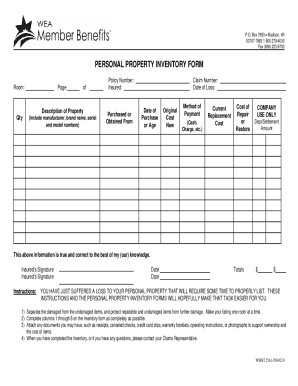

WI WEA Member Benefits WMBT 2561-290 2014 free printable template

Get, Create, Make and Sign WI WEA Member Benefits WMBT 2561-290

How to edit WI WEA Member Benefits WMBT 2561-290 online

Uncompromising security for your PDF editing and eSignature needs

WI WEA Member Benefits WMBT 2561-290 Form Versions

How to fill out WI WEA Member Benefits WMBT 2561-290

How to fill out WI WEA Member Benefits WMBT 2561-290

Who needs WI WEA Member Benefits WMBT 2561-290?

Instructions and Help about WI WEA Member Benefits WMBT 2561-290

Beginning in Report Year 2016, transit agencies reporting to the National Transit Database will be able to report their Fiscal Year 2017 Performance Targets for the Transit Asset Management or “TAM” Program. The A-90 Form is the first form available to agencies in the NTD Reporting System for the asset module. This form is designed to allow agencies to set their targets for the TAM performance measures in the next fiscal year. This presentation will cover accessing and completing this form, which is optional for Report Year 2016 and 2017. Completing this form will be required beginning in Report Year 2018. Agencies reporting performance measure targets on the A-90 form will then be expected to report on their progress towards these targets in the following report year. Tier 1 agencies are either transit providers that own, operate, or manage 101 vehicles or more in maximum service across all non-rail, fixed route modes or in anyone non-fixed route mode or transit providers that own, operate or manage rail modes. Tier 1 agencies are required to develop their own TAM plan and report their own A-90 Form. Tier 2 agencies are any transit providers that own, operate, or manage 100 vehicles or fewer in maximum service across all non-rail fixed route modes or in anyone non-fixed route mode, subrecipients under the §5311 Rural Area Formula Program, OR American Indian Tribes. Tier 2 agencies may participate in a Group TAM plan, in which the group sponsor will report the A-90 Form for all participants in the group. Generally, State Dots or Designated 5310 Recipients will be the Group Sponsor for sub-recipients and report on their behalf. If your agency is a Tier 2 group participant, no action is required of you for Report Year 2016. If you opt to report Fiscal Year 2017 targets, you can do so either through a Task on the Tasks tab or within your FY 2016 Annual Report Package. NTD Contacts and CEO roles in the reporting system will receive the task. If you are assigned one of these roles and your agency chooses not to report on your performance targets for this period, you do not have to accept the task — it will be removed once your annual report is closed out by FTA. If you do accept the Task, you will be taken into the A-90 form. The Task has a Save button and a Submit button. If you are not finished completing your A-90 Form, you can choose to click the Save button, which will save all current data in the form and leave the task open in your Tasks Tab. Saved data will also carry over to your report package. Once you have completed your A-90 Form, you can click the Submit button to close the task. This saves all current data and removes the task for the A-90 Form from your Tasks tab. You will also be able to access your A-90 Form through your 2016 Report Package. It will appear like any other form in your package. You can view and update this form as necessary. All A-90 Forms will be automatically listed as validated in the Report Package dashboard....

People Also Ask about

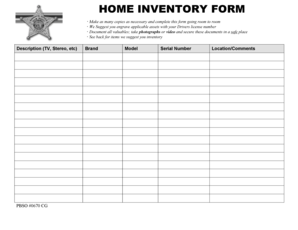

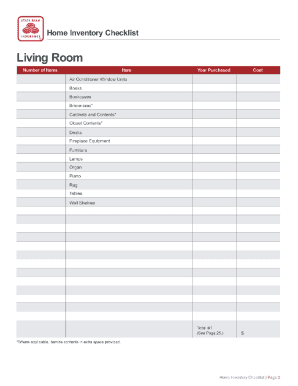

How do you list personal assets and liabilities?

What does Pai mean in military?

How do I make a list of personal assets?

What is an example of an asset inventory?

What is personal asset inventory?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete WI WEA Member Benefits WMBT 2561-290 online?

Can I sign the WI WEA Member Benefits WMBT 2561-290 electronically in Chrome?

How do I fill out the WI WEA Member Benefits WMBT 2561-290 form on my smartphone?

What is WI WEA Member Benefits WMBT 2561-290?

Who is required to file WI WEA Member Benefits WMBT 2561-290?

How to fill out WI WEA Member Benefits WMBT 2561-290?

What is the purpose of WI WEA Member Benefits WMBT 2561-290?

What information must be reported on WI WEA Member Benefits WMBT 2561-290?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.