Get the free Code Section 409A and Determining Private Company Stock Fair Market Value for Granti...

Show details

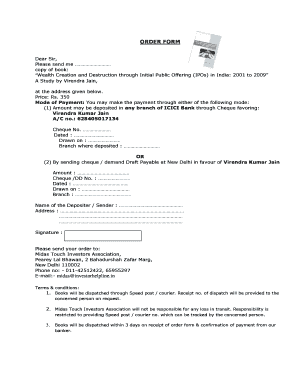

This document provides guidance on how private companies should determine the fair market value of company stock for granting stock options in compliance with Code Section 409A.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign code section 409a and

Edit your code section 409a and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your code section 409a and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit code section 409a and online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit code section 409a and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out code section 409a and

How to fill out Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options

01

Identify the type of equity compensation being offered (e.g., stock options).

02

Gather relevant company financial data including balance sheets, income statements, and market data.

03

Determine the valuation date for the fair market value assessment.

04

Select an appropriate valuation method (e.g., income approach, market approach, or asset approach).

05

Calculate the fair market value using the chosen valuation method, documenting all assumptions and processes.

06

Document the results and ensure they meet the requirements set forth in Code Section 409A.

07

Review and maintain proper record-keeping practices for future audits or assessments.

Who needs Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options?

01

Companies granting stock options to employees or contractors.

02

Private companies seeking to comply with tax regulations under Code Section 409A.

03

Startups looking to establish a fair market value for equity compensation to attract and retain talent.

04

Accountants and legal advisors involved in compensation planning and compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is the point of 409A?

A 409A valuation is an independent appraisal of the fair market value (FMV) of a private company's common stock. It is used to determine the strike price of a stock option, which is the price at which employees can buy company shares.

How to determine fair market value of private stock?

To determine FMV of a private company's stock, the most common and accepted approach is to conduct a 409A valuation. Conducting an independent 409A valuation is the standard and IRS-accepted method for determining the FMV of a private company's stock.

What is a 409A valuation for a private company?

A 409A valuation is an appraisal that determines the fair market value (FMV) of a company's common stock. It's named after the section of the U.S. tax code that sets rules for nonqualified deferred compensation plans issued by private companies, such as stock options or restricted stock units.

What is the purpose of a 409A valuation?

A 409A valuation is an appraisal that determines the fair market value (FMV) of a company's common stock. It's named after the section of the U.S. tax code that sets rules for nonqualified deferred compensation plans issued by private companies, such as stock options or restricted stock units.

Can I do a 409A valuation myself?

While technically you can attempt to come up with a valuation yourself, it is highly recommended to engage an independent, qualified third-party appraiser. This is because the IRS is more likely to respect a valuation performed by an independent party with the appropriate credentials and experience.

How is FMV calculated for stock options?

For a public company, the rules are fairly straightforward: FMV is basically determined by the closing price, arithmetic mean of the high and low prices, or similar methods. For a private company, the valuation method must be “reasonable.”

What is a typical 409A valuation?

A 409A valuation is the fair market value of the common stock of a private company as valued by a third-party appraiser.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options?

Code Section 409A is a section of the Internal Revenue Code that regulates nonqualified deferred compensation plans. It establishes rules for the timing of deferrals and distributions and imposes penalties for non-compliance. Determining the fair market value of private company stock is crucial for granting stock options to ensure compliance with 409A and to avoid adverse tax consequences.

Who is required to file Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options?

Employers who offer nonqualified deferred compensation plans or stock options are required to comply with Code Section 409A. This includes private companies that grant stock options to employees, directors, and consultants, ensuring that the stock's fair market value is accurately determined and documented.

How to fill out Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options?

To comply with Code Section 409A, companies need to assess the fair market value of their stock through a valuation process, which can include independent appraisals or other acceptable methods. This valuation should be documented, and the results should be used when setting the exercise price of stock options to ensure they meet the required guidelines.

What is the purpose of Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options?

The purpose of Code Section 409A is to provide guidelines for deferred compensation to prevent tax avoidance through improper deferment of income. Determining the fair market value for stock options is essential to avoid penalties and ensure that employees receive appropriate compensation without unnecessary tax burdens.

What information must be reported on Code Section 409A and Determining Private Company Stock Fair Market Value for Granting Stock Options?

Companies must report the fair market value determination, the exercise price of stock options, and any relevant details regarding the stock valuation methodology used. This information is necessary to ensure compliance with IRS regulations and to avoid penalties associated with Code Section 409A.

Fill out your code section 409a and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Code Section 409a And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.