Get the free Medical Impairments Underwriting - highlandbrokeragecom

Show details

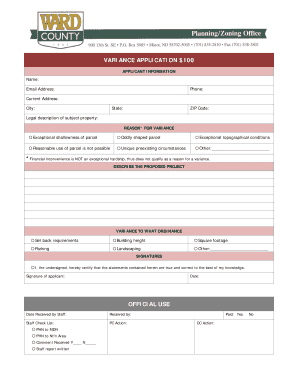

Medical Impairments Underwriting RESOURCES AVAILABLE TO YOU THROUGH HIGHLAND CAPITAL BROKERAGE Medical Evaluation Questionnaire Diabetes Agents name State LIFE INSURANCE Phone City The Medical Impairments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical impairments underwriting

Edit your medical impairments underwriting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medical impairments underwriting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing medical impairments underwriting online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit medical impairments underwriting. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medical impairments underwriting

How to fill out medical impairments underwriting:

01

Obtain the necessary forms: Start by obtaining the specific forms required for medical impairments underwriting. These forms can usually be found on the insurance company's website or by contacting their customer service department.

02

Provide personal information: Fill out the personal information section of the form, including your full name, date of birth, address, and contact information. It is important to ensure that all the provided information is accurate and up-to-date.

03

Disclose medical history: Provide a detailed account of your medical history, including any past illnesses, surgeries, or medical conditions you have experienced. Be sure to accurately disclose any current or ongoing medical conditions as well.

04

Include medication details: Make sure to list all medications that you are currently taking, including the dosage and frequency. This information is essential for evaluating the potential impact of the medications on your overall health and insurability.

05

Provide medical records: If requested, gather your medical records and include them with your application. These records may include doctor's notes, lab results, and diagnostic reports. The insurance company may use this information to assess your medical impairments accurately.

06

Submit supporting documentation: If you have undergone any relevant medical tests or screenings, be sure to include the results or supporting documentation as necessary. This may include X-rays, MRIs, or any other imaging studies.

07

Seek assistance if needed: If you are unsure about any part of the application or require assistance in filling it out accurately, consider reaching out to your doctor or an insurance professional. They can help you navigate the process and ensure that all necessary information is provided.

Who needs medical impairments underwriting?

01

Individuals applying for life insurance: When applying for life insurance coverage, the insurance company will typically require medical impairments underwriting to assess the applicant's health risks and determine the risk classification for premium calculation.

02

Applicants for health insurance: Some health insurance plans may require medical impairments underwriting to evaluate the applicant's pre-existing medical conditions and determine the coverage options and premiums.

03

Individuals applying for disability insurance: Disability insurance providers may require medical impairments underwriting to assess the risk of disability and determine the eligibility and premiums for coverage.

04

Applicants for critical illness insurance: Critical illness insurance often requires medical impairments underwriting to evaluate the potential risk of developing specific critical illnesses and determine coverage options and premiums.

It's important to note that the need for medical impairments underwriting may vary depending on the type of insurance coverage being applied for and the specific requirements of the insurance company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is medical impairments underwriting?

Medical impairments underwriting is the process of evaluating an individual's health condition to determine the level of risk associated with providing insurance coverage.

Who is required to file medical impairments underwriting?

Insurance companies are typically required to file medical impairments underwriting for individuals applying for insurance coverage.

How to fill out medical impairments underwriting?

Medical impairments underwriting is filled out by collecting information on an individual's medical history, current health status, and any pre-existing conditions.

What is the purpose of medical impairments underwriting?

The purpose of medical impairments underwriting is to assess the risk associated with providing insurance coverage to an individual based on their health condition.

What information must be reported on medical impairments underwriting?

Medical impairments underwriting typically requires information on an individual's medical history, current medications, recent health screenings, and any pre-existing conditions.

How do I modify my medical impairments underwriting in Gmail?

medical impairments underwriting and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in medical impairments underwriting without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit medical impairments underwriting and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out medical impairments underwriting on an Android device?

On an Android device, use the pdfFiller mobile app to finish your medical impairments underwriting. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your medical impairments underwriting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medical Impairments Underwriting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.