Get the free bir form 1945

Show details

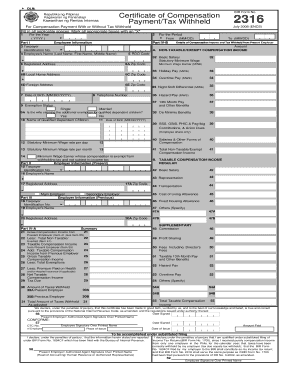

REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU OF INTERNAL REVENUE Quezon City May 23, 2008, REVENUE MEMORANDUM ORDER NO. 20-2008 SUBJECT: Prescribing the Guidelines for the Preliminary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 1945 download

Edit your 1945 bir form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1945 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir 1945 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bir form 1945. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bir form 1945

How to fill out bir form 1945 download?

01

Go to the official website of the Bureau of Internal Revenue (BIR).

02

Look for the forms section and search for form 1945.

03

Download the form by clicking on the designated link or button.

04

Open the downloaded form using a PDF viewer or editing software.

05

Read the instructions and guidelines indicated on the form carefully.

06

Fill in the required fields of the form, such as your personal information, taxpayer identification number, and other relevant details.

07

Double-check your entries to ensure accuracy and completeness.

08

Save the completed form on your computer or device.

09

Print the form if necessary or submit it online, depending on the requirements of the BIR.

Who needs bir form 1945 download?

01

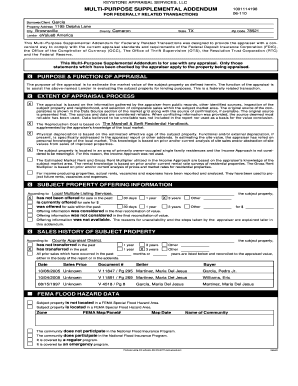

Individuals or businesses who engage in certain types of transactions with non-resident aliens or foreign corporations may need to download and fill out BIR Form 1945.

02

This form is specifically used for reporting purchases of goods or properties subject to value-added tax (VAT) from non-resident suppliers.

03

It is important to consult with the Bureau of Internal Revenue or a tax professional to determine if you are required to fill out and submit this form.

Fill

form

: Try Risk Free

People Also Ask about

What BIR form is required for filing of tax in the Philippines?

Properly fill-up BIR Form 2551Q in triplicate copies. Proceed to any Authorized Agent Bank (AAB)located within the territorial jurisdiction of the Revenue District Office (RDO) where the taxpayer is registered and present the duly accomplished BIR Form 2551Q and other requirements.

What is the BIR form used for?

This form is to be accomplished by all taxpayers who intend to apply for authority to use either Loose-Leaf / Computerized Books of Accounts and/or Accounting Records. To be filed with the Revenue District Office (RDO) having jurisdiction over the Head Office/or branch.

What is the use of Bir?

It enables corporate taxpayers to send their quarterly sales and purchases data through the BIR Website. BIR is able to accurately estimate the amount of sales and VAT liabilities of corporations. Another enforcement program of the BIR is the “Oplan Kandado”.

How do I get a copy of my tax return online?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Who should fill up BIR form 1905?

1) Taxpayer applicant files BIR Form 1905, together with the attachments, at the RDO where he is registered. 2) RDO verifies if taxpayer has open cases reflected in the Integrated Tax System.

Can I download tax forms online?

File your federal tax forms online for free You can e-file directly to the IRS and download or print a copy of your tax return. Federal tax filing is free for everyone with no limitations, and state filing is only $14.99.

What is the meaning of BIR Form?

BIR Forms - Bureau of Internal Revenue. × By using this website, you agree to the terms of the BIR Privacy Notice. Menu.

How do I use eBIRForms online?

After installing, open the software by clicking the icon of the eBIRForms. Fill out the necessary details like your RDO code, TIN, email address, active contact number, registered address, etc. Select what type of BIR form you want to file and click fill up. Fill out all the required information.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bir form 1945 to be eSigned by others?

Once your bir form 1945 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get bir form 1945?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific bir form 1945 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in bir form 1945?

With pdfFiller, it's easy to make changes. Open your bir form 1945 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is bir form 1945 excel?

BIR Form 1945 is a tax form used in the Philippines for the filing of income tax returns, specifically intended for the reporting of income earned by individuals and corporations.

Who is required to file bir form 1945 excel?

Individuals, corporations, and entities who have earned income and are subject to income tax in the Philippines are required to file BIR Form 1945.

How to fill out bir form 1945 excel?

To fill out BIR Form 1945, one must accurately input personal or business income details, tax identification numbers, and other required financial information into the Excel template, ensuring all entries comply with BIR guidelines.

What is the purpose of bir form 1945 excel?

The purpose of BIR Form 1945 is to provide the Bureau of Internal Revenue with a detailed account of taxable income, facilitating the calculation and collection of appropriate taxes.

What information must be reported on bir form 1945 excel?

BIR Form 1945 requires the reporting of taxpayer identification, income earned, applicable deductions, tax payable, and other relevant financial data that impacts the tax liability.

Fill out your bir form 1945 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 1945 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.