Get the free Personal Property Tax

Show details

This document provides detailed instructions and information regarding the administration of personal property tax in Ohio, including filing requirements, due dates, exemptions, and the process for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal property tax

Edit your personal property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

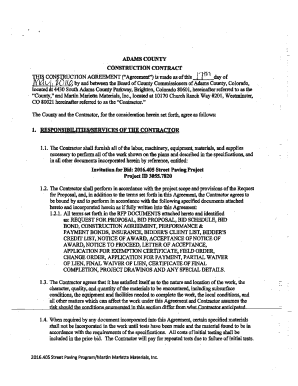

How to edit personal property tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal property tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

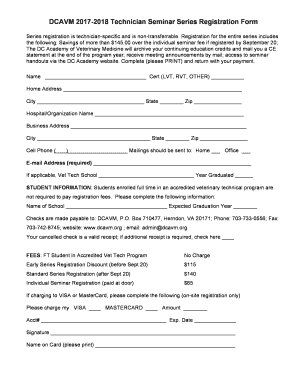

How to fill out personal property tax

How to fill out Personal Property Tax

01

Gather all relevant information about your personal property, including real estate, vehicles, and business equipment.

02

Obtain the appropriate Personal Property Tax form from your local tax authority's website or office.

03

Fill out your personal information accurately, including your name, address, and contact information.

04

List each item of personal property you own, providing details such as the description, value, and location.

05

Check for any applicable exemptions or deductions that you may qualify for and include them in your form.

06

Review the completed form for accuracy and ensure all necessary supporting documents are included.

07

Submit the completed form to your local tax authority by the specified deadline, either by mail or electronically.

Who needs Personal Property Tax?

01

Individuals and businesses that own personal property, such as vehicles, machinery, equipment, or inventory.

02

Property owners seeking to fulfill legal tax obligations.

03

Businesses that need to report their assets for taxation purposes.

Fill

form

: Try Risk Free

People Also Ask about

Does Ohio pay personal property taxes?

The tangible personal property tax was replaced with the Commercial Activity Tax (CAT). The CAT is an annual tax imposed on the privilege of doing business in Ohio, measured by gross receipts from business activities in Ohio.

Do you pay personal property tax on a house?

Real estate taxes are the amount of money the municipality you live in charges you for the assessed value of your home. Personal property taxes are assessed on moveable items, such as cars, campers, and boats, as well as business machinery, equipment, or furniture.

What is the personal property tax rate in Michigan?

Overview of Michigan Taxes Michigan has some of the highest property tax rates in the country. The Great Lake State's average effective property tax rate is 1.35%, well above the national average of 0.90%.

What states have a personal property tax?

State-by-state guide to property tax Is personal property taxable?Assessment date for personal property California Yes January 1 Colorado Yes January 1 Connecticut Yes October 1 Delaware No July 147 more rows • Jun 30, 2023

Why do people pay personal property taxes?

Public Services Funding: Property taxes are a primary source of revenue for local governments. They help fund essential services such as public education, law enforcement, fire protection, road maintenance, and other community services.

What is the ESA tax in Michigan?

The Essential Services Assessment (ESA) is a state specific tax on eligible personal property owned by, leased to or in the possession of an eligible claimant.

What is the reasoning behind personal property tax?

Personal property generally refers to valuable items like cars and boats but not real estate. States and localities with personal property taxes typically use the money to fund public works, such as schools and roads.

Why would a person pay property taxes?

Like any tax, property taxes are levied by your local municipality to pay for things like roads, schools, public transportation, parks, police, firefighters and other services that make your city hum along each day.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Property Tax?

Personal Property Tax is a tax imposed on movable assets owned by an individual or business, such as vehicles, machinery, and equipment. This tax is separate from real property tax, which applies to land and buildings.

Who is required to file Personal Property Tax?

Individuals and businesses that own personal property within a jurisdiction that enforces personal property tax are typically required to file. This includes anyone owning taxable personal assets.

How to fill out Personal Property Tax?

To fill out Personal Property Tax, you usually need to complete a specific form provided by the local tax authority, listing all owned personal property, its value, and any relevant identification or account numbers as requested.

What is the purpose of Personal Property Tax?

The purpose of Personal Property Tax is to generate revenue for local governments, which can be used for public services such as education, infrastructure, and emergency services. It's also a method to account for and track the value of personal assets.

What information must be reported on Personal Property Tax?

Information that must be reported typically includes a description of the personal property, its acquisition date, its location, estimated value, and sometimes the cost of acquisition. Specific requirements can vary by jurisdiction.

Fill out your personal property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.