Get the free TCS -CA Certificate

Show details

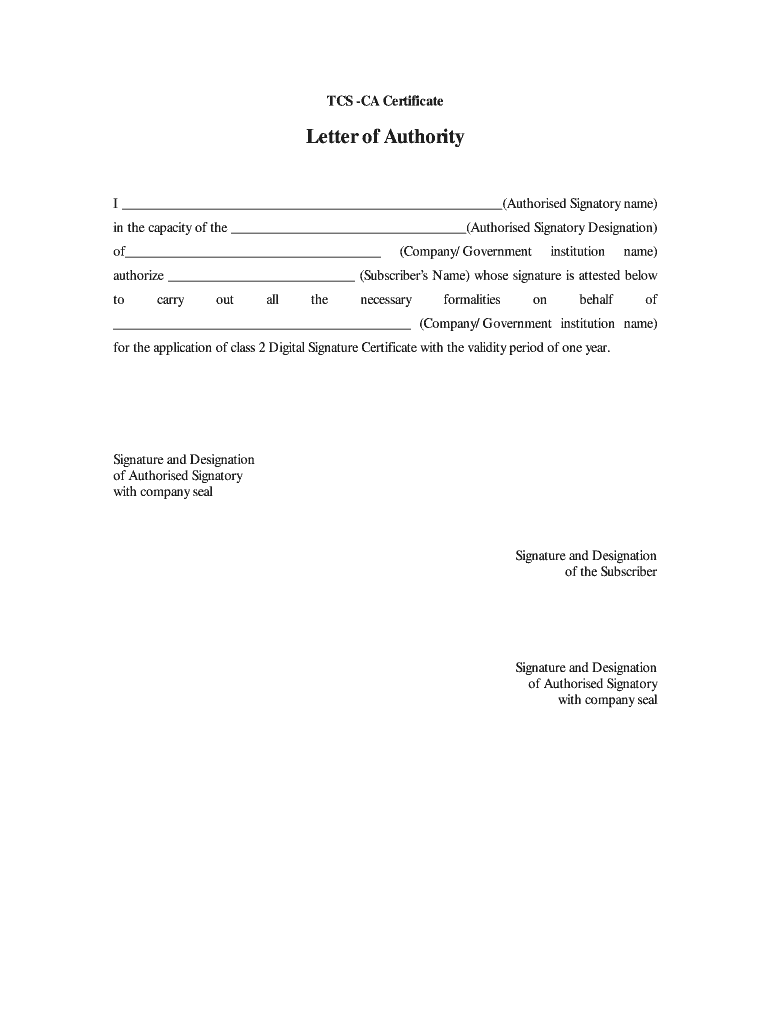

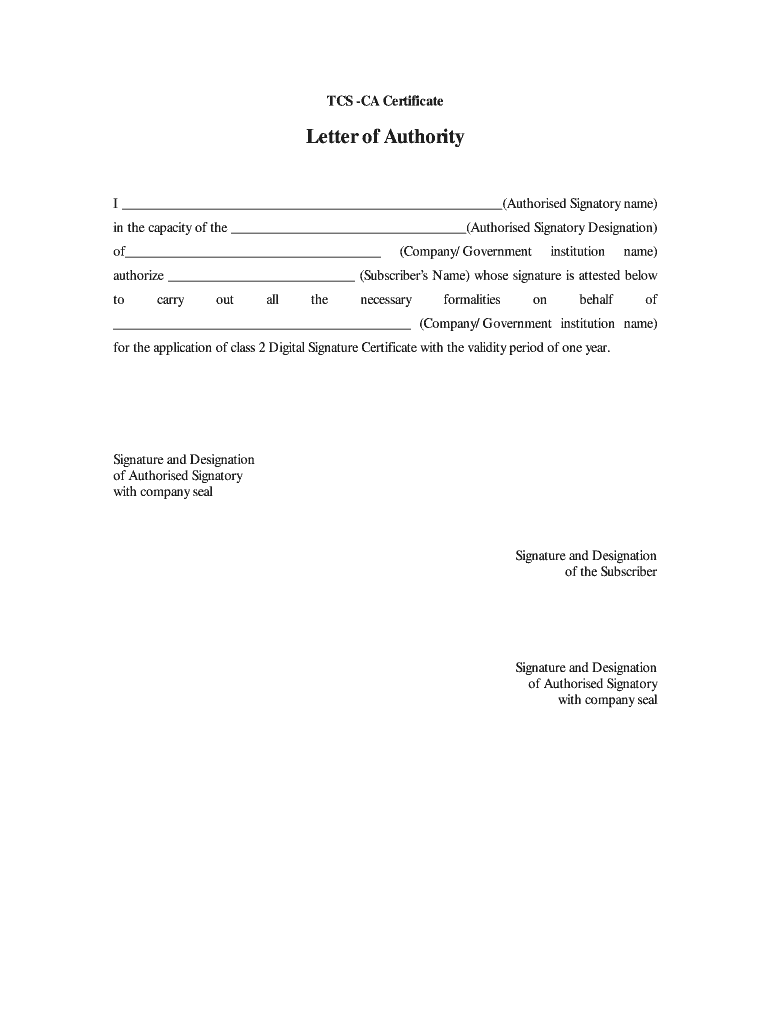

This document serves as a letter of authority allowing a designated subscriber to apply for a class 2 Digital Signature Certificate on behalf of a company or government institution.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tcs -ca certificate

Edit your tcs -ca certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tcs -ca certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tcs -ca certificate online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tcs -ca certificate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tcs -ca certificate

How to fill out TCS -CA Certificate

01

Obtain the TCS-CA Certificate application form from the official TCS website or the designated authority.

02

Fill in your personal details such as name, date of birth, and contact information accurately.

03

Provide your educational qualifications, including the names of institutions attended and degrees obtained.

04

Specify the purpose for which the certificate is required.

05

Attach required documents like ID proof, educational certificates, and any other necessary paperwork.

06

Review the completed form for accuracy and completeness.

07

Submit the form along with any applicable fees to the designated authority.

Who needs TCS -CA Certificate?

01

Students who are applying for higher education.

02

Job seekers who need proof of their educational qualifications.

03

Professionals who require certification for job transfers or promotions.

04

Individuals applying for governmental or public sector positions.

Fill

form

: Try Risk Free

People Also Ask about

What do the letters TCS stand for?

The traction control system (TCS) detects if a loss of traction occurs among the car's wheels. Upon identifying a wheel that is losing its grip on the road, the system automatically applies the brakes to that individual one or cut down the car's engine power to the slipping wheel.

What is TCS also known as?

TCS, also known as tax collected at source, is the income tax collected from the buyer by the seller on the sale of certain goods. The objective or goal of the tax collected at source is that the government authority can track the high-value transaction from the buyer and also get revenue at the earliest point in time.

What is the full form of TCS in office?

Tata Consultancy Services (TCS) (BSE: 532540, NSE: TCS) is a digital transformation and technology partner of choice for industry-leading organizations worldwide.

What is the full form of TCS in English?

Tata Consultancy Services. Tata Consultancy Services (TCS) is an Indian multinational technology company specializing in information technology services and consulting. Headquartered in Mumbai, it is a part of the Tata Group and operates in 150 locations across 46 countries.

What is the full form of tcs iON?

TCS iON is a strategic business unit of Tata Consultancy Services (TCS).

What does TCS mean?

Tax collected at source (TCS) is the tax payable by a seller which he collects from the buyer at the time of sale of goods. It is new provision under section 206C of Income Tax Act. It is applicable when the total gross receipts or turnover in the previous year was more than Rs. 10 crores.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TCS -CA Certificate?

The TCS -CA Certificate is a document issued by tax authorities to certify the collection of Tax Collected at Source (TCS) by a seller from a buyer, particularly for specific transactions as prescribed by taxation laws.

Who is required to file TCS -CA Certificate?

Entities that have collected tax at source on specified transactions, such as sellers of certain goods or services, are required to file the TCS -CA Certificate.

How to fill out TCS -CA Certificate?

To fill out the TCS -CA Certificate, one must provide details such as the name of the collector, the tax amount collected, the nature of the goods/services, and other relevant transaction details as required by the tax authorities.

What is the purpose of TCS -CA Certificate?

The purpose of the TCS -CA Certificate is to provide evidence of tax collection at source which serves both as a source of revenue for government and a means for taxpayers to validate tax payments against their income.

What information must be reported on TCS -CA Certificate?

The TCS -CA Certificate must report information including the collector's details, amount of TCS collected, nature of the transactions, date of the transaction, and other particulars as required by the tax laws.

Fill out your tcs -ca certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tcs -Ca Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.