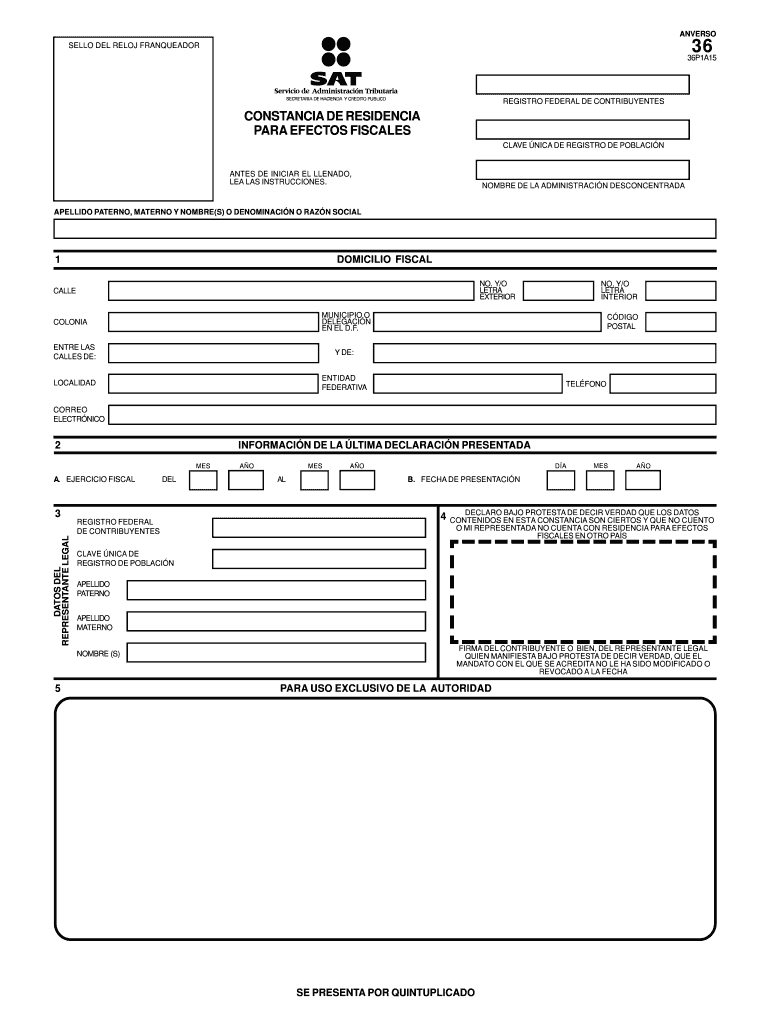

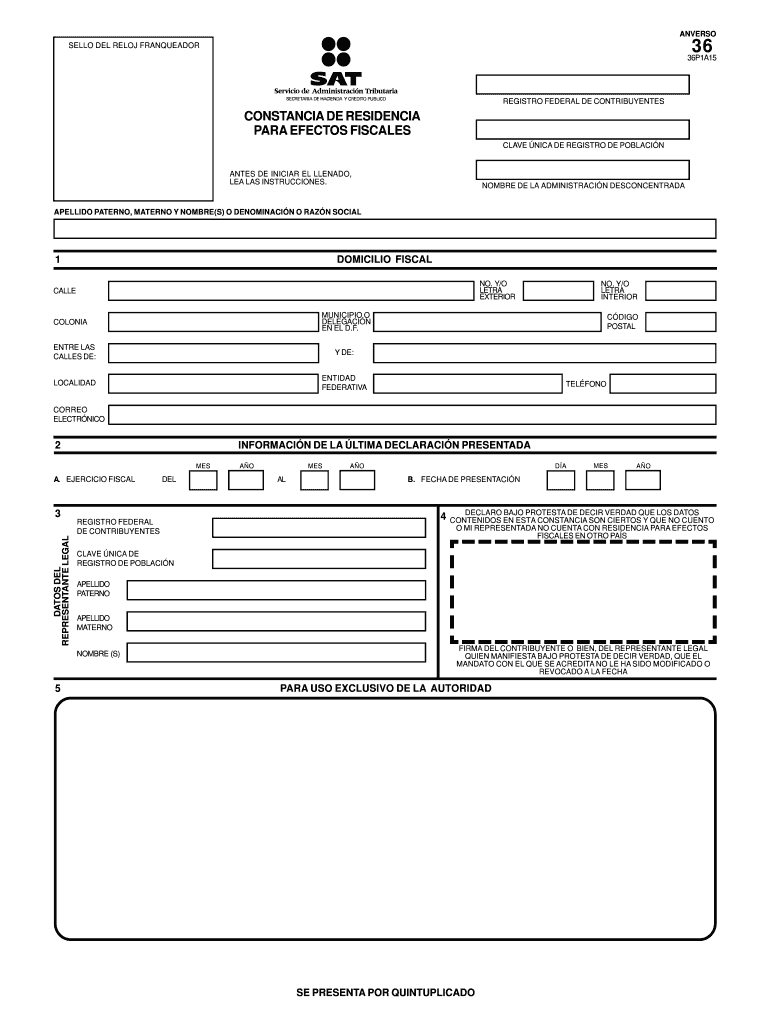

MX SAT 36 2015 free printable template

Show details

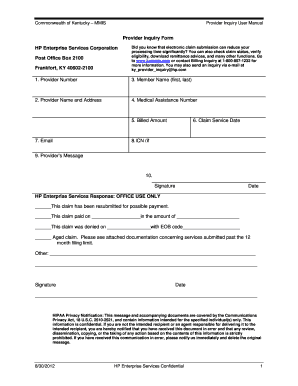

ANVERSO De click para limpiar campos SELLO DEL RELOJ FRANQUEADOR 36P1A15 REGISTRO FEDERAL DE CONTRIBUYENTES CONSTANCIA DE RESIDENCIA PARA EFECTOS FISCALES CLAVE NICA DE REGISTRO DE POBLACI N ANTES DE INICIAR EL LLENADO LEA LAS INSTRUCCIONES. NOMBRE DE LA ADMINISTRACI N DESCONCENTRADA APELLIDO PATERNO MATERNO Y NOMBRE S O DENOMINACI N O RAZ N SOCIAL DOMICILIO FISCAL NO. SE EXPIDA CONSTANCIA OPCIONAL D. DESCRIBA EL MOTIVO POR EL QUE SOLICITA LA CONSTANCIA DE RESIDENCIA PARA EFECTOS FISCALES...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign MX SAT 36

Edit your MX SAT 36 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MX SAT 36 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MX SAT 36 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MX SAT 36. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MX SAT 36 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MX SAT 36

How to fill out MX SAT 36

01

Begin by downloading the MX SAT 36 form from the official website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information in the designated sections, including your name, contact details, and identification number.

04

Complete the section regarding your educational background, including previous schools attended and grades achieved.

05

Provide information on any relevant tests or assessments you have taken.

06

Review the information you have entered to ensure accuracy and completeness.

07

Submit the form electronically or print it out and send it to the specified address.

Who needs MX SAT 36?

01

Individuals applying for admission to educational institutions that require the MX SAT 36.

02

Students aiming for scholarships or specific programs that consider the MX SAT 36 in their selection process.

03

Anyone seeking to assess their academic readiness for higher education in Mexico.

Fill

form

: Try Risk Free

People Also Ask about

¿Cuál es la constancia de residencia?

Constancia de residencia, vecindad y/o domiciliaria. Es un documento que comprueba la residencia y el tiempo que lleva viviendo un ciudadano en el Municipio.

¿Qué es un residente en el extranjero para efectos fiscales?

Para fines fiscales, se consideran residentes en el extranjero a: Las personas físicas, nacionales o extranjeras, que no tengan su casa habitación en México.

¿Cómo obtener certificado de residencia fiscal?

Obtener el certificado de residencia fiscal es un trámite sencillo. Se puede realizar de forma telemática o en formato papel. Tan solo hay que acceder a la página web de la Agencia Tributaria, y autenticarse mediante DNI-electrónico, certificado digital o Clave PIN.

¿Cómo descargar Certificado de residencia fiscal?

Para ello hay que entrar en la Sede Electrónica de la aeat .aeat.es y seguir la ruta: Inicio-Todos los trámites-Certificaciones- Censales- Certificados tributarios- Expedición de certificados tributarios – Residencia fiscal.

¿Qué es una certificacion fiscal?

La Constancia de Situación Fiscal es un acta que permite conocer el estatus de los contribuyentes ante el SAT. Se trata de una referencia sobre la legalidad de la situación fiscal del contribuyente. De manera similar a la CIF, esta constancia funge como identificación fiscal para personas físicas y morales.

¿Qué es la constancia para efectos fiscales?

La Constancia de Situación Fiscal es un acta que permite conocer el estatus de los contribuyentes ante el SAT. Se trata de una referencia sobre la legalidad de la situación fiscal del contribuyente. De manera similar a la CIF, esta constancia funge como identificación fiscal para personas físicas y morales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MX SAT 36 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your MX SAT 36 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send MX SAT 36 to be eSigned by others?

Once you are ready to share your MX SAT 36, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete MX SAT 36 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MX SAT 36. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MX SAT 36?

MX SAT 36 is a tax form used by residents of Mexico to report their income and financial activities for tax purposes.

Who is required to file MX SAT 36?

Individuals and entities in Mexico who have generated income within the tax year are required to file MX SAT 36.

How to fill out MX SAT 36?

To fill out MX SAT 36, taxpayers must provide personal identification information, income details, deductions, and any applicable credits in the designated sections of the form.

What is the purpose of MX SAT 36?

The purpose of MX SAT 36 is to ensure compliance with tax regulations in Mexico and to facilitate the assessment of tax liabilities.

What information must be reported on MX SAT 36?

MX SAT 36 requires reporting of personal identification details, total income earned, deductions claimed, tax credits, and other relevant financial information.

Fill out your MX SAT 36 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MX SAT 36 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.