Get the free FORM TOT 030

Show details

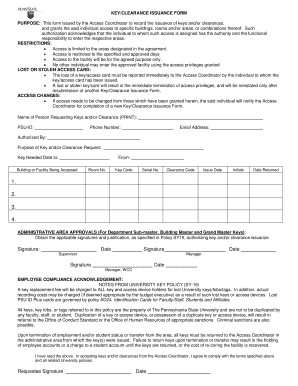

This document is used by TOT dealers to claim refunds by providing necessary details such as tax office address, order of assessment, and verification of information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form tot 030

Edit your form tot 030 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form tot 030 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form tot 030 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form tot 030. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form tot 030

How to fill out FORM TOT 030

01

Obtain FORM TOT 030 from the official website or the relevant office.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact information.

04

Provide details required for your specific situation, such as financial information or identification numbers.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate agency or office according to the instructions.

Who needs FORM TOT 030?

01

Individuals or businesses required to report specific financial information.

02

Taxpayers needing to fulfill their obligations under relevant tax laws.

03

Applicants seeking permits or licenses that require FORM TOT 030 for processing.

Fill

form

: Try Risk Free

People Also Ask about

What is overtime taxed in CA?

Is overtime taxed in California right now? Yes, overtime pay is currently taxed as regular income under both federal and state rules. California's progressive tax brackets mean higher earners might lose more to taxes on overtime hours.

What is the Transient Occupancy Tax in Sonoma County?

This tax is levied in Sonoma County at a rate of 12% for accommodations at lodging and camping facilities in the unincorporated areas of the County. Transient Occupancy Tax (TOT) funds are discretionary, in that the Board of Supervisors may direct use of these funds for any legitimate county expense.

What is the Transient Occupancy Tax in Orange County CA?

The Transient Occupancy Tax is 10% of the rent charged to the transient by the hotel operator (O.M.C. 5.16.

What is the Transient Occupancy Tax in Napa CA?

What is Transient Occupancy Tax (TOT)? TOT is an acronym for Transient Occupancy Tax. The City of Napa's TOT rate is 12% and tax remittance is due on the 10th day of the month subsequent to the month of taxable transactions.

What is the tot tax in California?

WHAT IS THE “BED TAX”? The Transient Occupancy Tax (TOT) is a tax of 12% of the rent charged to transient guests in hotels/motels, including properties rented through home sharing services like Airbnb, located in the unincorporated areas of Los Angeles County. The TOT is commonly known as a “bed tax”.

What is the PTO tax in California?

How to Calculate PTO Payouts. PTO payouts are subject to the supplemental income flat rate tax of 22%.

What is the meaning of tot in taxes?

What is Turnover Tax (TOT)? Turnover Tax is a tax charged on businesses whose gross turnover is more than Kshs. 1,000,000 but does not exceed or is not expected to exceed Kshs. 25, 000,000 during any year of Income. TOT is chargeable under Section 12 (C) of the Income Tax Act (CAP 470).

What is the LTC tax in California?

California is considering a Long-Term Care Tax that would force residents to pay an increased income tax of 0.40 to 0.60% to cover the cost of state-funded long-term care program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM TOT 030?

FORM TOT 030 is a tax form used for reporting certain transactions or financial activities to the tax authorities.

Who is required to file FORM TOT 030?

Entities or individuals engaged in specific transactions that fall under the regulations stipulated by the tax authority are required to file FORM TOT 030.

How to fill out FORM TOT 030?

To fill out FORM TOT 030, one must provide accurate personal or business information, report relevant financial figures, and ensure all required fields are completed as per the instructions provided by the tax authority.

What is the purpose of FORM TOT 030?

The purpose of FORM TOT 030 is to ensure transparency and compliance with tax regulations by documenting specific financial transactions.

What information must be reported on FORM TOT 030?

The information reported on FORM TOT 030 typically includes identification details, types of transactions, amounts involved, and any other relevant data as required by the tax authority.

Fill out your form tot 030 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Tot 030 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.