Get the free Accounts Payable Are you using sponsored awards or gifts - af nmsu

Show details

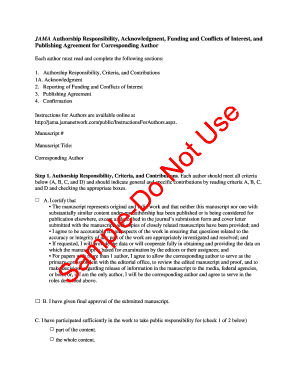

New Mexico State University Accounts Payable Document # Are you using sponsored awards or gifts on this form? Yes Route MSC SPA No Route MSC AFR Employee Travel Advance ROUTING INSTRUCTIONS: (1) Advance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable are you

Edit your accounts payable are you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable are you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounts payable are you online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accounts payable are you. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable are you

How to fill out accounts payable:

01

Gather all relevant invoices and documents related to the payments that need to be made. This includes invoices from vendors, bills, and any other payment requests.

02

Review each invoice carefully to ensure accuracy. Check for any discrepancies, such as incorrect amounts or missing information, and communicate with the vendor or supplier if necessary.

03

Organize the invoices in a systematic manner, either by vendor or by due date. This will make it easier to track and prioritize payments.

04

Enter the necessary information into your accounting software or financial system. This includes the invoice number, date, vendor name, payment terms, and amount owed. It is essential to record this information accurately to maintain proper financial records.

05

Once the invoices are entered, review the total amount owed and compare it to your available funds. This will help you prioritize payments and ensure that you have sufficient funds to meet your financial obligations.

06

Set up a payment schedule based on the due dates and payment terms. This allows you to manage cash flow effectively and avoid late payment penalties or damaged vendor relationships.

07

Obtain necessary approvals for payment if required by your organization's policies or procedures. This may involve getting signatures or clearance from appropriate individuals within the company.

08

Prepare and issue payment to the vendors according to the established payment schedule. This can be done through various methods, such as checks, electronic funds transfer, or online payment platforms.

09

Keep track of all payments made and update your accounts payable records accordingly. This includes recording the payment date, method of payment, and any references or notes related to the payment.

10

Regularly reconcile your accounts payable records with your bank statements or financial reports to ensure accuracy and identify any discrepancies that need to be addressed.

Who needs accounts payable:

01

Businesses of all sizes, from small startups to large corporations, require accounts payable to manage their financial obligations and payments to suppliers and vendors.

02

Non-profit organizations also need accounts payable to handle their payment responsibilities and maintain financial transparency.

03

Government agencies and public institutions have accounts payable departments to process payments for goods, services, and contracts as part of their operations.

04

Individuals or households may also need to manage accounts payable if they have recurring bills, such as rent, utilities, or installment payments.

Note: The information provided here is for general informational purposes only and should not be considered as financial or accounting advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my accounts payable are you directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your accounts payable are you and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I sign the accounts payable are you electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your accounts payable are you in seconds.

How do I edit accounts payable are you on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign accounts payable are you on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is accounts payable are you?

Accounts payable is the amount of money a business owes to its suppliers for the goods or services purchased on credit.

Who is required to file accounts payable are you?

Companies and businesses that purchase goods or services on credit are required to file accounts payable.

How to fill out accounts payable are you?

Accounts payable can be filled out by recording the invoices received from suppliers, tracking the due dates for payment, and ensuring accurate payment is made on time.

What is the purpose of accounts payable are you?

The purpose of accounts payable is to accurately track and manage the amount of money owed to suppliers, ensuring timely payments and maintaining good relationships with vendors.

What information must be reported on accounts payable are you?

Information that must be reported on accounts payable includes the supplier name, invoice number, amount owed, due date, and payment status.

Fill out your accounts payable are you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable Are You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.