Get the free N-3

Show details

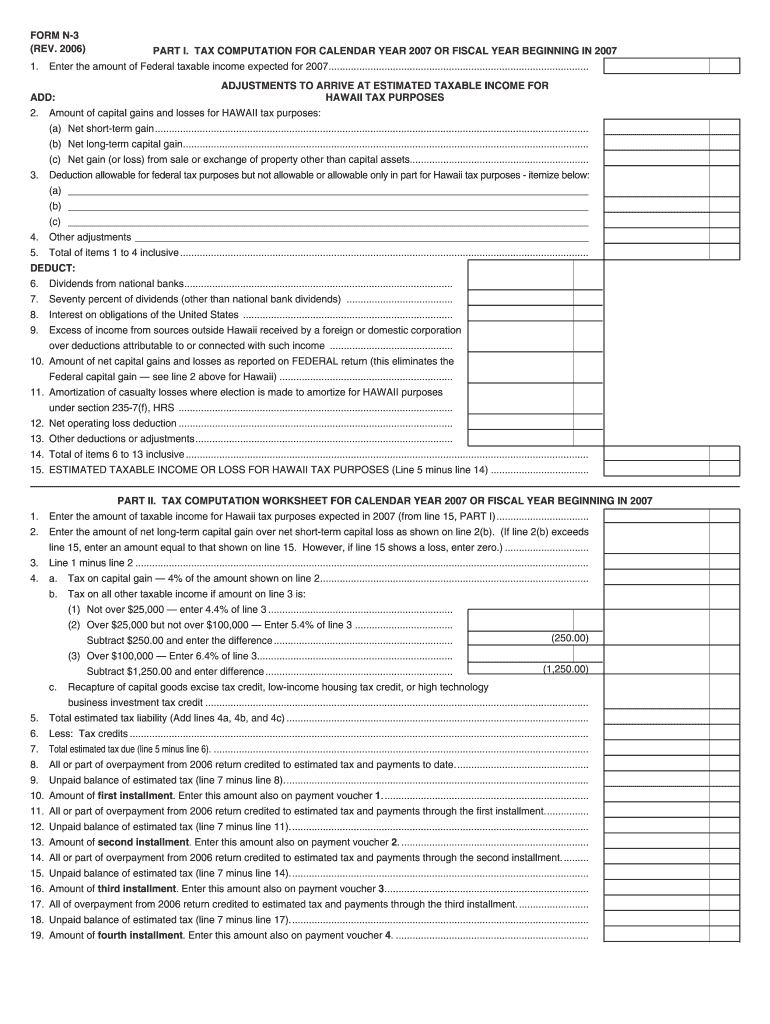

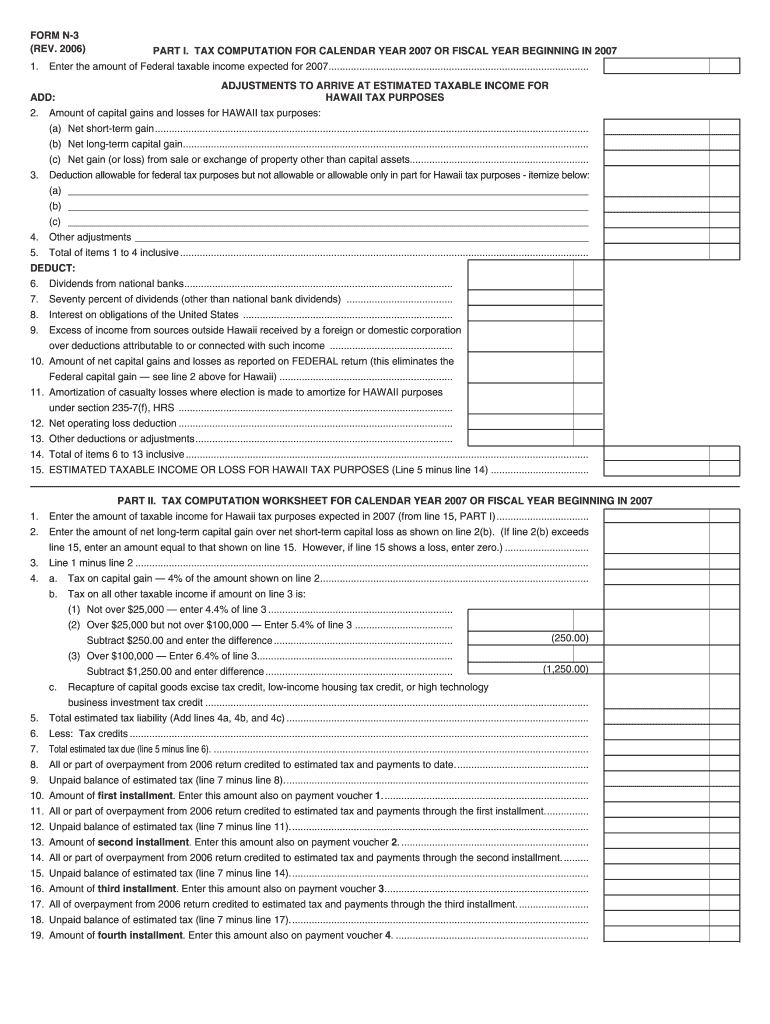

This form is used for the declaration of estimated income tax for corporations and S corporations in Hawaii for the tax year 2007. It outlines the requirements for filing and payment of estimated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign n-3

Edit your n-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit n-3 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit n-3. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out n-3

How to fill out N-3

01

Obtain the N-3 form from the official website or local tax office.

02

Fill in your personal information at the top of the form, including your name and address.

03

Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

04

Complete the relevant sections of the form based on your financial information.

05

Double-check all information for accuracy, making sure to include all necessary documents.

06

Sign and date the form at the designated area.

07

Submit the completed form by mail or online, as per the instructions provided.

Who needs N-3?

01

Individuals who are filing their taxes and need to report specific income.

02

Business owners that are required to disclose their earnings for tax purposes.

03

Non-resident aliens who have income that must be reported.

Fill

form

: Try Risk Free

People Also Ask about

What is level 3 English level?

Your English Level LevelClass LevelDescription 3 Pre-intermediate I can communicate simply and understand in familiar situations but only with some difficulty. 2 Elementary I can say and understand a few things in English. 1 Beginner I do not speak any English.6 more rows

What is level 3 teaching English?

What is the Level 3 English Literacy and Language for Teachers? This specialized qualification has been thoughtfully designed for individuals who are passionate about improving their English literacy and language proficiency while developing the skills to support learners who need it most.

What grade is English III?

English Language Arts III is a required course for eleventh grade students. Course Rationale: The English Language Arts III curriculum is considered essential for the academic, social and cognitive development of students who are expected to become successful and productive members of society.

What is the National 3 English course specification?

Course structure This Course is made up of three mandatory Units. The Course provides learners with the opportunity to develop their listening, talking, reading and writing skills in order to understand and use language. The three Units include the four language skills of listening, talking, reading and writing.

What does level 3 qualification mean?

Level 3 qualifications are: A level. access to higher education diploma. advanced apprenticeship.

What is a Level 3 English qualification?

The Level 3 Award in English for Literacy and Language Teaching is designed to help you develop the skills needed for the teaching of literacy and language, exploring the varied aspects of speaking, listening, reading and writing.

What is the National 3 level?

National 3 courses are made up of units which are assessed as pass or fail by a teacher or lecturer. These Units require learners to develop: basic knowledge and understanding of the subject. apply skills to a range of simple tasks in familiar contexts, with guidance from teachers.

What is a Level 3 diploma in English?

In this course, students are encouraged to use correct grammar, spelling and punctuation in order to develop style and presentation as well as facilitating understanding of meaning and language. Through the first 4 units, students will be asked to study through comprehensive and independent reading texts and extracts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is N-3?

N-3 is a tax form used by certain taxpayers to report income and calculate tax obligations.

Who is required to file N-3?

Taxpayers who meet specific criteria regarding income, residency, or type of income are required to file N-3.

How to fill out N-3?

To fill out N-3, gather the required financial information, complete the form following the instructions, and ensure all calculations are accurate before submitting.

What is the purpose of N-3?

The purpose of N-3 is to report income accurately, calculate the tax owed, and ensure compliance with tax laws.

What information must be reported on N-3?

N-3 requires reporting of personal identification details, income types, deductions, credits, and any other relevant financial information.

Fill out your n-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

N-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.