Get the free VAT 250A

Show details

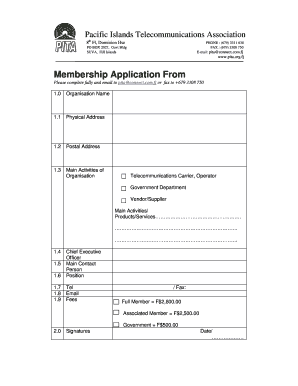

This document is an application form for dealers to withdraw from the composition scheme of tax payment under the APVAT Act 2005.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat 250a

Edit your vat 250a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat 250a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat 250a online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vat 250a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat 250a

How to fill out VAT 250A

01

Gather all necessary documentation, including invoices and receipts related to your VAT claims.

02

Complete the VAT 250A form, ensuring that you use the correct tax period.

03

Enter your business information, including your VAT registration number.

04

List all sale and purchase transactions along with their corresponding VAT amounts.

05

Calculate the total VAT payable and the total VAT reclaimable.

06

Check for accuracy in your calculations and details entered.

07

Submit the completed VAT 250A form to the relevant tax authority before the deadline.

Who needs VAT 250A?

01

Businesses that are registered for VAT and want to reclaim VAT paid on their purchases.

02

Tax professionals assisting clients with VAT submissions.

03

Entities involved in cross-border trade within the EU that need to report VAT.

Fill

form

: Try Risk Free

People Also Ask about

What does VAT mean?

Value-Added Tax (VAT) A value-added tax (VAT) is not a tariff, it is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

What is VAT in English?

VAT Business English abbreviation for Value Added Tax: a tax that is paid at each stage in the production of goods or services, and by the final customer.

What is the English name for VAT?

VAT Business English abbreviation for Value Added Tax: a tax that is paid at each stage in the production of goods or services, and by the final customer.

What does 20% VAT mean?

At the moment, the standard rate of VAT charged on products and services in the UK is 20%. This means that if a product is priced at £100 and the VAT rate on this item is 20%, the consumer will pay £120 to the merchant. The business therefore keeps £100 and remits £20 to the government.

What is VATS in English with example?

noun. a large container, as a tub or tank, used for storing or holding liquids: a wine vat.

What is the VAT number in English?

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes.

What does VAT stand for in batteries?

Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain.

What does VAT stand for in English?

VAT is an abbreviation for the term Value-Added Tax. It is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to register for VAT.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VAT 250A?

VAT 250A is a tax form used for reporting Value Added Tax (VAT) in certain jurisdictions. It is specifically designed to capture transactions related to VAT obligations.

Who is required to file VAT 250A?

Businesses and individuals who are registered for VAT and engage in taxable activities are required to file VAT 250A. This typically includes VAT-registered sellers, service providers, and importers.

How to fill out VAT 250A?

To fill out VAT 250A, taxpayers need to provide relevant financial information, including total sales, VAT charged, and any claimed deductions. Instructions may vary by jurisdiction, so it's essential to refer to local guidelines.

What is the purpose of VAT 250A?

The purpose of VAT 250A is to ensure proper reporting and collection of VAT, allowing tax authorities to monitor compliance and assess tax liabilities accurately.

What information must be reported on VAT 250A?

VAT 250A typically requires the reporting of total sales, VAT collected on sales, VAT paid on purchases, and any adjustments or exemptions that apply to the transaction.

Fill out your vat 250a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat 250a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.