Get the free Fixed Indemnity InsuranceCoverage for the In ... - Health Insurance

Show details

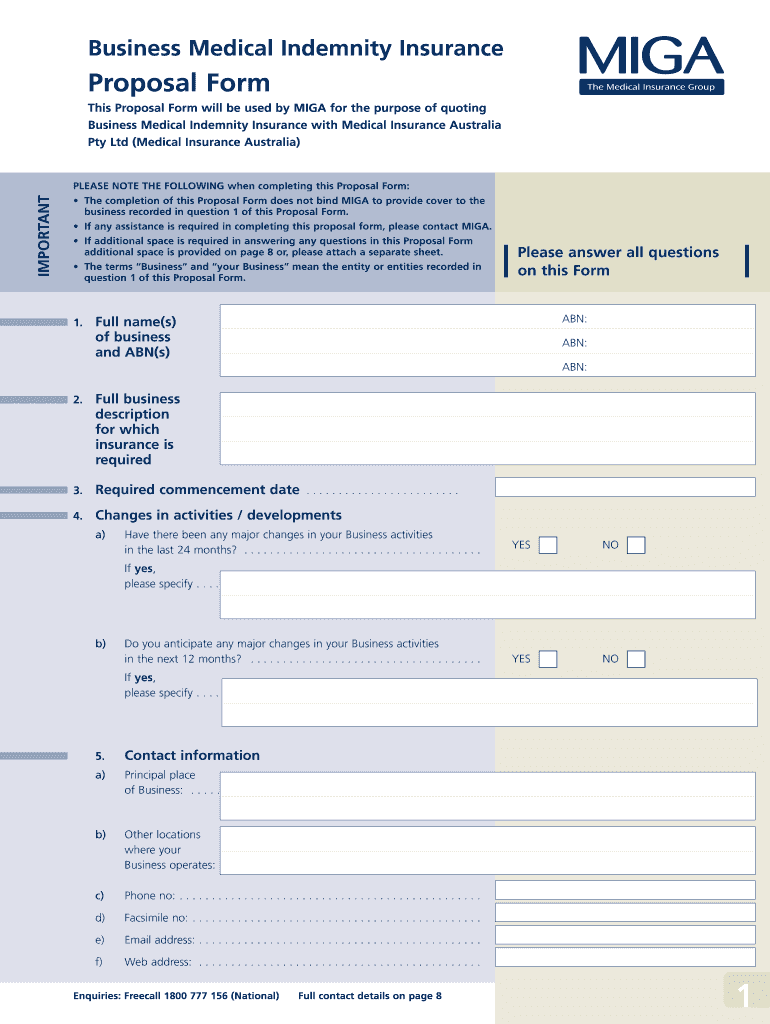

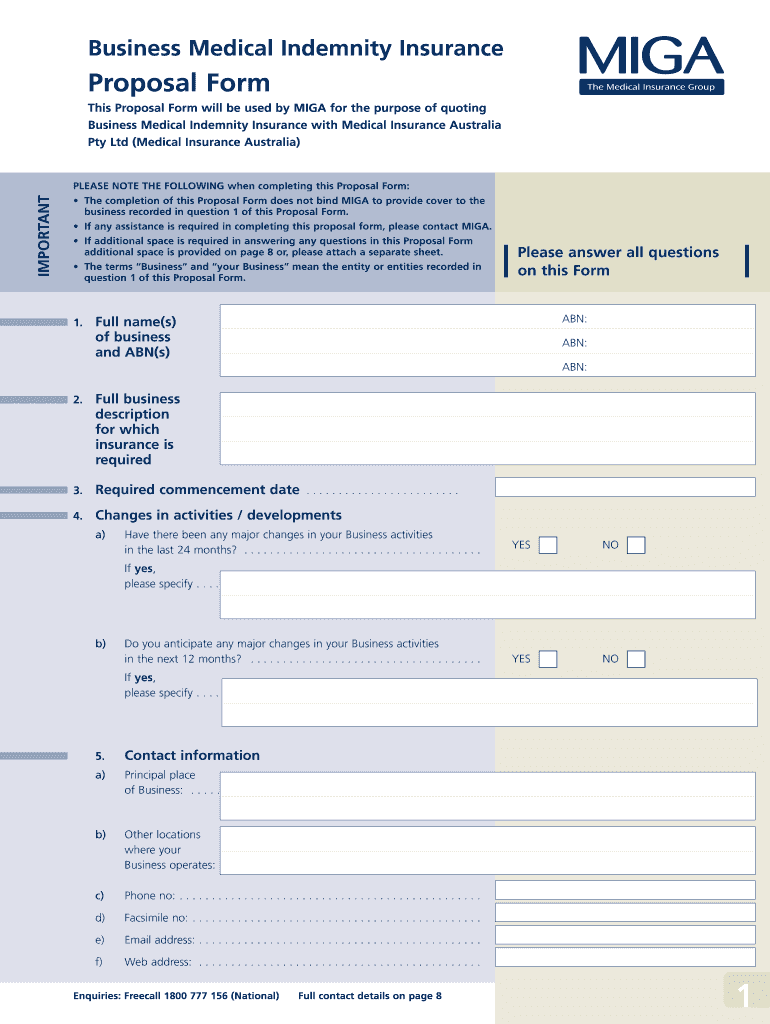

Business Medical Indemnity Insurance Proposal Form IMPORTANT This Proposal Form will be used by AMIGA for the purpose of quoting Business Medical Indemnity Insurance with Medical Insurance Australia

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed indemnity insurancecoverage for

Edit your fixed indemnity insurancecoverage for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed indemnity insurancecoverage for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed indemnity insurancecoverage for online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fixed indemnity insurancecoverage for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed indemnity insurancecoverage for

How to Fill Out Fixed Indemnity Insurance Coverage:

01

Gather the necessary information: Before starting to fill out the fixed indemnity insurance coverage form, gather all the required information. This may include personal details such as name, address, contact information, and social security number.

02

Understand the coverage options: Familiarize yourself with the different coverage options available under fixed indemnity insurance. This may include options for hospital stays, doctor visits, surgeries, and other medical expenses. Knowing the coverage options will help you complete the form accurately.

03

Review the format of the form: Take a moment to review the fixed indemnity insurance coverage form. Understand the structure of the form and the specific sections that require your attention. This will ensure that you don't miss any important fields while filling it out.

04

Provide accurate personal information: In the designated sections, provide accurate personal information such as your name, address, and contact details. Make sure to double-check the accuracy of this information for timely communication and documentation purposes.

05

Indicate the desired coverage options: Select the appropriate coverage options based on your needs and preferences. Carefully indicate the type and level of coverage you wish to avail, considering your medical history, anticipated expenses, and budget.

06

Provide additional requested information: The form may request additional information such as existing medical conditions or previous surgeries. If applicable, provide accurate and detailed information to ensure a comprehensive understanding of your health background.

07

Review and double-check all details: After completing the form, review every detail carefully. Make sure all the information provided is accurate, as any discrepancies could lead to complications in the future. Take the time to verify the accuracy of your responses before submitting the form.

Who Needs Fixed Indemnity Insurance Coverage:

01

Self-employed individuals: Freelancers, consultants, and business owners who do not have access to employer-sponsored health insurance plans may benefit from fixed indemnity insurance coverage. It provides a financial safety net in case of unexpected healthcare expenses.

02

Individuals with high-deductible health plans: Those enrolled in high-deductible health insurance plans may opt for fixed indemnity insurance coverage to supplement their primary coverage. It can help cover out-of-pocket costs, deductibles, and other medical expenses not covered by their primary plan.

03

Retirees not eligible for Medicare: Individuals who have retired before becoming eligible for Medicare may consider fixed indemnity insurance coverage to bridge the gap until they can enroll in Medicare. It offers a temporary solution to ensure healthcare coverage during this transition period.

04

Young adults no longer covered under parental plans: When young adults age out of their parents' health insurance plans, they can explore fixed indemnity insurance coverage as an affordable option. It provides limited coverage for various medical services until they secure alternative insurance.

05

Individuals seeking additional coverage: Some individuals may want additional coverage beyond their primary insurance plan. Fixed indemnity insurance coverage can be purchased as a supplement to enhance their overall healthcare coverage and protect against unexpected medical expenses.

Remember, it is always recommended to consult with an insurance professional or agent who can provide personalized guidance and help determine whether fixed indemnity insurance coverage is the right choice for your specific needs.

Fill

form

: Try Risk Free

People Also Ask about

Are fixed indemnity plans good?

Who is a good fit for fixed-indemnity health insurance? Fixed-indemnity insurance is a safe choice for people who already have major medical coverage. The cash payouts from the fixed-indemnity policy can help cover deductibles, copayments, coinsurance, and any other out-of-pocket costs.

What are fixed indemnity and ancillary benefits?

Fixed indemnity insurance is a supplemental health insurance that can help you to manage out-of-pocket costs. These plans can provide an extra layer of protection in the event of serious injury or illness by paying you a set amount of cash benefits for specific covered medical expenses you incur.

What is a fixed indemnity plan for health insurance?

Fixed indemnity health insurance is a type of medical insurance that pays a pre-determined amount on a per-period or per-incident basis, regardless of the total charges incurred. Plans might pay $200 upon hospital admission, for example, or $100 per day while a person is hospitalized.

What are the disadvantages of indemnity health insurance?

Cons Can leave you with a large debt in case of a major medical event. Doesn't cover pre-existing conditions, preventive care, or other “essential benefits” as defined by the Affordable Care Act (ACA). Limits your annual or lifetime benefit, which leaves you responsible for remaining costs.

What does indemnity insurance provide?

Indemnification is an agreement where your insurer helps cover loss, damage or liability incurred from a covered event. Indemnity is another way of saying your insurer pays for a loss, so you don't have financial damages.

What is fixed indemnity vs indemnity?

Fixed-indemnity health insurance pays out a set dollar amount for each medical event, treatment, or service. Hospital indemnity insurance pays a given sum per day for time you spend in the hospital.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed indemnity insurancecoverage for without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your fixed indemnity insurancecoverage for into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the fixed indemnity insurancecoverage for electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your fixed indemnity insurancecoverage for in seconds.

Can I edit fixed indemnity insurancecoverage for on an iOS device?

You certainly can. You can quickly edit, distribute, and sign fixed indemnity insurancecoverage for on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is fixed indemnity insurance coverage for?

Fixed indemnity insurance coverage is designed to provide a specific, fixed amount of benefit for covered services or events, regardless of the actual expenses incurred.

Who is required to file fixed indemnity insurance coverage for?

Employers or individuals who have purchased fixed indemnity insurance policies are required to report the coverage.

How to fill out fixed indemnity insurance coverage for?

You can fill out fixed indemnity insurance coverage by providing the necessary information about the policy and the covered individual(s) on the appropriate forms.

What is the purpose of fixed indemnity insurance coverage for?

The purpose of fixed indemnity insurance coverage is to provide a specific level of financial protection for covered services or events.

What information must be reported on fixed indemnity insurance coverage for?

You must report the name of the policyholder, the type of coverage, the coverage period, and any covered individuals.

Fill out your fixed indemnity insurancecoverage for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Indemnity Insurancecoverage For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.