Get the free Michigan Department of Treasury 614 (Rev. 4-07)

Show details

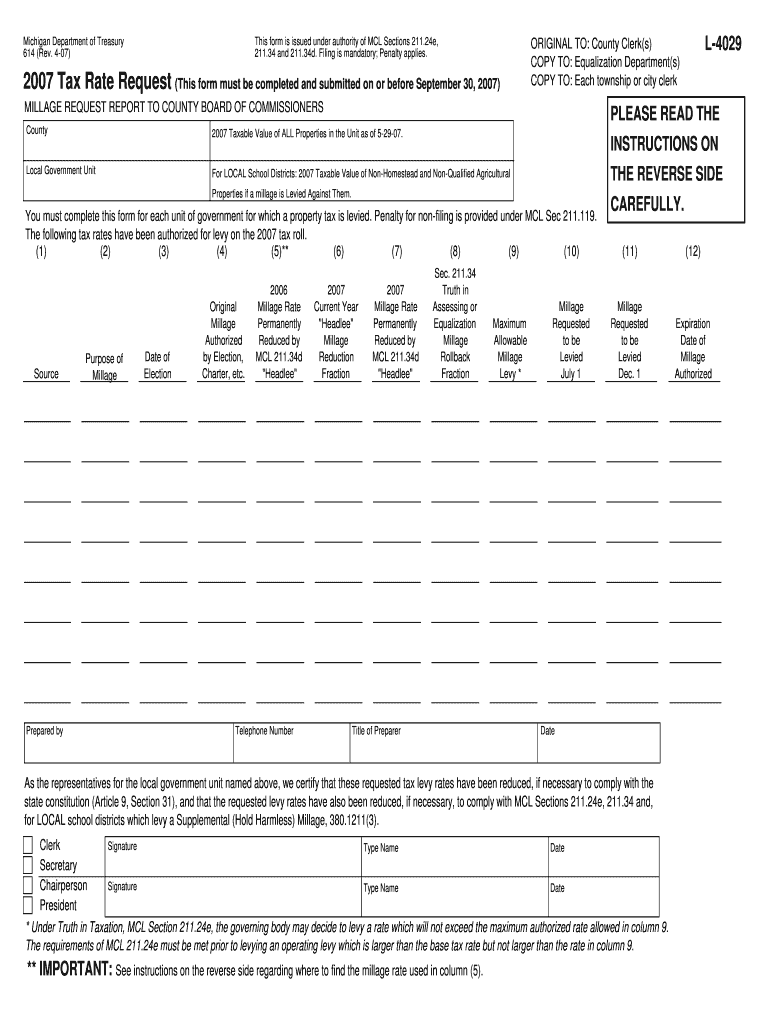

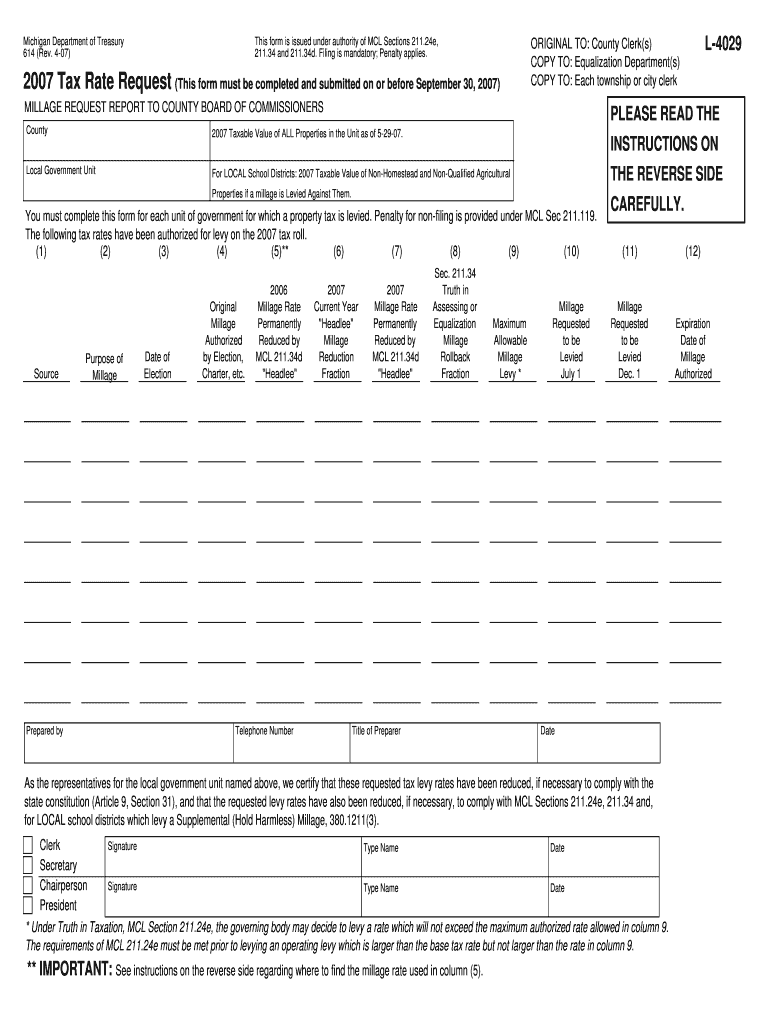

This form is used to request a tax rate for local government units in Michigan, specifically for reporting millage requests to county boards of commissioners for the year 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan department of treasury

Edit your michigan department of treasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan department of treasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan department of treasury online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit michigan department of treasury. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan department of treasury

How to fill out Michigan Department of Treasury 614 (Rev. 4-07)

01

Obtain a copy of Michigan Department of Treasury 614 (Rev. 4-07) form from the official website or local office.

02

Start by filling out your personal information in the designated fields at the top of the form, including your name, address, and social security number.

03

Provide details regarding your income, including wages, pensions, and any other sources of income.

04

Enter any applicable deductions or credits that you are eligible for, as per the instructions provided on the form.

05

Double-check all entered information for accuracy and completeness.

06

Sign and date the form at the bottom to certify that the information is true and correct.

07

Submit the completed form to the Michigan Department of Treasury by the specified deadline.

Who needs Michigan Department of Treasury 614 (Rev. 4-07)?

01

Individuals residing in Michigan who need to report their income for tax purposes.

02

Taxpayers seeking to claim tax credits or refunds from the Michigan Department of Treasury.

03

Residents who have received a notice from the Department of Treasury requiring them to file the form.

Fill

form

: Try Risk Free

People Also Ask about

Why am I getting a check from Michigan Department of Treasury?

The Michigan Earned Income Tax Credit (EITC) was expanded from 6% to 24% effective tax year 2022. When this law took effect, 2022 tax returns were already filed. Therefore, in February 2024, Treasury mailed supplemental check payments to qualified filers who claimed the credit on their 2022 return.

Why would the Michigan Department of Treasury call me?

There is absolutely no reason you would get a call from the Michigan Treasury Department. This is a scam and you should NOT call them back. If you do, you'll be told you owe taxes and will be subject to an arrest. THat's not how the government works, however.

What is the Michigan Department of Treasury Discovery and tax Enforcement?

The Discovery and Tax Enforcement Division administers projects to detect non-filers of taxes, identify underreporting of tax and other noncompliance with the State of Michigan tax statutes. This division also detects and assists in the prosecution of tax fraud cases.

How to request a tax clearance from the Michigan Department of Treasury?

Tax Clearance Requests File Form 5156, Request for Tax Clearance Certificate or Tax Status Letter if you: Want to know your current total tax liability with the Michigan Department of Treasury.

What comes from the Michigan Department of Treasury?

The Michigan Department of Treasury (Treasury) is responsible for collecting, disbursing, and investing all state monies. The department advises the Governor on all tax and revenue policy, collects and administers over $20 billion a year in state taxes, and safeguards the credit of the state.

Where do I mail my Michigan tax return?

File by Mail If you have a refund, a credit, or no amount due, mail your return to: Michigan Department of Treasury. Lansing, MI 48956. If you owe taxes, mail your return to: Michigan Department of Treasury. Lansing, MI 48929.

Why is the Michigan Department of Treasury sending me mail?

We will send a letter/notice if: You have an unpaid balance. You are due a larger or smaller refund. We have a question about your tax return. We need to verify your identity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Michigan Department of Treasury 614 (Rev. 4-07)?

Michigan Department of Treasury 614 (Rev. 4-07) is a form used for reporting Michigan income tax withholdings for employees, including details required for reconciliation of state tax withheld from wages.

Who is required to file Michigan Department of Treasury 614 (Rev. 4-07)?

Employers in Michigan who have withheld state income taxes from employee wages are required to file Michigan Department of Treasury 614 (Rev. 4-07).

How to fill out Michigan Department of Treasury 614 (Rev. 4-07)?

To fill out Michigan Department of Treasury 614 (Rev. 4-07), employers must provide accurate details regarding their business, total wages paid, total tax withheld, and any other required information as outlined in the form instructions.

What is the purpose of Michigan Department of Treasury 614 (Rev. 4-07)?

The purpose of Michigan Department of Treasury 614 (Rev. 4-07) is to report the amounts of state income tax withheld by employers and ensure compliance with state tax regulations.

What information must be reported on Michigan Department of Treasury 614 (Rev. 4-07)?

The information that must be reported includes the employer's identification details, total wages paid, total state income tax withheld, and any adjustments or credits that apply.

Fill out your michigan department of treasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Department Of Treasury is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.