provide a detailed breakdown of the withholding tax for each nonresident involved in the property transfer.

Who needs to file a Hawaii nonresident return?

Any person who is in Hawaiʻi for a temporary or transient purpose and whose permanent residence is not Hawaiʻi is considered a Hawaiʻi nonresident. Each year, a nonresident who earns income from Hawaiʻi sources must file a State of Hawaiʻi tax return and will be taxed only on income from Hawaiʻi sources.

What is the Hawaii real estate tax withholding?

The 7.25% withhold is on the total sales price. The actual tax is 7.25% on the gains from the sale. HARPTA Exemptions: Hawaii residents, sellers participating in a 1031 tax-deferred exchange, and sellers losing money on a sale may be eligible for an exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM N-288C?

FORM N-288C is a form used by certain individuals seeking a waiver of inadmissibility under the Immigration and Nationality Act.

Who is required to file FORM N-288C?

Individuals who are applying for a waiver of inadmissibility related to their immigration status are required to file FORM N-288C.

How to fill out FORM N-288C?

To fill out FORM N-288C, individuals must provide personal information, details of their inadmissibility, and any supporting documentation as specified in the form's instructions.

What is the purpose of FORM N-288C?

The purpose of FORM N-288C is to formally request a waiver for grounds of inadmissibility that may prevent an individual from becoming a lawful permanent resident.

What information must be reported on FORM N-288C?

Applicants must report their full name, address, date of birth, reasons for inadmissibility, and any pertinent details regarding their immigration history and legal circumstances.

Fill out your form n-288c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N-288c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.