Get the free bir form 1700 excel file download

Show details

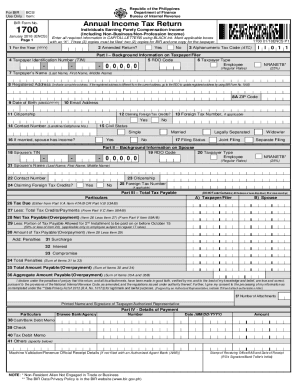

The Tax System of the Philippines I. Personal Income Tax 1. Who are Liable? General Treatment of Taxation of Individuals Under Section 23 of the National Internal Revenue Code of the Philippines (NRC),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 1700 download

Edit your bir form 1700 excel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1700 excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir form 1700 excel online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bir form 1700 excel. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bir form 1700 excel

How to fill out bir form 1700 excel:

01

Open Microsoft Excel on your computer.

02

Download the BIR Form 1700 Excel template from the official BIR website or any reliable source.

03

Open the downloaded template in Excel.

04

Start by entering your personal information such as name, address, and taxpayer identification number (TIN).

05

Fill in the necessary details related to your income, such as compensation income, business income, and other taxable income.

06

Calculate and input the applicable deductions, exemptions, and tax credits.

07

Compute the total tax due based on the given tax table or tax rate.

08

Include any other information required by the form, such as information on dependents, receipts of income, and proof of taxes withheld.

09

Review and double-check all the information you have entered.

10

Once you are certain that everything is accurate, save the completed form on your computer and print a physical copy.

Who needs bir form 1700 excel:

01

Individuals who are engaged in business and practicing their profession, including professionals such as doctors, lawyers, and engineers, need to fill out BIR Form 1700 Excel.

02

Employees who have multiple employers or those who have self-employed income in addition to their compensation income should also fill out this form.

03

Individuals who earn income from sources other than employment, such as rental income or capital gains, are also required to file BIR Form 1700 Excel.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between 1701A and 1701?

1701 is for those with mixed-income (eg. someone who is both a freelance writer and a teacher), while 1701A is for those whose income is only coming from his/her business or profession (eg. a full-time freelance writer or a bakery owner).

Who are required to submit audited financial statements to BIR?

Under the Bureau of Internal Revenue (BIR), corporations, partnerships, or individuals earning gross sales of more than P3,000,000 per year must submit an Audited Financial Statement to the BIR each year.

Do I need to file BIR 1700?

For individuals earning purely compensation income from two or more employers within the same taxable year, they are required to file BIR Form 1700 as their annual income tax return.

What is the difference between BIR form 1700 and 1701?

1700 while self-employed individuals should file either the Annual Income Tax Return for Individuals Earning Purely from Business or Profession (BIR Form No. 1701A) or the Annual Income Tax Return for Individuals including Mixed Income Earner, Estates and Trusts (BIR Form No. 1701).

Who is not required to file the quarterly income tax return?

But if the earning has deducted with final withholding tax, it is not mandatory to file BIR Form 1701Q. In addition, individual employees earning purely compensation income do not need to file BIR Form 1701Q quarterly.

How to file BIR form 1700 online?

Procedures Fill-up applicable fields in the BIR Form No. 1700. Pay electronically by clicking the "Proceed to Payment" button and fill-up the required fields in the "eFPS Payment Form" click "Submit" button. Receive payment confirmation from eFPS-AABs for successful e-filing and e-payment.

Are BIR forms downloadable?

Through the use of the downloadable eBIRForms Software Package (also known as the Offline Package), taxpayers and Accredited Tax Agents (ATAs) will be able to fill up tax returns offline and submit it to the BIR through the Online eBIRForms System.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my bir form 1700 excel in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your bir form 1700 excel and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify bir form 1700 excel without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like bir form 1700 excel, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the bir form 1700 excel electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your bir form 1700 excel in minutes.

What is bir form 1700 excel?

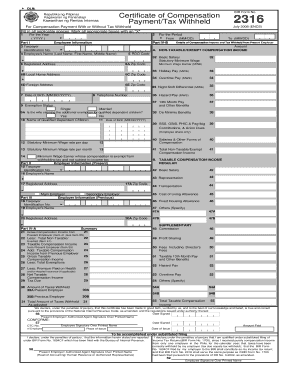

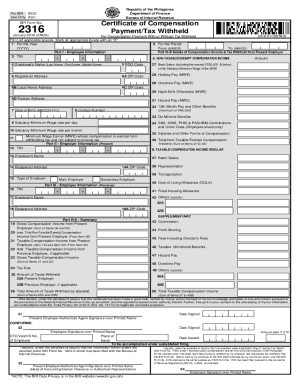

BIR Form 1700 Excel is a tax return form used in the Philippines for individuals earning purely compensation income, which is filed electronically in Excel format.

Who is required to file bir form 1700 excel?

Individuals who are employees receiving compensation income and whose taxes are withheld by their employers are required to file BIR Form 1700 Excel.

How to fill out bir form 1700 excel?

To fill out BIR Form 1700 Excel, you need to download the form from the BIR website, complete the required fields with your personal and income details, and ensure that all necessary attachments are included before submitting it electronically.

What is the purpose of bir form 1700 excel?

The purpose of BIR Form 1700 Excel is to declare income earned from employment, calculate the tax liability owed, and comply with the income tax filing obligations set by the Bureau of Internal Revenue.

What information must be reported on bir form 1700 excel?

Information reported on BIR Form 1700 Excel includes the taxpayer’s name, Tax Identification Number (TIN), details of compensation income, tax withheld, and other relevant personal information.

Fill out your bir form 1700 excel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 1700 Excel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.