Get the free ERISA Compliance Audit

Show details

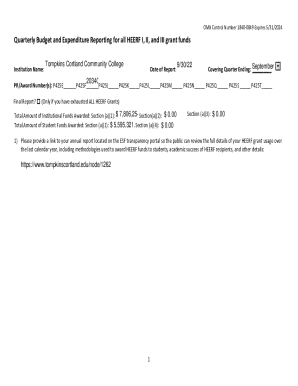

This document provides an overview of the Employee Retirement Income Security Act (ERISA), detailing its requirements for employers regarding compliance audits for employer-sponsored group benefits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign erisa compliance audit

Edit your erisa compliance audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your erisa compliance audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit erisa compliance audit online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit erisa compliance audit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out erisa compliance audit

How to fill out ERISA Compliance Audit

01

Gather all relevant plan documents including the Summary Plan Description (SPD) and the Plan Document.

02

Collect participant and beneficiary data including enrollment forms and information on contributions.

03

Review the plan's eligibility and participation criteria to ensure compliance with ERISA standards.

04

Examine the fiduciary responsibilities and decision-making processes to ensure they align with ERISA requirements.

05

Analyze the plan's financial statements and disclosures for accuracy and compliance with ERISA regulations.

06

Conduct an assessment of the plan’s reporting and disclosure obligations, including Form 5500 filing.

07

Document findings and identify areas of non-compliance, recommending corrective actions as necessary.

08

Prepare a final report summarizing the audit process, findings, and recommendations.

Who needs ERISA Compliance Audit?

01

Employers offering retirement or health benefit plans to their employees.

02

Plan administrators responsible for managing employee benefit plans.

03

HR departments ensuring compliance with federal regulations.

04

Employees who may need assurance that their benefits are managed according to ERISA standards.

Fill

form

: Try Risk Free

People Also Ask about

What is the ERISA threshold?

Under ERISA, each fund is subject to additional requirements and obligations once more than 25 percent of the fund's assets under management (AUM) are subject to ERISA (the 25 percent threshold).

What is the ERISA section audit?

An ERISA or employee benefit plan audit is an independently conducted inspection of a private business's employee benefit plan.

What are the requirements for ERISA Section 103 A )( 3 )( C audit?

To meet the requirements for the ERISA Section 103(a)(3)(C) audit election, the qualified institution must certify both the completeness and accuracy of the required information, and the certification must be signed by a person authorized to represent the institution.

What are the requirements for a 133 single audit?

A Single Audit must be completed on all recipients who receive $750,000 or more in federal funds in the recipient's fiscal year. Audits must be performed in accordance with GAGAS (Generally Accepted Governmental Auditing Standards) by an independent auditor.

What is ERISA Section 103 A 3 C audit?

The primary difference between an ERISA 103(a)(3)(c) and an ERISA non 103(a)(3)(c) audit is that an ERISA 103(a)(3)(c) audit does not require substantive testing of investments such as year-end market values, interest and dividends and realized and unrealized gains/losses on investments.

What is the 120 rule for 401k audit?

Are you required to audit your 401(k) plan? The answer lies in what is known as the 80-120 rule. If your organization offers a qualified retirement plan with fewer than 120 participants, as of the 1st day of the plan year, the answer is no. Your organization doesn't need a plan audit.

When would a plan generally need an audit?

Generally, defined contribution or defined benefit plans with 100 or more participants on the first day of the plan year are subject to the audit requirement. However, there is an exception under the 80 to 120 participant rule.

What accounts are subject to ERISA?

Accounts Covered by ERISA Common types of employer-sponsored retirement accounts that fall under ERISA include 401(k) plans, pensions, deferred-compensation plans, and profit-sharing plans. In addition, ERISA laws don't apply to simplified employee pension (SEP) IRAs or other IRAs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ERISA Compliance Audit?

An ERISA Compliance Audit is an examination of employee benefit plans to ensure they comply with the Employee Retirement Income Security Act (ERISA) regulations and standards.

Who is required to file ERISA Compliance Audit?

Generally, employee benefit plans with 100 or more participants at the beginning of the plan year are required to undergo an ERISA Compliance Audit.

How to fill out ERISA Compliance Audit?

To fill out an ERISA Compliance Audit, plan administrators must gather necessary documentation, engage a qualified auditor, and complete the IRS Form 5500, along with any required attachments and schedules.

What is the purpose of ERISA Compliance Audit?

The purpose of an ERISA Compliance Audit is to protect the rights of participants by ensuring that benefit plans are managed responsibly and that participants receive the benefits they are entitled to under the law.

What information must be reported on ERISA Compliance Audit?

Required information typically includes details about plan finances, funding, participant demographics, plan operations, and compliance with various ERISA provisions.

Fill out your erisa compliance audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Erisa Compliance Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.