Get the free S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed

Show details

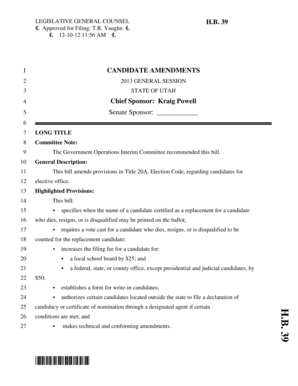

This document prescribes the format for a Chartered Accountant's certificate required under Section 201 of the Income-tax Act, 1961 to indicate that the payee has paid the due tax and fulfilled certain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign s 201 no tds

Edit your s 201 no tds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your s 201 no tds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit s 201 no tds online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit s 201 no tds. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out s 201 no tds

How to fill out S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed

01

Obtain the S. 201 CA Certificate format from the relevant tax authority or download it from their website.

02

Fill in the basic details such as the name and address of the payee, along with the PAN (Permanent Account Number).

03

Mention the period for which the certificate is being issued.

04

Detail the total amount paid to the payee during the financial year along with the applicable tax rate.

05

Include a declaration stating that the payee has paid the necessary tax on the income received.

06

Sign the certificate by a Chartered Accountant (CA) who verifies the information.

07

Submit the completed certificate to the relevant tax authorities or maintain it for your records.

Who needs S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed?

01

Any entity or individual who has made payments subject to TDS (Tax Deducted at Source) and wants to certify that the payee has already paid tax on the income.

02

Business owners and professionals who make payments to vendors, contractors, or consultants.

03

Chartered Accountants who need to provide the certificate on behalf of their clients.

Fill

form

: Try Risk Free

People Also Ask about

What is Section 201 of the TDS?

"(1A) Without prejudice to the provisions of sub-section (1), if any such person, principal officer or company as is referred to in that sub-section does not deduct the whole or any part of the tax or after deducting fails to pay the tax as required by or under this Act, he or it shall be liable to pay simple interest

What is section 201 of the Trade Act?

What Is Section 201? Section 201 or "safeguard" actions are designed to provide temporary relief for a U.S. industry (for example, additional tariffs or quotas on imports) in order to facilitate positive adjustment of the industry to import competition.

What is Section 201 of the UP Land Revenue Act?

No appeal from orders passed ex parte or by default. - No appeal shall lie from an order passed under Section 200 ex parte or by default.

What is TDS under section 201?

Section 201 of the Income Tax Act, 1961 is an important provision that deals with the Tax Deducted at Source (TDS) on failure to deduct or pay tax. The section imposes a penalty on those who fail to deduct TDS or fail to deposit the deducted TDS with the government.

What is the Section 201 relief?

Currently, section 201 exempts deductors from being deemed in default if they fail to deduct tax on payments to residents, provided certain conditions are met. This relief is not available for non-resident payments. The amendment extends this relief to non-resident payments, effective from September 1, 2019.

How to write a TDS declaration format?

We hereby declare that as per the provision of section 194Q of the Income Tax Act, we __(name of buyer/consumer organization), having PAN_( consumer PAN), had turn over in the preceding financial year(FY 2020- 21) for more than Rs 10 corers.

What is the format of a TDS certificate?

TDS certificates can be of two types; Form 16 (for TDS on Salary), and Form 16A (for TDS on non-Salary payments). As per Section 203 of the Income Tax Act, 1961, you are entitled to receive a certificate whenever a tax is deducted at source on you income.

What is the format for TDS not applicable?

Form 13 is an application form under section 197 of the Income Tax Act, 1961. Taxpayers whose tax liability for the financial year is less than the tax deducted at source can make an application to the assessing officer by filing Form 13 for the non/ lower deduction of TDS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed?

S. 201 refers to a provision in the Income Tax Act, which mandates that if the payee has already paid the tax on the income received, the payer is not liable for TDS defaults. The CA Certificate format prescribed is a document that certifies this compliance by the payee.

Who is required to file S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed?

The payer, who is responsible for deducting TDS, needs to file S. 201 in instances where it is claimed that no TDS is applicable as the payee has already paid the requisite tax.

How to fill out S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed?

To fill out the S. 201 CA Certificate Format, the payer must include details such as the payee’s name, PAN, the nature of the payment, the amount paid, and the tax paid by the payee, along with the CA's signature and stamp to validate the information provided.

What is the purpose of S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed?

The purpose is to provide a mechanism for payers to demonstrate that they are not liable for TDS defaults, as the payee has already fulfilled their tax obligations on the income received.

What information must be reported on S. 201: No TDS Default If Payee Has Paid Tax: CA Certificate Format Prescribed?

The information that must be reported includes the name and PAN of the payee, details of the payment, the amount of tax paid by the payee, and any other relevant financial details required by the Income Tax Department.

Fill out your s 201 no tds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

S 201 No Tds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.