Get the free COST RECOVERY CERTIFICATE AND AGREEMENT

Show details

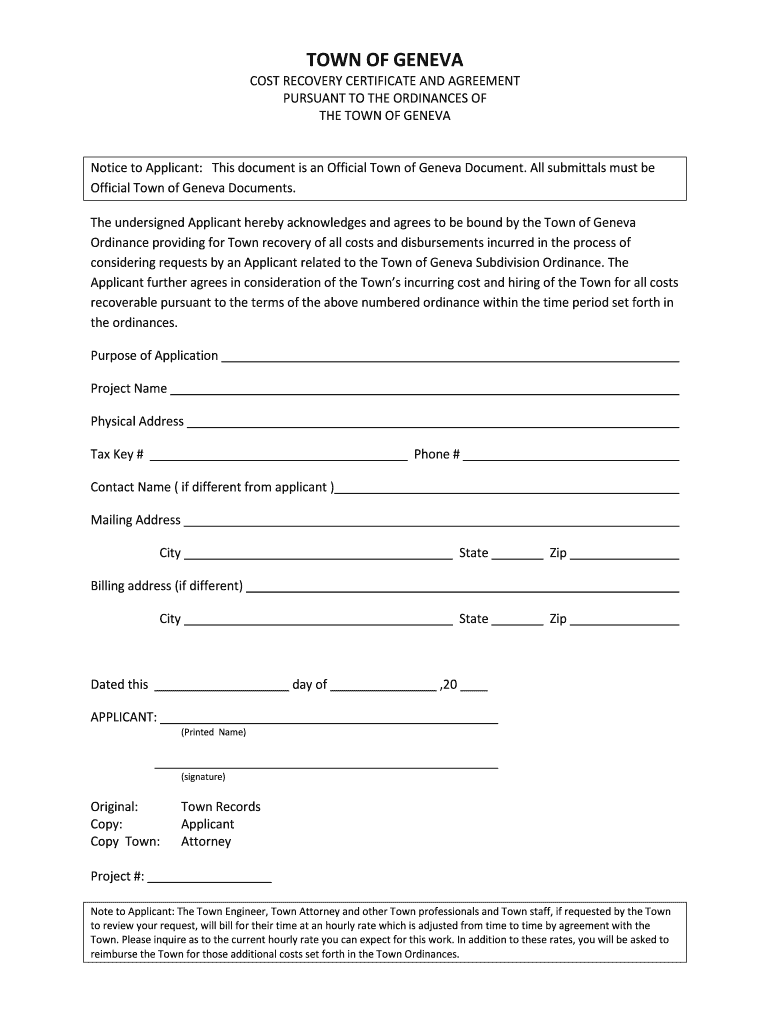

This document serves as an agreement for the recovery of costs incurred by the Town of Geneva when considering applications related to the Subdivision Ordinance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost recovery certificate and

Edit your cost recovery certificate and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost recovery certificate and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cost recovery certificate and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cost recovery certificate and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost recovery certificate and

How to fill out COST RECOVERY CERTIFICATE AND AGREEMENT

01

Obtain the COST RECOVERY CERTIFICATE AND AGREEMENT form from the relevant authority or website.

02

Read the instructions carefully to understand the requirements and terms.

03

Fill in your personal information, including name, address, and contact details.

04

Provide specific details about the project or services for which cost recovery is being claimed.

05

List all applicable costs that are being recovered, ensuring to itemize each cost with a description.

06

Attach any necessary documentation that supports your claims, such as receipts or invoices.

07

Review the form for accuracy and completeness before submission.

08

Sign and date the agreement to confirm your understanding and acceptance of the terms.

09

Submit the completed form to the designated authority as instructed.

Who needs COST RECOVERY CERTIFICATE AND AGREEMENT?

01

Individuals or organizations seeking reimbursement for specific costs associated with a project or service.

02

Contractors who have incurred expenses on behalf of a client or organization.

03

Non-profit organizations needing to recover costs related to funded projects.

04

Businesses participating in government contracts where cost recovery is applicable.

Fill

form

: Try Risk Free

People Also Ask about

What is a cost recovery contract?

Example of a cost recovery clause “The Client agrees to reimburse the Contractor for all reasonable costs incurred in the performance of the services, including but not limited to labor, materials, and expenses.

What is the meaning of cost recovery?

Cost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions.

What are the three types of cost recovery?

The cost recovery types are as follow: Depreciation: It is the cost recovery technique used for tangible non-current assets. Amortization: This method recovers the acquisition cost of the intangible assets. Depletion: This technique reduces the natural resources' cost per their use.

What is the cost recovery method?

Using the cost recovery method, a business will recognize revenue and cost of sales for any given transaction but will not immediately count the profit. When payment is received for the transaction, it will not be considered until it counts as recovery of costs of goods sold. Any remainder is then considered profit.

What is the cost recovery process?

Using the cost recovery method, a business will recognize revenue and cost of sales for any given transaction but will not immediately count the profit. When payment is received for the transaction, it will not be considered until it counts as recovery of costs of goods sold. Any remainder is then considered profit.

What is the principle of cost recovery?

Cost recovery is the principle of recovering a business expenditure, and generally refers to regaining the cost of any business-related expense. For accountants, cost recovery accounting is a tax concept that refers to the recovery of an expense, and accountants generally do this through depreciation.

How is cost recovery calculated?

Cost recovery is relatively easy to calculate. Accountants calculate this by taking the sale transaction's cost for the product and the product's revenue sources into account.

What is a full cost recovery contract?

Full cost recovery means securing funding for all the costs involved in running a project. This means that you can request funding for direct project costs and for a proportionate share of your organisation's overheads.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COST RECOVERY CERTIFICATE AND AGREEMENT?

A Cost Recovery Certificate and Agreement is a document used to establish the terms and conditions under which costs incurred by one party can be recovered from another party, often related to project expenses or services rendered.

Who is required to file COST RECOVERY CERTIFICATE AND AGREEMENT?

Typically, parties engaged in agreements where one party is to reimburse costs incurred by another must file a Cost Recovery Certificate and Agreement. This usually includes contractors, service providers, and clients involved in project-based work.

How to fill out COST RECOVERY CERTIFICATE AND AGREEMENT?

To fill out a Cost Recovery Certificate and Agreement, one should provide details such as the parties involved, the scope of the agreement, specific costs to be recovered, payment terms, and any relevant dates. It is important to ensure all sections are completed accurately.

What is the purpose of COST RECOVERY CERTIFICATE AND AGREEMENT?

The purpose of a Cost Recovery Certificate and Agreement is to formalize the understanding between parties regarding cost reimbursements, ensuring transparency and setting expectations for financial transactions related to services or projects.

What information must be reported on COST RECOVERY CERTIFICATE AND AGREEMENT?

The information that must be reported typically includes the names and contact details of the parties involved, a detailed description of the costs to be recovered, the basis for those costs, payment terms, and signatures from authorized representatives of both parties.

Fill out your cost recovery certificate and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Recovery Certificate And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.