Get the free IMP OR TAN T DAT E S

Show details

Post Oak School 4600 Bissonnet Bella ire, TX 77401 7136616688 www.postoakschool.org Founded in 1963; accredited by the Association Montessori Internationale (AMI) and the Independent Schools Association

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign imp or tan t

Edit your imp or tan t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your imp or tan t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing imp or tan t online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit imp or tan t. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

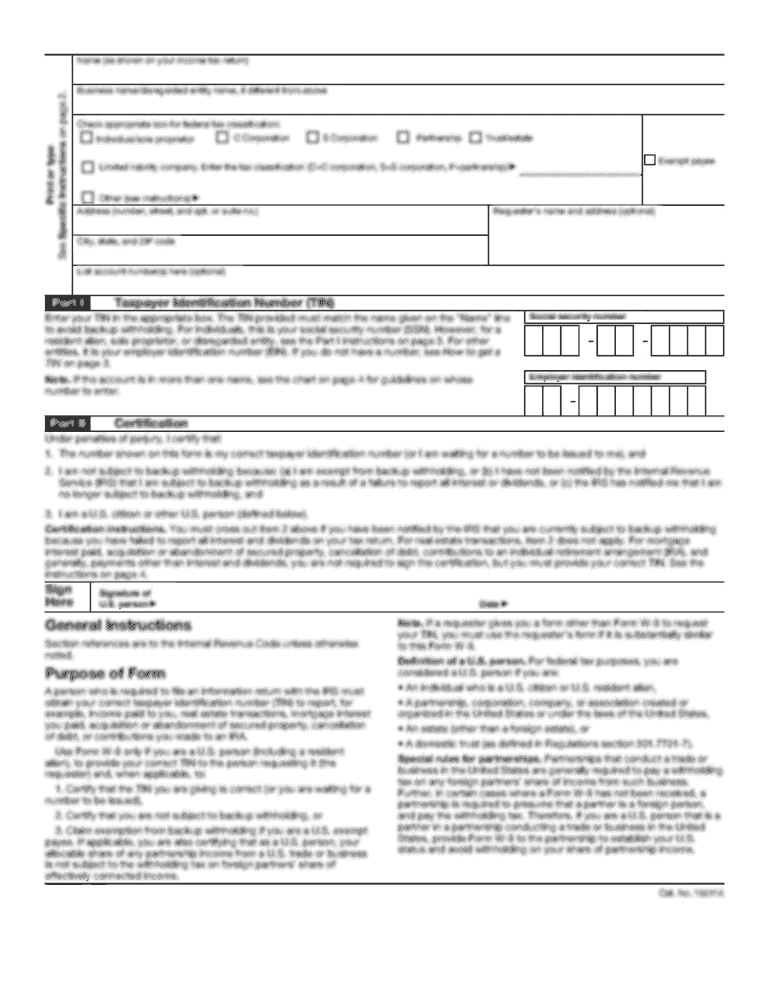

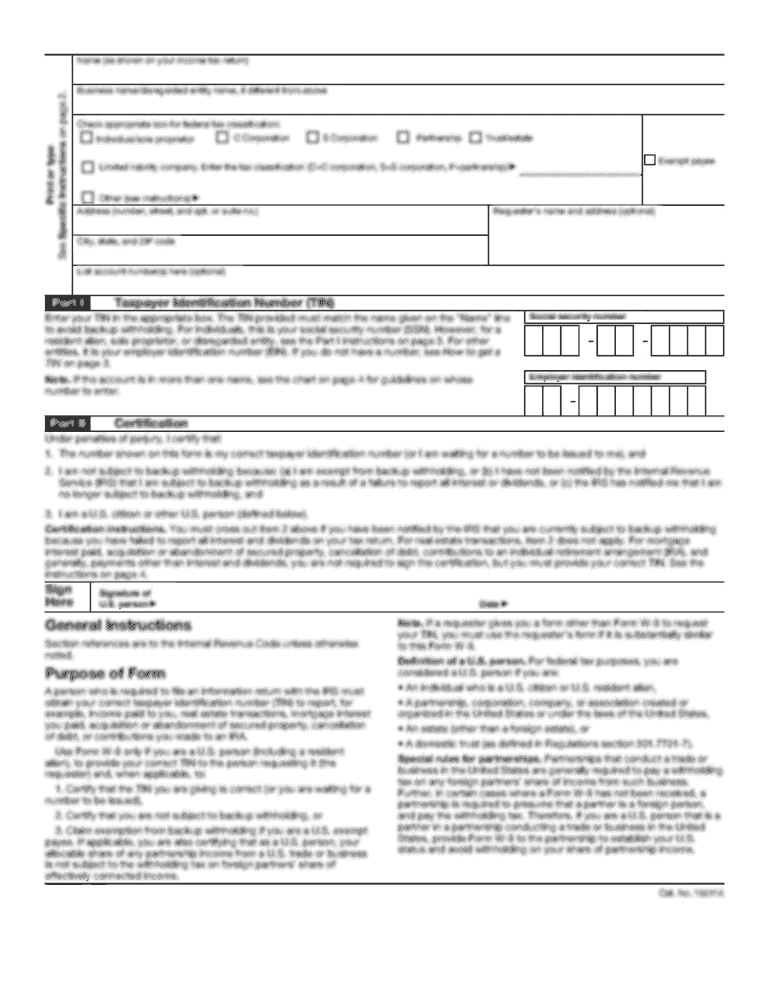

How to fill out imp or tan t

How to fill out imp or tan t:

01

Begin by gathering all necessary information and documents. This may include personal identification, business registration details, tax identification numbers, and any relevant financial information.

02

Determine the purpose for which you are filling out the imp or tan t form. Different forms may be required for various reasons, such as importing goods, applying for tax incentives, or registering as a taxpayer.

03

Carefully read through the instructions provided on the imp or tan t form. Make sure you understand the requirements and any specific guidelines for filling out each section.

04

Start by providing your personal or business details in the designated sections. This may include your name, address, contact information, and tax identification number.

05

Fill out any additional sections that relate to the specific purpose of the form. For example, if you are importing goods, you may need to provide details such as the type of goods, their value, and the country of origin.

06

Double-check all the information you have entered to ensure accuracy. Any mistakes or missing information may cause delays or complications in processing your imp or tan t application.

07

Sign and date the form as required. Some forms may also require a witness or additional signatures, so be sure to follow the instructions provided.

Who needs imp or tan t:

01

Importers: Individuals or businesses involved in the importation of goods into a country typically require an imp or tan t. This form helps to ensure proper customs control and compliance with import regulations.

02

Businesses seeking tax incentives: Companies that qualify for certain tax incentives or exemptions may be required to fill out an imp or tan t form. This helps the tax authorities verify eligibility and enforce the appropriate tax treatment.

03

Individuals or businesses registering as taxpayers: When registering as a taxpayer, individuals or businesses may need to submit an imp or tan t form to provide necessary information to the tax authorities. This form helps establish tax liability and compliance.

In summary, filling out an imp or tan t requires careful attention to detail and understanding the specific purpose of the form. It is typically required by importers, businesses seeking tax incentives, and individuals or businesses registering as taxpayers. By following the instructions provided and providing accurate information, you can ensure a smooth process and avoid any potential complications.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send imp or tan t to be eSigned by others?

Once your imp or tan t is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in imp or tan t?

The editing procedure is simple with pdfFiller. Open your imp or tan t in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out imp or tan t using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign imp or tan t and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is imp or tan t?

Imp or tan t is an abbreviation for Importer Security Filing or ISF.

Who is required to file imp or tan t?

Importers are required to file imp or tan t.

How to fill out imp or tan t?

Imp or tan t can be filled out online through the Automated Broker Interface (ABI) or other approved electronic data interchange systems.

What is the purpose of imp or tan t?

The purpose of imp or tan t is to improve security and facilitate customs clearance by providing advance information about shipments.

What information must be reported on imp or tan t?

Information such as shipper name, consignee name, commodity description, and vessel/voyage details must be reported on imp or tan t.

Fill out your imp or tan t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Imp Or Tan T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.