Get the free Beneficiary Designation

Show details

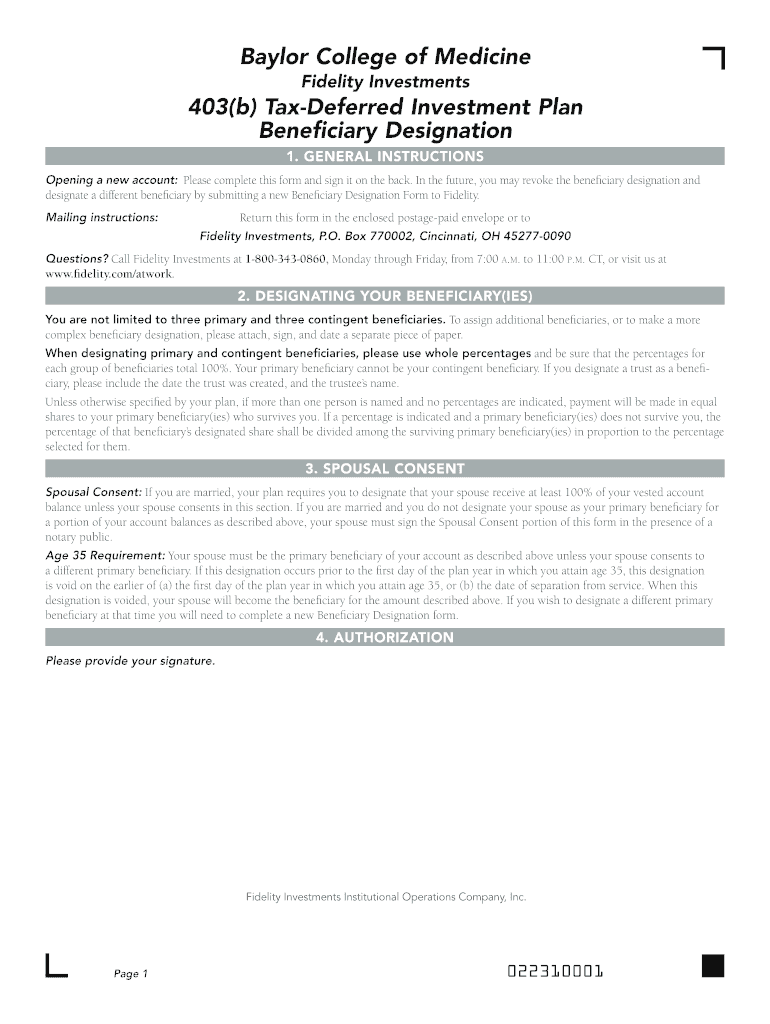

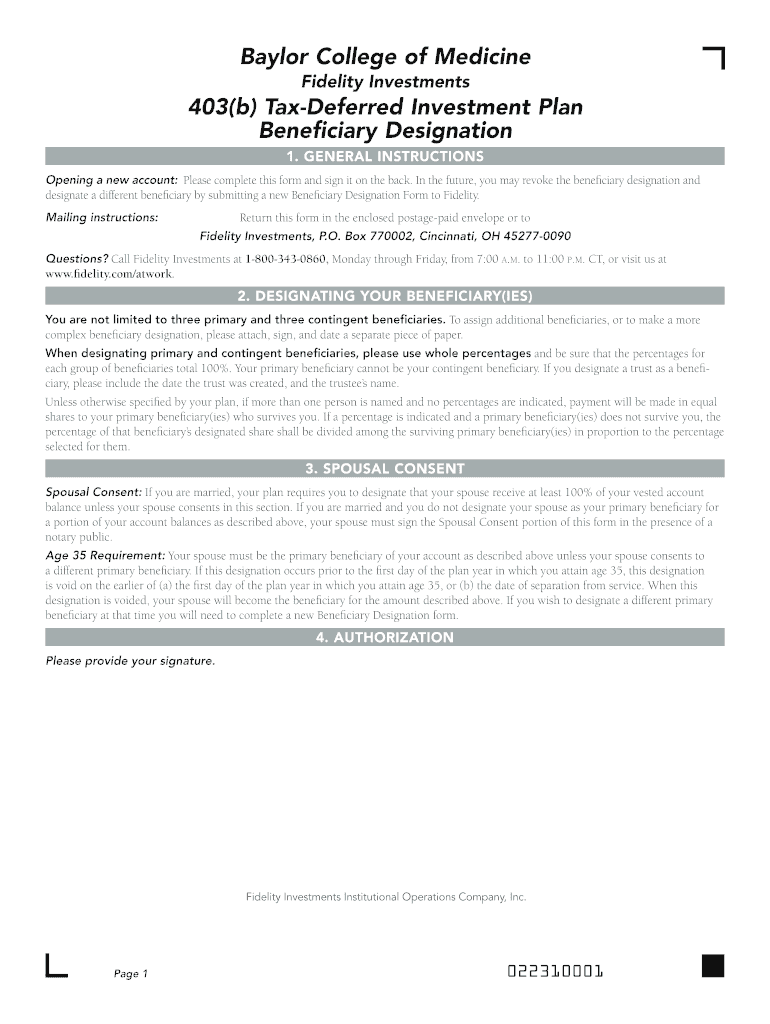

This document serves as a form for participants of the Baylor College of Medicine 403(b) Tax-Deferred Investment Plan to designate their beneficiaries for the account. It outlines instructions on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficiary designation

Edit your beneficiary designation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary designation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beneficiary designation online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit beneficiary designation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary designation

How to fill out Beneficiary Designation

01

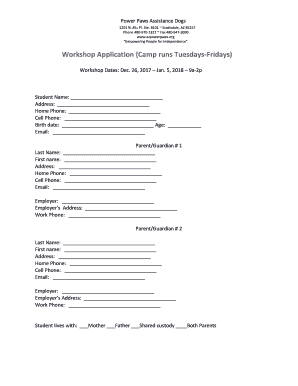

Obtain the Beneficiary Designation form from your financial institution or insurance provider.

02

Read through the instructions to ensure you understand the requirements.

03

Fill in your personal information, including your name, address, and account number.

04

Identify your beneficiaries by entering their names, relationship to you, and contact information.

05

Specify the percentage of your assets each beneficiary will receive.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to validate your designations.

08

Submit the form according to your provider’s instructions, and keep a copy for your records.

Who needs Beneficiary Designation?

01

Individuals who want to designate who will receive their assets after their death.

02

People with life insurance policies wishing to ensure financial support for loved ones.

03

Trust holders looking to clarify distribution of assets.

04

Those with retirement accounts (IRA, 401(k)) needing to name beneficiaries.

05

Anyone desiring to avoid probate for their assets by naming direct beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

What is the designation of a beneficiary?

Meaning of beneficiary in English. a person or group who receives money, advantages, etc. as a result of something else: Her wife was the chief beneficiary of her will.

Does beneficiary mean recipient?

A beneficiary is simply the recipient of money or other benefits.

What does it mean when it says beneficiary name?

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products. For life insurance coverage, that is the death benefit your policy will pay if you die. For retirement or investment accounts, that is the balance of your assets in those accounts.

What does beneficiary name translate to in English?

In estate planning, a beneficiary is any person or entity you designate to receive an asset after you're gone. Naming beneficiaries is an integral part of several different estate planning elements, including: A will. Life insurance policies. Qualified retirement plans, including any 401(k), 403(b) and pensions.

What is the meaning of beneficiary name in English?

1. a person or group that receives benefits, profits, or advantages. 2. a person designated as the recipient of funds or other property under a will, trust, insurance policy, etc. 3.

Is the beneficiary name the bank name?

Additional tips for creating wires: • “beneficiary” is the person/entity you are sending the wire to. “beneficiary bank” or “beneficiary FI (financial institution)” is the final bank you are sending the wire to.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Beneficiary Designation?

Beneficiary Designation is a legal document that specifies who will receive the benefits or assets from a financial account, insurance policy, or retirement plan upon the account holder's death.

Who is required to file Beneficiary Designation?

Generally, anyone who owns a financial account, has a life insurance policy, or participates in a retirement plan is encouraged to file a Beneficiary Designation to ensure their assets are distributed according to their wishes.

How to fill out Beneficiary Designation?

To fill out a Beneficiary Designation, you typically need to provide your personal information, identify the beneficiaries by name and relationship, and sign the document in accordance with the rules of the financial institution or insurer.

What is the purpose of Beneficiary Designation?

The purpose of Beneficiary Designation is to ensure that your assets are transferred quickly and directly to your chosen beneficiaries without going through probate, thereby simplifying the process after your death.

What information must be reported on Beneficiary Designation?

The information that must be reported includes the full name of each beneficiary, their relationship to the account holder, their Social Security number (if required), and contact information, as well as any contingent beneficiaries.

Fill out your beneficiary designation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Designation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.