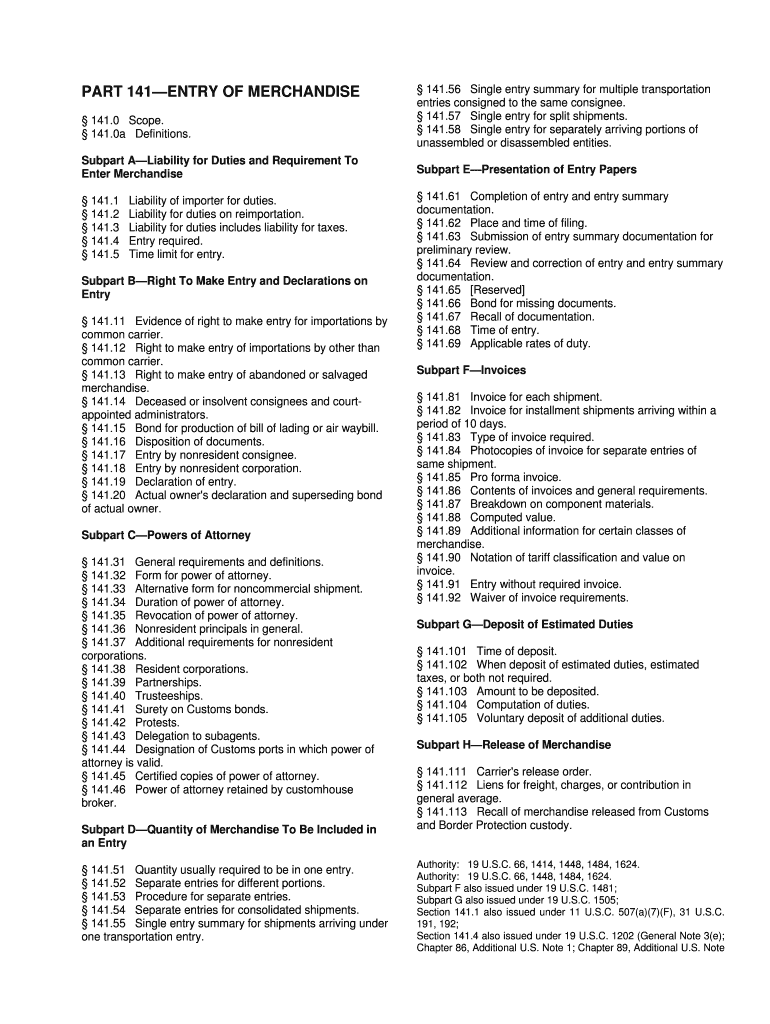

Get the free PART 141—ENTRY OF MERCHANDISE

Show details

This document outlines the general requirements and procedures for the entry of imported merchandise, detailing the liability for duties, the right to make entry, the powers of attorney, the quantity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign part 141entry of merchandise

Edit your part 141entry of merchandise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your part 141entry of merchandise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit part 141entry of merchandise online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit part 141entry of merchandise. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out part 141entry of merchandise

How to fill out PART 141—ENTRY OF MERCHANDISE

01

Obtain the PART 141—ENTRY OF MERCHANDISE form from the relevant customs authority.

02

Fill out the identification section of the form, providing your name and contact information.

03

List the details of the merchandise, including descriptions, quantities, and values.

04

Provide the country of origin for each item being imported.

05

Include any applicable invoices and supporting documentation for the merchandise.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the designated customs office for processing.

Who needs PART 141—ENTRY OF MERCHANDISE?

01

Importers bringing goods into the country.

02

Businesses that require customs clearance for their merchandise.

03

Freight forwarders and customs brokers handling shipments on behalf of clients.

Fill

form

: Try Risk Free

People Also Ask about

What is the import date for 19 CFR?

“Date of importation” means, in the case of merchandise imported otherwise than by vessel, the date on which the merchandise arrives within the Customs territory of the United States.

Who has the right to make entry?

For merchandise to enter and clear with Customs and Border Protection, the importer of record should have the legal right to make the necessary filings, this is known as having the Right to Make Entry.

What is the meaning of customs entry?

Customs entry is a declaration of the kind, amount, and value of goods being taken in or out of a country, for purposes of customs clearance.

What is the authority to make entry?

The Right to Make Entry refers to the exclusive authority given to certain parties to submit customs entries for imported goods. In simpler terms, these are the individuals or entities responsible for interacting with customs authorities and ensuring compliance with regulations.

How to make a bill of entry?

To create a bill of entry, importers or their agents must submit detailed information about the imported goods, including value, quantity, and type, along with all necessary supporting documents like invoices and packing lists, to the customs authorities through the electronic data interchange (EDI) system or the

What is the right to make entry?

§ 141.12 Right to make entry of importations by other than common carrier. When merchandise is not imported by a common carrier, possession of the merchandise at the time of arrival in the United States shall be deemed sufficient evidence of the right to make entry.

What is CFR entered for consumption?

(f) Entered for consumption. ''Entered for consumption'' means that an entry summary for consumption has been filed with CBP in proper form, includ- ing electronic submission to the Auto- mated Commercial Environment (ACE) or any other CBP-authorized electronic data interchange system, with esti- mated duties attached.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PART 141—ENTRY OF MERCHANDISE?

PART 141—ENTRY OF MERCHANDISE is a section of the U.S. Customs regulations that outlines the requirements for the entry of imported merchandise into the United States.

Who is required to file PART 141—ENTRY OF MERCHANDISE?

Importers or their agents are required to file PART 141—ENTRY OF MERCHANDISE to ensure that goods are properly documented and comply with customs regulations.

How to fill out PART 141—ENTRY OF MERCHANDISE?

To fill out PART 141—ENTRY OF MERCHANDISE, one must complete the appropriate customs entry forms, providing details about the merchandise, including classification, valuation, and applicable duties.

What is the purpose of PART 141—ENTRY OF MERCHANDISE?

The purpose of PART 141—ENTRY OF MERCHANDISE is to provide customs with the necessary information to assess duties, enforce trade laws, and ensure the proper collection of tariffs on imported goods.

What information must be reported on PART 141—ENTRY OF MERCHANDISE?

Information that must be reported includes the description of the merchandise, value, tariff classification, country of origin, and any applicable exemptions or special duties.

Fill out your part 141entry of merchandise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Part 141entry Of Merchandise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.