Get the free Business Access Saver Application and Authority to Operate

Show details

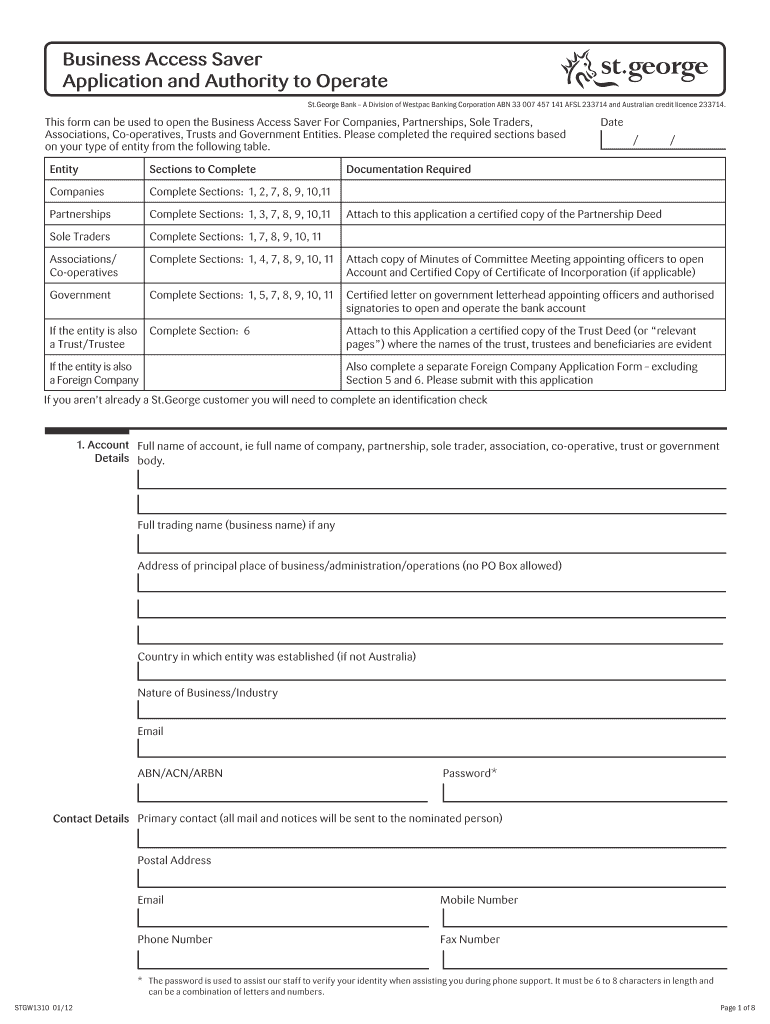

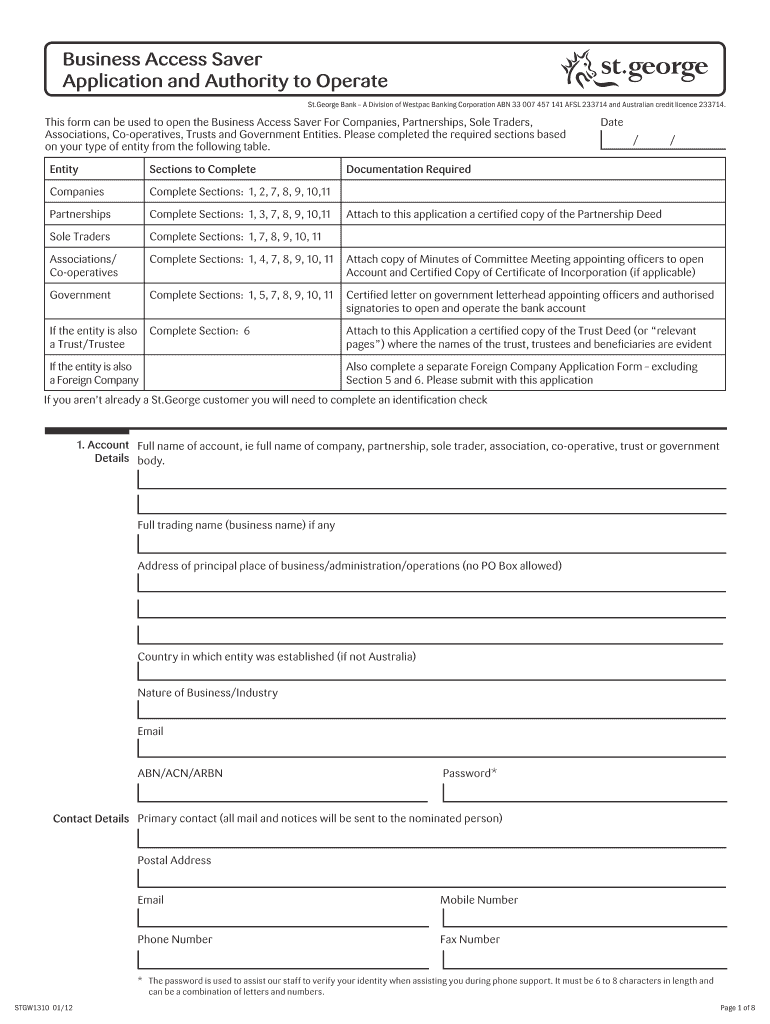

Business Access Saver Application and Authority to Operate St. George Bank A Division of Westpac Banking Corporation ABN 33 007 457 141 ADSL 233714 and Australian credit license 233714. This form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business access saver application

Edit your business access saver application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business access saver application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business access saver application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business access saver application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business access saver application

How to fill out business access saver application:

01

Start by gathering all the necessary information and documents required for the application. This may include your business details, financial statements, identification documents, and any other supporting paperwork.

02

Visit the website or branch of the financial institution offering the business access saver application. Ensure that you have chosen a reputable and reliable institution that suits your business needs.

03

Request an application form for the business access saver account. Some financial institutions may offer an online application process, while others may require you to fill out a physical form. Follow the provided instructions carefully.

04

Begin by filling in your business details accurately. This may include your company name, business registration number, address, telephone number, and email address.

05

Provide the necessary identification information. This typically includes your name, date of birth, residential address, and social security number or any other identification number required by the institution.

06

Fill out the section regarding the type of account you wish to open. In this case, select the business access saver account option.

07

Enter your financial details, such as the expected average balance, funding source, and purpose of the account. Be precise and honest in stating your expected business activities and revenue.

08

If required, provide additional information or documents to support your application, such as financial statements, business plan, or reference letters. Make sure these documents are accurate, up-to-date, and clearly show the financial stability of your business.

09

Review the completed application form thoroughly to ensure all information provided is correct. Double-check for any errors or missing information.

10

Sign and date the application form as instructed. This may require your physical or electronic signature, depending on the submission method chosen.

Who needs a business access saver application:

01

Business owners or entrepreneurs who want a convenient and flexible savings account specifically designed for business purposes.

02

Companies that aim to maintain a separate account for their business funds, ensuring better financial management and separation from personal finances.

03

Small businesses and startups looking to earn competitive interest rates on their surplus funds while maintaining easy access to their money for operational needs.

04

Businesses that require quick access to their liquid assets and assets that can be easily converted into cash whenever needed.

05

Companies that want to take advantage of additional features such as online banking, electronic transfers, or business banking services provided with the business access saver account.

In summary, filling out a business access saver application requires gathering the required information, completing the application form accurately, and providing any additional supporting documents. This account is suitable for businesses that desire a dedicated savings account with convenient access to their funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business access saver application in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your business access saver application and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit business access saver application in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your business access saver application, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out business access saver application on an Android device?

Use the pdfFiller app for Android to finish your business access saver application. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is business access saver application?

The business access saver application is a form used to apply for access to a business's savings account.

Who is required to file business access saver application?

Any business or individual who needs access to a business's savings account must file the business access saver application.

How to fill out business access saver application?

The business access saver application can be filled out online or submitted in person at the financial institution where the savings account is held.

What is the purpose of business access saver application?

The purpose of the business access saver application is to authorize individuals or entities to access the funds in a business's savings account.

What information must be reported on business access saver application?

The business access saver application typically requires information such as the name of the business, the names of individuals authorized to access the account, and any required documentation.

Fill out your business access saver application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Access Saver Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.