Get the free VAT – 22B Audit Report

Show details

This document serves as an audit report for a registered person under the Punjab VAT Act, 2005, detailing financial assessments, observations, and compliance with tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat 22b audit report

Edit your vat 22b audit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat 22b audit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

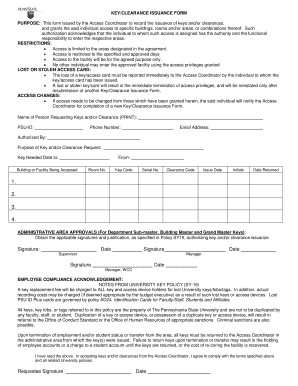

How to edit vat 22b audit report online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vat 22b audit report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat 22b audit report

How to fill out VAT – 22B Audit Report

01

Gather all necessary financial documents related to VAT.

02

Ensure all VAT transactions for the audit period are documented.

03

Complete the header section of the report with your details.

04

Fill in the relevant sections by calculating total VAT collected and paid.

05

Review each entry for accuracy and compliance with VAT regulations.

06

Sign the report to certify its authenticity before submission.

Who needs VAT – 22B Audit Report?

01

Businesses that are registered for VAT and required to report to the tax authority.

02

Entities subject to VAT audits to ensure compliance with tax laws.

Fill

form

: Try Risk Free

People Also Ask about

How to test VAT audit?

Example tests Obtain and check, or prepare, a VAT control account. Agree the VAT creditor or repayment due to the relevant VAT return. Obtain a breakdown of turnover by gross, net and VAT and reconcile to the outputs recorded on the VAT returns. Test a sample of items back to invoice.

How do traders report VAT transactions?

A sales VAT report, which forms part of an electronic account, should include the tax-point, value and VAT rate of supplies made. A purchases VAT report, which forms part of an electronic account, should include the tax-point, value and input tax claimed on supplies received.

How to do a VAT audit?

However, a VAT audit report will typically involve the following criteria, among others: Details of entity's owners and (where applicable) directors and responsible officers. Details on how many people are employed by the business. Internal accounting systems. A description of all goods and/or services supplied.

What is a VAT audit report?

VAT Audit is the process where the National Bureau for Revenue (NBR) will assess the general compliance level of a taxable person with the VAT legislation and verify if the net amount of VAT declared and the amount paid by the taxable person is accurate.

What is VAT audit?

The VAT audit is an integral part of a VAT compliance / self-assessment system. It is important to note that, the role of VAT Audit is to undertake business investigation at dealer's place of business with prior intimation to the VAT dealer.

What is the purpose of the tax audit report?

A tax audit catches any errors or discrepancies early on by looking into your books of accounts and ensures that you are disclosing the information you are supposed to. Also, once you carry out a tax audit, it is easy for the tax authorities to go through your Income Tax Returns.

What is a VAT report?

A VAT report supports the VAT Return process by listing all of the information related to a company's input and output VAT and calculating the overall amount of VAT the business should pay or reclaim from HMRC.

How to conduct a VAT audit?

Obtain and check, or prepare, a VAT control account. Agree the VAT creditor or repayment due to the relevant VAT return. Obtain a breakdown of turnover by gross, net and VAT and reconcile to the outputs recorded on the VAT returns. Test a sample of items back to invoice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VAT – 22B Audit Report?

VAT – 22B Audit Report is a document that provides a detailed audit of a business's Value Added Tax (VAT) compliance using a specific format required by the tax authorities. It assesses the accuracy of VAT returns filed by a business.

Who is required to file VAT – 22B Audit Report?

Businesses that are registered for VAT and meet certain turnover thresholds or have specific transactions that require an audit are obligated to file the VAT – 22B Audit Report. This may include companies operating in certain industries or sectors.

How to fill out VAT – 22B Audit Report?

To fill out VAT – 22B Audit Report, a business must gather all relevant financial documentation, including VAT returns, receipts, and supporting documentation for sales and purchases. The report should be completed in accordance with the format provided by tax authorities, detailing VAT calculations and any discrepancies.

What is the purpose of VAT – 22B Audit Report?

The purpose of the VAT – 22B Audit Report is to ensure compliance with VAT laws and regulations. It helps tax authorities confirm that a business is accurately reporting VAT, thus preventing tax evasion and ensuring correct tax assessment.

What information must be reported on VAT – 22B Audit Report?

The VAT – 22B Audit Report must include information such as total sales and purchases, VAT charged and reclaimed, a summary of transactions, details of any discrepancies, and an explanation for any adjustments made to VAT figures. It may also require disclosures regarding related parties and transactions.

Fill out your vat 22b audit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat 22b Audit Report is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.