Get the free RISK LIABILITY EXPOSURE - FPA Australia

Show details

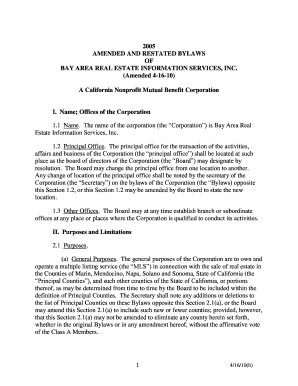

FIREAUSTRALIA.COM.AU #Firearms RISK, LIABILITY +EXPOSURE DELIVERING POSITIVE OUTCOMES EXHIBITION & SPONSORSHIP 4+5 MAY 2016 MELBOURNE CONVENTION & EXHIBITION Center Fire Protection Association Australia

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk liability exposure

Edit your risk liability exposure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk liability exposure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing risk liability exposure online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit risk liability exposure. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk liability exposure

How to fill out risk liability exposure:

01

Understand the purpose of risk liability exposure: Before filling out the form, it's important to understand why risk liability exposure is necessary. It is a way to protect individuals or businesses from potential financial loss or legal action resulting from accidents, injuries, or property damage caused by their actions or products.

02

Gather essential information: Start by collecting all the necessary information required for the form. This may include personal or company details, such as name, address, contact information, and insurance policy details. Additionally, you may need to provide information about the nature of your business, products, or services offered.

03

Evaluate potential risks: Assess the potential risks associated with your activities or operations. This involves identifying hazards or potential situations that could lead to accidents or injuries. Take into account any safety measures or protocols already in place and consider additional measures to mitigate risks.

04

Consult with an insurance professional: If you are unsure about the specific details or coverage options within the risk liability exposure form, it is recommended to consult with an insurance professional. They can provide guidance and ensure you are adequately protected based on your unique circumstances.

05

Review and complete the form: Carefully review the form, ensuring all required fields are filled accurately and completely. Double-check for any errors or omissions. Consider seeking assistance from a legal or insurance expert if needed. Once you are satisfied, sign and submit the form as per the instructions provided.

Who needs risk liability exposure:

01

Businesses: Any business, regardless of its size or industry, can benefit from having risk liability exposure. Small businesses, in particular, may face significant financial consequences from lawsuits or claims related to accidents or injuries caused by their operations, products, or services.

02

Professionals: Professionals in various fields, such as doctors, lawyers, accountants, or consultants, also need risk liability exposure. They can be held accountable if their advice or services result in financial loss or harm to their clients.

03

Contractors and Service Providers: Individuals or companies offering services, such as contractors, plumbers, electricians, or cleaning services, should have risk liability exposure. Accidents or property damage caused by their work can lead to costly lawsuits or claims.

04

Event Organizers: Those organizing events, whether it's a small gathering or a large-scale conference, should consider risk liability exposure. Accidents, injuries, or property damage that occur during the event can result in legal and financial liabilities.

05

Individuals Engaged in High-risk Activities: Individuals engaged in activities with inherent risks, such as extreme sports, adventure tourism, or even operating recreational vehicles, should have risk liability exposure. This ensures they are protected in case of accidents or injuries they may cause to themselves or others.

Remember, it is always advisable to consult with an insurance professional to determine the exact level of risk liability exposure required for your specific situation and to ensure adequate coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is risk liability exposure?

Risk liability exposure refers to the potential financial loss a company may face due to lawsuits, accidents, or other liabilities.

Who is required to file risk liability exposure?

Certain businesses, particularly those in high-risk industries, may be required to file risk liability exposure reports with regulatory agencies.

How to fill out risk liability exposure?

Risk liability exposure reports typically require detailed information about potential risks, insurance coverage, and mitigation strategies.

What is the purpose of risk liability exposure?

The purpose of risk liability exposure reports is to help companies assess and manage their potential financial risks.

What information must be reported on risk liability exposure?

Information that may need to be reported on risk liability exposure includes types of risks, insurance policies, claims history, and risk management practices.

How do I modify my risk liability exposure in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your risk liability exposure as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the risk liability exposure in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your risk liability exposure right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out risk liability exposure on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your risk liability exposure from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your risk liability exposure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Liability Exposure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.