Get the free GUIDELINES FOR CHARITABLE GIFTS OF GRAIN

Show details

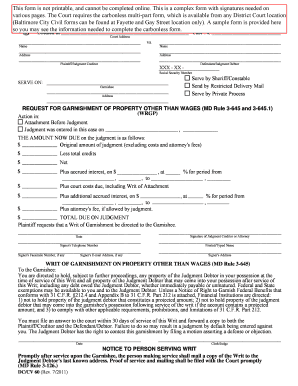

This document provides guidelines for taxpayers on how to make charitable gifts of agricultural commodities, including tax implications and required procedures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for charitable gifts

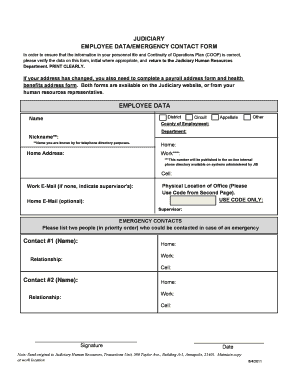

Edit your guidelines for charitable gifts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for charitable gifts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guidelines for charitable gifts online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guidelines for charitable gifts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for charitable gifts

How to fill out GUIDELINES FOR CHARITABLE GIFTS OF GRAIN

01

Obtain a copy of the GUIDELINES FOR CHARITABLE GIFTS OF GRAIN document.

02

Review the eligibility criteria for charitable gifts of grain.

03

Gather necessary information about the grain to be donated, including type, quantity, and market value.

04

Ensure that the grain meets the quality standards required by the charitable organization.

05

Complete any required forms provided in the guidelines.

06

Sign the document to confirm the donation and date.

07

Submit the completed forms to the designated representative of the charitable organization.

08

Retain a copy of all documents for your records.

Who needs GUIDELINES FOR CHARITABLE GIFTS OF GRAIN?

01

Farmers looking to donate grain to charitable organizations.

02

Non-profit organizations that accept grain donations.

03

Taxpayers seeking potential tax deductions through charitable contributions of grain.

Fill

form

: Try Risk Free

People Also Ask about

How to gift a charitable donation?

Give a Donation in Your Loved One's Name Search for a charity's name or by cause area. Click the donate button on the search result or profile page. Select the amount you wish to donate. Enter your loved one's name and email address. Complete the checkout - your loved one will receive an email notification.

What is a charitable gift?

A charitable gift is a contribution of cash or property to, or for the use of, a qualified charity. A gift is “for the use of” an organization when it's held in a legally enforceable trust for the qualified organization or in a similar legal arrangement.

What do you say when giving a donation as a gift?

A simple card that reads something along these lines would be such a heartwarming surprise: “I made a donation to [organization name] in your name — I know how much this means to you!” “You inspired me to make a gift to [organization name] in your name this year.

What is grain donation?

Donating a gift of grain to your Community Foundation is a simple way to make a lasting difference. The value of the grain can be used to start an endowed fund in the name of your family, for a specific nonprofit organization important to you, or to support charitable causes in your community.

What is the gift of grain?

Donating a gift of grain to your Community Foundation is a simple way to make a lasting difference. The value of the grain can be used to start an endowed fund in the name of your family, for a specific nonprofit organization important to you, or to support charitable causes in your community.

What is the meaning of grain?

A grain is a small, hard, dry fruit (caryopsis) – with or without an attached hull layer – harvested for human or animal consumption. A grain crop is a grain-producing plant. The two main types of commercial grain crops are cereals and legumes.

What is the symbolism of grain?

It symbolized fertility, growth, and spiritual cycles, making it a powerful emblem of prosperity and survival. From the agricultural rituals in the ancient Near East to the sacred offerings in the Mediterranean, wheat was central to life and divine provision.

What is the gifting in Fae farm?

If you want to foster a relationship with someone in Fae Farm, you will need to give them their favorite gifts. Some important gifts include food, materials, gemstones, and flowers. Each marriage candidate has a few gifts they love that have a similar theme.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GUIDELINES FOR CHARITABLE GIFTS OF GRAIN?

The GUIDELINES FOR CHARITABLE GIFTS OF GRAIN provide a framework for individuals and entities looking to donate grain to charitable organizations, ensuring compliance with tax regulations and maximizing the benefits of such contributions.

Who is required to file GUIDELINES FOR CHARITABLE GIFTS OF GRAIN?

Farmers and individuals or entities who wish to make charitable contributions of grain to qualifying organizations are required to file the GUIDELINES FOR CHARITABLE GIFTS OF GRAIN.

How to fill out GUIDELINES FOR CHARITABLE GIFTS OF GRAIN?

To fill out the GUIDELINES FOR CHARITABLE GIFTS OF GRAIN, one must provide detailed information about the grain being donated, its market value, the recipient organization, and the donor's identification details, following the specific format and instructions provided by the governing regulatory body.

What is the purpose of GUIDELINES FOR CHARITABLE GIFTS OF GRAIN?

The purpose of the GUIDELINES FOR CHARITABLE GIFTS OF GRAIN is to assist donors in understanding the legal requirements and benefits associated with donating grain, ensuring that such actions are carried out in a tax-compliant manner.

What information must be reported on GUIDELINES FOR CHARITABLE GIFTS OF GRAIN?

The information that must be reported includes the type and quantity of grain donated, its fair market value, the name and address of the charitable organization, as well as the name and contact information of the donor.

Fill out your guidelines for charitable gifts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Charitable Gifts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.