Get the free Declaration for a Non Resident Indian for encashing

Show details

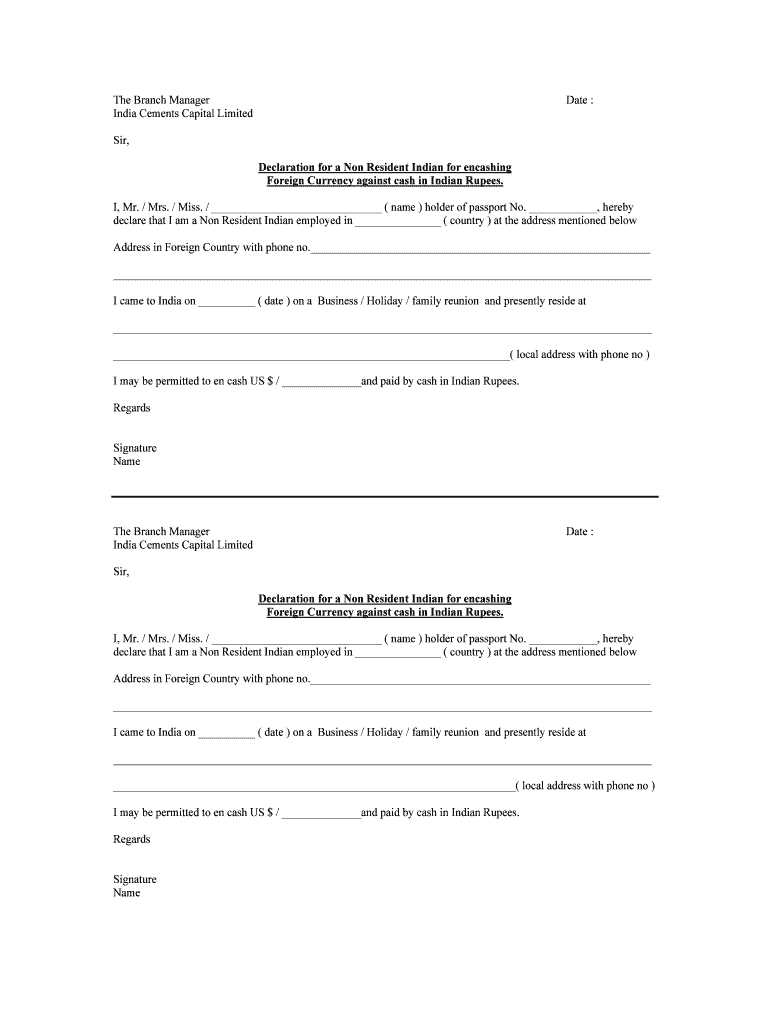

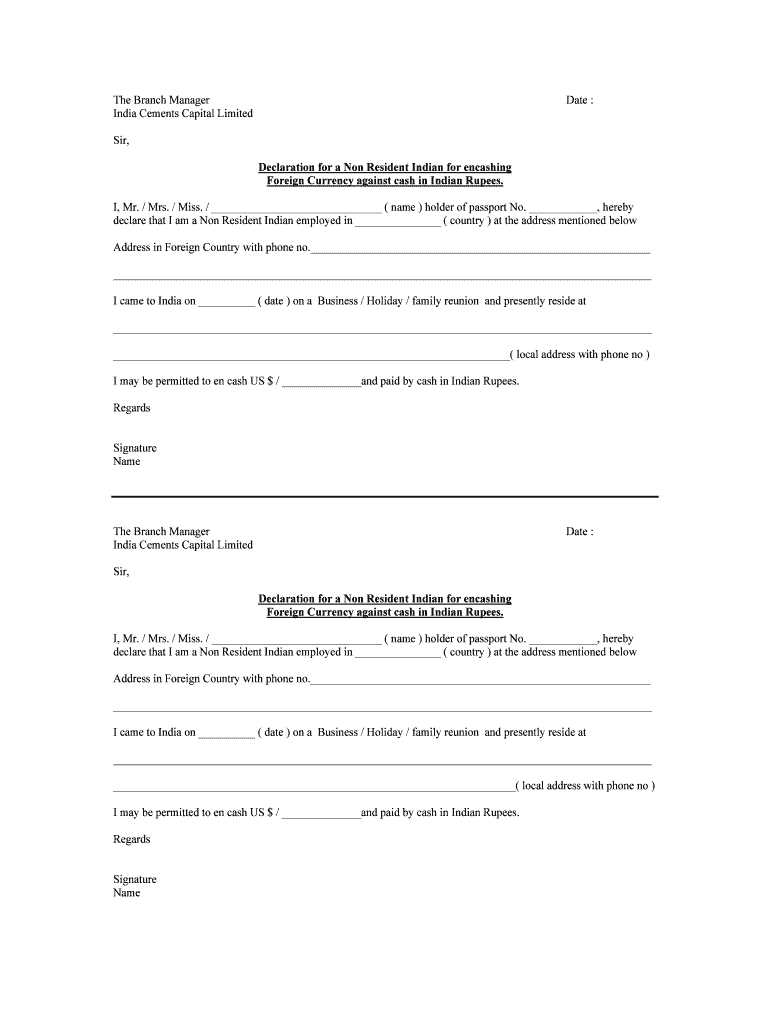

The Branch Manager India Cements Capital Limited Date : Sir, Declaration for a Non-Resident Indian for encasing Foreign Currency against cash in Indian Rupees. I, Mr. / Mrs. / Miss. / (name) holder

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration for a non

Edit your declaration for a non form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration for a non form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration for a non online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit declaration for a non. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration for a non

Point by point on how to fill out a declaration for a non and who needs it:

How to fill out a declaration for a non:

01

Begin by obtaining the proper form for filing a declaration for a non. This can usually be found on the official website of the relevant government agency or department.

02

Fill in your personal information accurately. This may include your name, address, contact details, and any other required information.

03

Provide the necessary details about the non or organization for which the declaration is being filed. This could include the non's name, purpose, activities, and any other relevant information.

04

Clearly state the financial information of the non. This may involve detailing its sources of income, expenditures, assets, liabilities, and any other financial details required by the form.

05

Attach any supporting documents that may be needed to substantiate the information provided in the declaration. These could include financial statements, receipts, contracts, or any other relevant paperwork.

06

Review the completed declaration form for any errors or missing information before submitting it. Ensure that all sections have been filled out accurately and completely.

07

Sign and date the declaration form in the designated spaces. If required, ensure that any other necessary signatures are also obtained.

08

Submit the filled-out declaration form along with any required attachments to the appropriate government agency or department as per their instructions.

Who needs a declaration for a non:

01

Nonprofit organizations: Nonprofit organizations, also known as non-governmental organizations (NGOs), charitable organizations, or foundations, may need to fill out and submit a declaration to comply with legal or regulatory requirements. This ensures transparency and accountability in the organization's operations and finances.

02

Government agencies: Government bodies responsible for overseeing nonprofits or issuing tax-exempt status may require declarations to verify the non's eligibility for benefits, exemptions, or funding.

03

Grantors or donors: Grantors or donors often require nonprofits to provide a declaration to assess their eligibility for grants, donations, or other forms of financial assistance.

04

Auditors or accountants: Auditors or accountants may request a declaration from a non to verify its financial information and compliance with accounting standards or regulations.

05

Legal entities: Legal entities, such as banks, financial institutions, or regulatory bodies, may ask for a declaration as part of their due diligence procedures before engaging in any financial or legal transactions with a non.

Remember to consult the specific regulations and requirements of your jurisdiction or the relevant government agency to ensure accurate and complete completion of the declaration form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send declaration for a non for eSignature?

When you're ready to share your declaration for a non, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete declaration for a non online?

Filling out and eSigning declaration for a non is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my declaration for a non in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your declaration for a non and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is declaration for a non?

Declaration for a non is a form that must be submitted to provide information about a non-resident entity.

Who is required to file declaration for a non?

Any non-resident entity that conducts business activities in a specific country is required to file a declaration for a non.

How to fill out declaration for a non?

Declaration for a non can be filled out online or in paper form, providing details about the non-resident entity's business activities and financial information.

What is the purpose of declaration for a non?

The purpose of declaration for a non is to ensure that non-resident entities are compliant with tax laws and regulations in the country where they conduct business activities.

What information must be reported on declaration for a non?

Information such as business activities, financial statements, ownership structure, and tax identification numbers must be reported on declaration for a non.

Fill out your declaration for a non online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration For A Non is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.